Bitcoin extended its recent run with another +13% gain on the week and is now up over 165% on the year.

Traditional markets generally maintained gains from the past few weeks even as economic indicators continued to look mixed. While non-farm payrolls data for last month came in above expectations and the unemployment rate ticked down sequentially, the latest data for both job openings and US manufacturing continued their downward slides, with job openings looking particularly soft relative to expectations. Additionally, following last week’s report on unrealized bank balance sheet losses once again nearing all time highs, this week saw some additional evidence of growing bank stress, as use of the Fed’s BTFP facility – which is ostensibly scheduled to expire in March 2024 – increased by $9 billion W/W as small bank cash reserves continue to plummet even despite BTFP support. Meanwhile, bitcoin extended its recent run with another +13% gain on the week and is now up over 165% on the year. Notably, bitcoin has been able to put up this impressive move even as interest rates remain at or above 20+ year highs; while we take no view on near-term swings in bitcoin’s price, we think the recent strength in this kind of environment bodes well for a world where central banks may be ending their tightening cycles, investors may be seeking “flight to quality” trades, and blue-chip institutions are preparing to roll out new vehicles to access bitcoin.

Unchained is a bitcoin financial services platform offering a suite of products to consumers and enterprises for securing and managing bitcoin holdings through a multi-signature, collaborative custody model. Unchained’s infrastructure allows users and institutions to hold anywhere from 0 to 2 of 3 keys in a multi-sig quorum, offering customizable custody experiences to meet a variety of needs. Clients can either remain in full control of their bitcoin while leveraging Unchained for backup signing and technical support or delegate custody to a quorum of three reputable institutions within Unchained’s network of key partners, creating an ETF-like experience while eliminating single points of failure and increasing transparency. Unchained offers a variety of additional financial services on top of its custody platform, including integrated trading services, bitcoin-backed lending, IRA and inheritance products, and many more to come.

Fold launched a new feature for automatic dollar cost averaging at zero fees and low spreads:

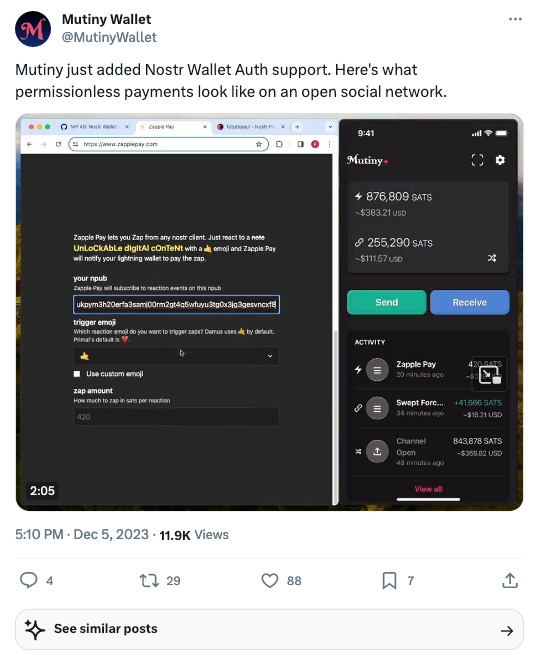

Mutiny added support for Nostr Wallet Auth, an easier way to connect external wallets to nostr clients and services:

Primal Founder and CEO Miljan Braticevic joined Ten31 Managing Partner Matt Odell on Citadel Dispatch to discuss Primal’s 1.0 release on iOS. Miljan also wrote a piece detailing some key features of the iOS release.

Upstream Data CEO Steve Barbour appeared on the What Bitcoin Did podcast for a deep dive on bitcoin mining economics.

Will Cole, Zaprite’s Head of Product, joined the TFTC podcast with Ten31 Managing Partner Marty Bent to discuss his experience in product management and the processes behind product development.

Unchained Co-Founder and CSO co-hosted a webinar with new key agent Bakkt to discuss the evolution of bitcoin collaborative custody and key networks.

Strike published a blog piece on peerswaps, a new technique for rebalancing lightning channels.

Macro indicators generally trended negative on the week, as data for job openings in October declined 7% M/M to their lowest level since March 2021, well below consensus expectations.

Meanwhile, the latest US manufacturing PMI clocked in at 47.6, in line with last month and lower than expected. This represents the 13th consecutive month in which the metric has printed at under 50, marking the longest such streak since August 2000 to January 2002.

On the flipside, non-farm payrolls for November increased 199,000 (ahead of consensus) and the unemployment rate ticked down slightly. However, payroll figures for September and October were once again revised down.

Use of the Fed’s BTFP facility – intended to shore up impaired bank balance sheets in the wake of this spring’s banking crisis – took a notable step up this week, while the Fed’s Standing Repo Facility saw its largest spike in usage since 2020 (though borrowing there remains substantially below 2020 highs).

At the same time, new data this week showed US bank lending down 1.5% over the last twelve months, the first time the metric has been negative since 2011.

In the latest bearish headline for the challenged commercial real estate backdrop, ratings agency Moody’s downgraded debt of Vornado Realty Trust – one of the largest REITs in the US – from investment grade to speculative grade (or “junk”) on concerns over the firm’s debt service capacity over the next two years.

Overseas, massive Chinese property developer Evergrande – whose default on commitments two years ago touched off major headwinds for China’s property market – was given until January 2024 to reach a new debt restructuring deal, pushing out a potential resolution of its default for another couple months.

Bitcoin’s price broke $40,000 for the first time since April 2022 this week and is hovering near $44,000 at the time of writing, bringing its YTD performance to +165%. Despite the price inflection of the past few months, conviction among long-term holders remains strong, as over 70% of UTXOs have still not moved for more than a year (up 66% from the start of 2023). Meanwhile, less than 7% of UTXOs have moved at all during bitcoin’s +25% run over the past month.

A variety of new bitcoin spot ETF filing amendments rolled in this week, suggesting ongoing progress between issuers and the SEC.

Policymakers in Japan introduced a proposed change to the country’s tax code that would eliminate taxes on unrealized gains from long-term holdings of bitcoin and other cryptocurrencies.

The US Congress removed several “anti-money laundering” provisions from this year’s National Defense Authorization Act.

It was a grim week for the protection of sensitive user data on a variety of fronts.

Early in the week, genetic testing and ancestry company 23andMe announced a widespread hack affecting sensitive data of nearly 7 million users, highlighting once again the vulnerability of centralized data honeypots.

Apple confirmed that unidentified governments around the world have been using metadata associated with push notifications on both Apple and Android phones to track and identify individual users.

New work from an anonymous user showed that Ledger’s wallet coordinator software Ledger Live extensively tracks users’ activity and transactions by default, while sharing some information with outsourced data collection services. While not surprising, this disclosure highlights the importance of tools like Coldcard and Sparrow Wallet, which can be used together with much better privacy assurances.