In a shift from capital-intensive models, Bitcoin mining is evolving towards strategic efficiency and adaptability, led by pioneers like Bob Burnett.

The podcast episode delves into the intricacies of Bitcoin asset management with a particular focus on the evolution of the mining sector. The discussion centers around the transition from a capital-intensive industry that relied heavily on raising funds and purchasing mining equipment to a more strategic and nuanced approach that emphasizes operational efficiency, economic sustainability, and adaptability.

The conversation touches upon the journey of Bob Burnett, who navigated the technology sector from the early days of personal computing to the cutting-edge realm of Bitcoin mining. Burnett sees Bitcoin mining as a multi-generational pursuit that aligns with his ideals of perseverance, aspiration, and legacy. His experience with tech giants like Gateway informs his cautious and agile approach to mining, especially in the face of a competitive and rapidly changing industry.

The episode also highlights the significance of Bitcoin's halving events and the impact on mining strategies. The guests ponder the future of the public mining companies, the importance of being quick and smart in the industry, and the evolution of block space as a scarce and valuable commodity.

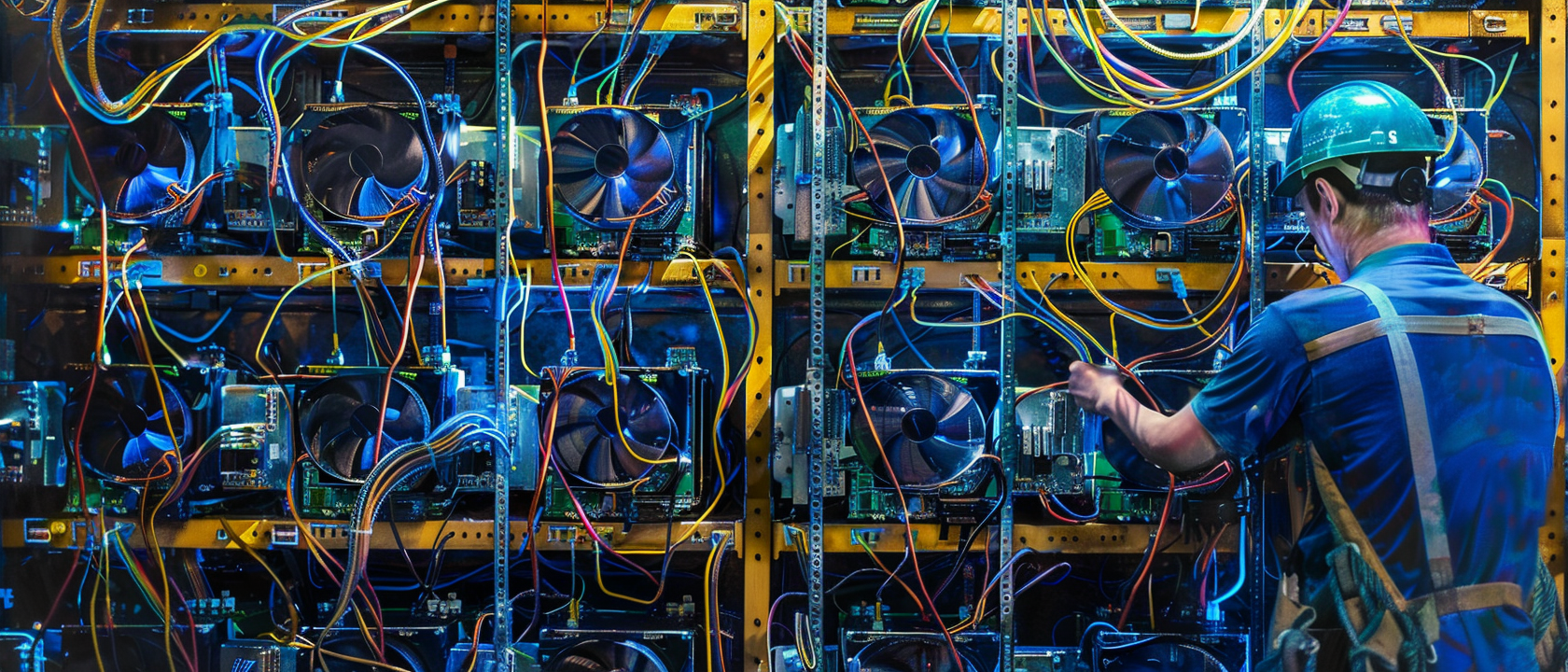

Burnett's vision for a vertically integrated mining operation, where control over the full stack—from energy to ASIC chip design to block template creation—is essential for long-term success and autonomy. He warns against complacency and underscores the importance of continuous innovation to protect Bitcoin's future.

The podcast episode offers an insightful and reflective analysis of the Bitcoin mining industry through the lens of an experienced technologist and miner, Bob Burnett. The overarching message is that the mining sector is undergoing a significant transformation, where success is no longer solely dependent on raising capital and expanding quickly, but rather on being able to adapt, operate efficiently, and plan for the long-term.

The implications for future discussions are vast. The role of public mining companies, the significance of the Bitcoin halving, the emergence of block space as a critical asset, and the necessity of vertical integration in mining operations are all points that merit further exploration. The conversation ends with a call to action for continuous innovation and vigilance to ensure the resilience and prosperity of Bitcoin and its surrounding ecosystem.