Bitcoin offers a fair, finite standard for valuing human productivity, safeguarding the true worth of our time and energy from the inflationary distortions of fiat currency. By aligning value with real effort, Bitcoin could redefine the way we measure and reward productivity.

Time is money, or so the saying goes. It follows that money is also time: a representation of the collective economic energy stored by humanity — Dergigi

Human productivity is inherently finite, representing the limited energy we can expend within any given period. The fruits of our labor are the product of this energy.

Energy = Time = Money

To measure (and reward) the finite energy of human productivity, we must use a finite asset to measure that limited energy. In this paper, I propose that bitcoin is the ideal solution for this purpose.

The law of conservation of energy states that the total energy of an isolated system remains constant; it is said to be conserved over time. In the case of a closed system the principle says that the total amount of energy within the system can only be changed through energy entering or leaving the system. Energy can neither be created nor destroyed; it can only be transformed or transferred from one form to another.

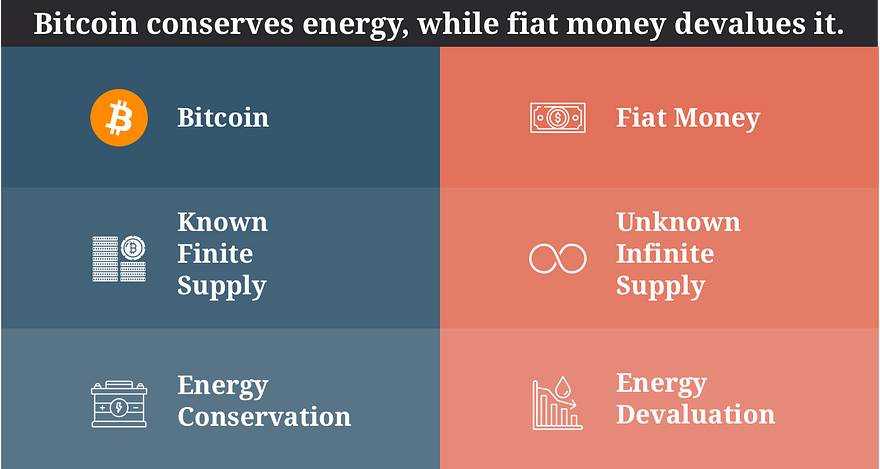

Bitcoin aligns with the law of conservation of energy by avoiding the corruption of what is currently used on the reward side of a value exchange: fiat money that is endlessly created from thin air.

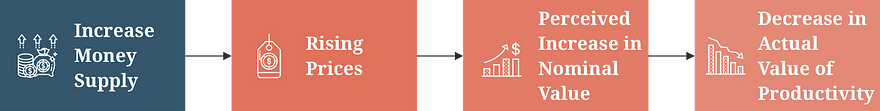

In the case of fiat money, when the money supply increases but productivity remains constant, prices for goods and services rise.

Contrary to mainstream economic beliefs that celebrate higher earnings or GDP, higher nominal prices do not represent an actual increase in the value of productivity; but in fact, represent the opposite. Let me explain:

Expanding the money supply devalues the existing currency units. This is what real inflation is. You need more currency units (higher prices) to buy the same goods and services as before. For instance, the US dollar has lost over 95% of its purchasing power since 1913 when the Federal Reserve was established. The Euro has lost over 70% of its value since its introduction in 1999.

Because the expended energy that was used to create these goods or services did not change, this energy is devalued when measured in the inflated currency units.

The same amount of units now buys you less of the desired goods or services. That means a decrease in the value of our productivity.

This goes directly against the natural direction that human creativity, improved technology, and evolving markets, would take us. All of us humans are in the game of making things better, cheaper, faster, and more efficient every day.

In this natural state (without the influence of fiat money), all prices should fall forever and whatever we would create or produce would become more accessible to more people over time.

Bitcoin, on the other hand, cannot be endlessly printed because it has a verifiably hard supply cap of 21 million units that are each divisible into 100 million subunits, called satoshis. When we use bitcoin on the reward side of a value exchange, as the standard measurement for human productivity, it provides creators and consumers with a verifiable standard that ensures both parties participate in an equal exchange of value (and energy).

Here, the finite nature of human energy expended over time (transformed into a delivered good or service) is mirrored by — and equal to — the finite digital scarcity of bitcoin (the reward). The parties involved in the transaction determine the value of the exchange, and agree upon the amount of units to reward it, at the moment of transacting.

Now that it is clear that there is a superior alternative reward that can be offered instead of an infinite one, the following conclusion can be drawn: rewarding something finite with something that could be created infinitely is not a fair exchange of value.

A stronger conclusion is that participating in such a value exchange sets you up to be robbed. If the reward for your exchanged energy gets devalued by a third party, your energy is also devalued and you can’t ever get that back. You could call that theft.

This game of theft is rigged though. If you know how to play this game you have an unfair advantage. Central bankers, politicians, and rich people with connections are not only aware of this game but they are also winning at it. At the expense of you. When prices rise faster than people’s wages (their rewards), they will hold on to their cash because they need to “save”. But while that cash is being devalued, wealthy people have put their cash into assets like real estate.

This is a reverse Robin Hood effect. If you are holding money that is being devalued you are siphoning that money’s value from your pockets to the pockets of the rich, who will see their assets grow.

That is why the human expenditure of finite energy in time deserves to be rewarded with something that can store that expended energy equitably, instead of leaking it.

How this looks currently: at the exact moment of transaction, a value exchange is perfectly equal. We agree on the terms: I provide you with product A, and in return, you give me B amount of local fiat currency units. This makes it look like we operate in a market where we exchange value freely.

After this moment, however, the value of the reward side of this exchange starts to deteriorate.

Rather than energy, time, and money being equal in a value exchange, the usage of fiat money as a reward for our energy in time creates a one-way value exchange:

Energy -> Time -> Money

This is the really important part. The existence of this unequal value exchange not only disincentivizes quality but also incentivizes recipients to spend their rewards as quickly as possible before further devaluation occurs. This high time preference triggers a nasty cycle of reduced productivity and promotes a market flooded with substandard (food) products, poor services, and detrimental habits. Such outcomes are far less likely under a monetary regime where the reward is as hard (scarce) as what it is rewarding.

One key point that is critical to understanding this dynamic: fiat money can be likened to kinetic energy, while bitcoin represents potential energy. Kinetic energy must be used immediately — either for consumption or investment — often leading to malconsumption or malinvestment because it cannot be stored over time and space.

In contrast, potential energy is stored by default and can be converted into kinetic energy when deemed more valuable than when in its stored state. Thus, bitcoin, as potential energy, is always used thoughtfully, either as consumption or investment, without the inefficiencies associated with fiat money. The key insight here is that fiat monetary energy cannot be stored productively, whereas bitcoin can.

Having established the flaws of fiat currency and the need for a finite reward system, let’s explore how Bitcoin fulfills this role by functioning as a form of digital energy.

The guarantee we won’t live forever is what allows us to value time and our lives. The guarantee of bitcoin is what allows us to value energy and our money. Money is our time and energy in an abstract form. If your money isn’t fixed, how do you value anything in your life? — Jack Mallers

To foster a fair exchange, we need a proven finite reward. That reward is bitcoin. When new bitcoin is mined (part of bitcoin’s proof-of-work mechanic), real energy — measurable in kWh, kilojoules, calories, etc. — is expended over a fixed time frame (typically about 10 minutes). This energy from the physical world is then transformed, adhering to the law of conservation of energy, into a digital commodity: new units of bitcoin.

This energy does not literally exist in digital form. The physical energy is “packaged” digitally in a figurative sense. The energy represented by one unit of bitcoin is metaphysical.

Energy is fundamental to everything around us. Natural resources, products, and services all require energy to create or maintain. For instance, sunlight energy over time allows a tree to grow. When we transform that tree into paper or matches, we’re essentially repurposing that stored energy.

Our current monetary system, however, seems to ignore this basic principle of energy conservation. Fiat money is created out of thin air, without any corresponding energy input. Yet, we use it to represent economic value. This disconnect has led to the monetization of many aspects of our lives.

Consider how we’ve turned homes into financial assets rather than seeing them as consumptive goods that fulfill a basic human need. This shift occurred because our money doesn’t hold value well over time. As a result, we’re forced to monetize other assets and use them as a surrogate for our money. This results in homes going up in price faster than possible buyers can earn money to pay for them. This harms our society, productivity, and outlook (hope) for the future.

The two main concepts to understand why Bitcoin could serve as a standard measure of human productivity are as follows:

At its core, bitcoin is just a unit of something that promises and can verifiably prove that it stays that way forever. This is where the term “1 BTC equals 1 BTC” comes from. The units themselves never change; There are never more than 21 million coins and we know the issuance schedule of new units until the last unit is mined in 2140.

Bitcoin is the only verifiably finite scarce unit in the world. For that reason alone, bitcoin is the best choice for measuring finite human productivity, as it is a unit of account of human productivity, which reflects an essential property of real money.

However, some critics might argue that inflation can transfer to bitcoin itself, making its value a moving target. They’re missing the point. Bitcoin doesn’t inflate. It’s everything else that’s losing value. The measure against bitcoin’s value should be the human productivity it rewards, which although it might fluctuate, reflects a more stable, equitable basis for valuation than fiat currencies that are subject to arbitrary, and endless, inflation.

How we get there will take some time. Bitcoin is currently going through its monetization phase; the world is figuring out what this is, the price is volatile in the short term but keeps going up in the long term. A maturation phase will follow in which it reaches an equilibrium of “how much humans value this thing”, volatility decreases, and the average growth could follow as a proxy for GDP growth, as bitcoin is the only constant this could accurately be measured in.

Other critics might claim that this perspective mirrors the labor theory of value too closely. However, it’s more about ensuring fair value exchange. At the moment of transaction, when a value agreement is made, the representation of value (the reward) must be finite, just like the energy and time that was used to create the product or service exchanged.

Bitcoin is the measurement against everything. It is both the finite asset and the unit of account.

Aligning our financial exchange system with the finite nature of both human productivity and bitcoin creates a fairer, more balanced economic environment. This alignment is essential for fostering genuine productivity and quality in a market less distorted by the negative characteristics of inflated fiat currencies.

Let’s now refer back to the equation from the beginning of this paper:

Energy = Time = Money

With bitcoin, this can now finally be achieved.

Using it as a standard measurement for human productivity represents a paradigm shift in how we value and reward human effort. By using a finite, verifiable asset to measure finite human output, we create a more equitable system that:

As we progress towards an increasingly digital world, adopting bitcoin in this role is key to creating a more transparent, efficient, and fair global economy. Bitcoin is not just a new form of money. Bitcoin can redefine the relationship between human effort and its reward.

If bitcoin’s benefits as a standard for human productivity resonate with you, but you’re worried you’re too late to adopt bitcoin, think about this: If you are committed to staying productive for the rest of your life then you are never, ever too late to Bitcoin.

—

Thank you for reading Bitcoin: The Standard Measurement for Human Productivity. I’d love to hear your thoughts on this paper.

Let me know on 𝕏 or below? Thanks!

Bram Kanstein