Don't be afraid to admit it; bitcoin competes with the dollar as a currency.

Most people in their day-to-day, practical lives don't distinguish between money and currency and rightly so. As a practical distinction, it's mostly irrelevant. The dollar is money and a currency. Most people will look at you cross-eyed if you ask the difference. But the difference does matter from a policy perspective and there are implications for bitcoin going forward as mass adoption occurs, which is why this discussion matters.

Bitcoin is a commodity, money and a currency all at once, and there is fundamental consequence to this that makes bitcoin unique in the history of money. Historically, certain commodities have emerged and been used as money. Gold is a great example. Gold emerged as commodity money over thousands of years, but gold was never practically or functionally a currency on its own. The US dollar (and virtually all fiat currencies) emerged as a fractional representation of gold, but more importantly, a currency that was convertible to gold.

JP Morgan (the man himself, not the bank) is famously quoted as saying, "Gold is money, everything else is credit." The dollar was credit for gold. It was a contract, as in an actual contract, convertible to gold. You don't have to understand the history of gold to accept that the entire world converged on gold as money and as a standard of value. The gold standard existed. It wasn't random, nor was it a collective hallucination. What is important is understanding the distinction. Gold was money. It wasn't a currency on its own. The dollar (or yen or euro) was the currency.

Prior to fiat currencies, gold was coined. Importantly, the process of coining necessitated an issuer. The process of coining set a standard weight and measure and through that process, gold was transformed into a currency. The coin was the currency, and the refinement (and issuance) was necessary to making it so. An issuer was a necessary part of the equation. It is was of no small consequence to transform the commodity into a currency with a standard unit (weights and measures). That is what helped turn a chemical element into a utility. The standard unit was critical to ability to use the money to effect trade and exchange.

Fiat currencies were just the progression of the same reality. Every fiat currency needs an issuer. It was true when the dollar was convertible to gold and it is also true today. The Fed is the issuer of the US Dollar. The US treasury prints the physical bills. Both are critical to the functioning of the currency system. Collectively, the Fed and Treasury issue currency, validate transactions and ensure the integrity of the currency by protecting against counterfeits (digitally and physically). In the long history of money, an issuer of currency was necessary to the money functioning as a utility in trade.

With the advent of bitcoin, that is no longer true. And it's not just because magic internet money is amazing. There is something fundamentally different about bitcoin that makes it unique. Bitcoin is the first form of money to ever exist that is also a currency. Read that again. There is no issuer of bitcoin, and it is also functional as a currency on its own, without the need for an issuer. The fundamental reason is that there is also a defined unit baked into bitcoin (not a standard unit but importantly, a unit). Bitcoin has no issuer but it also is the measure. It eliminates the need for an issuer to set standard units. It eliminates the need for standard weights and measures in addition to eliminating the issuer. The currency is also validated, not by an issuer, but by the network itself.

These collective set of facts (and properties) are what set bitcoin apart and why it revolutionizes money as we know it (or have known it). Bitcoin is a money that is also functional as currency because it collectively i) eliminates the issuer from the supply of currency, ii) eliminates the need for an issuer to set a unit or units of measure and iii) eliminates the need for an issuer in the validation of the currency and currency transactions (i.e. defining what is and isn't currency and what are or are not valid transactions). Any policymakers or those advocating for bitcoin policy need to understand this. It changes money and currency forever.

This is the TLDR but if you want to understand the logic and consequence at a deeper level continue reading. The next quick section is a Bitcoin 101 to catch anyone up who does not already have a deep understanding of bitcoin as money. Skip the next section if you already do.

First, to set a baseline for everyone new, when I say bitcoin, I mean bitcoin and only bitcoin. Everything I just explained does not translate to what you might associate with crypto. This is not an article about "crypto" or blockchain tech. Bitcoin is not synonymous with crypto. And blockchain is not "tech" in the way Silicon Valley has tried to sell it. It is important to understand the basics about bitcoin and to not lump it together with what you might otherwise associate with crypto or blockchain buzzwords.

Bitcoin is money and the concept of a blockchain was one of many important puzzle pieces that allows bitcoin to function with a credibly enforced fixed supply by removing a central third party in process of issuance and validation of the currency. Bitcoin is not just the most transformative innovation since the internet. It's likely to be far more consequential because money touches everything. The internet needs bitcoin to survive more than bitcoin needs the internet, but bitcoin is not just money for the internet.

At it's most basic level, bitcoin is money that can't be printed. Everyone in the world would stand to benefit from a form of money that anyone could access and that no one could print or debase. There are three key concepts that help bridge why nothing (and I mean nothing) in "crypto" is valuable beyond bitcoin. First, a form of money that cannot be printed would be better than any other alternative forms of money, if it were easily accessible and widely adopted. A currency with a fixed supply would be more optimal than one that (arbitrarily) increased in supply by 1%, 2%, 3%, etc. per year (or even decreased arbitrarily). 100 out of 100 rational individuals would select a money that can't be printed over one that can be easily printed. That is generally more intuitive.

Now, the second concept is less intuitive. It is that economic systems converge on one form of money due to the problem that it solves: trade. Money helps coordinate trade. Trade involves a minimum of two people and as a result, it is an intersubjective problem. I must have the form of money you accept, and you must accept the form of money I have. We must reach consensus to trade. Each individual objectively evaluates what form of money would be best to facilitate trade (and store value), but part of the evaluation is what others will value. The problem extends out to every last person on earth. It is not a 1:1 problem. It is 1:8 billion. I must have the form of money you accept and part of your evaluation is what the next person would accept. Ultimately, everyone converges on the money that is hardest to produce (and possible to access).

Economic systems converge on one form money for fundamental, non-random reasons, and the world is converging on bitcoin because it is finitely scarce. It is the hardest money to produce because in the end (and functionally soon), it won't be possible to produce any at all. The supply is fixed at 21 million. It is also permissionless, global and widely accessible. Now, the third concept ties it together. If an asset is only valuable in exchange and does not have a claim on a productive asset or income stream (like a stock or bond), it must compete as money to store value. All other crypto is competing as money. And it all fails because bitcoin does have a credibly fixed supply, money converges to one and everyone has an incentive to adopt money that can't be printed.

The concept of a blockchain is necessary in bitcoin to issue currency, enforce bitcoin's fixed supply and validate currency transactions. In practice, its function is to order transactions. In order to validate transactions and ownership of the currency across the network, you need to know which transactions happen first (or in order). Bitcoin transactions are ordered in a series of blocks which define which transactions happen first and when the transactions happen in time. Collectively, the order of blocks make what is commonly referred to as the bitcoin blockchain.

This ordering process is native to the network. There is no trusted third-party that validates all the transactions, serving as an oracle. Each participant in the network validates blocks and transactions to keep a record of its own version of the blockchain. The network enforces the rules & validates transactions as a whole. This is a key part to how bitcoin eliminates the need for a central third-party in the issuance and validation of the currency. The integrity of the records is critical to the functioning of the currency system. If the records were not immutable (i.e. if they were subject to change, arbitrarily or otherwise), the currency system would not be able to function, and the currency would not be valuable.

In short, bitcoin is all that matters in the world of crypto and blockchain. Money converges to one, a blockchain is only useful in the context of money, all other crypto is competing as money and there is only one currency and only one blockchain in quote crypto that matters: bitcoin.

Now on to the discussion of why this matters to the matter of money and currency.

Many people who have arrived at the conclusion that bitcoin is money or otherwise use it as a store of value still question whether bitcoin is viable as a currency, whether it should be a currency or whether it needs to be a currency to succeed. Michael Saylor, CEO of Strategy (formerly MicroStrategy) is one of these people. Saylor is one of the best advocates of bitcoin and I have an incredible amount of respect and appreciation for him. His view, shared by many, is that bitcoin is a commodity and money, but not a currency.

My logic and reasoning leads to the conclusion that bitcoin is collectively a commodity, money and currency. The logic is either right or wrong, sound or flawed. But, the consequence is that bitcoin can't not be currency. I know, that's a double negative. It either is or it isn't, not because I want it to be or have an opinion that it is. But because bitcoin has a fixed supply and because it works the way it does, it will also inevitably be used directly as currency in direct exchange for goods and services and ultimately, as a pricing mechanism (and unit of account).

This is not just a distinction between bitcoin's use as a store of value vs. its uses as a medium of exchange or unit of account. Instead, it's that in the future there will not be a logical basis or economic incentive to have a separate currency incremental to bitcoin. There is no need for such a currency therefore there won't be. And the insertion of a separate currency and currency layer (by regulatory or legal decree) would be the equivalent of trying to stop water from moving downhill. It would insert friction and cost without benefit. Again, this is not an opinion of what should happen or what policy should or shouldn't be. It is simply explaining the economic reality based on logic and reason.

Bitcoin works as a currency and because it works as currency, it would be economically irrational not to use it as a currency. Policy will be forced to fit the economic reality. Governments can make bad policy, and constituents can be harmed by it. But it still doesn't change the economic reality, and those that accept the reality benefit from it economically and those that don't, do in the end. So now here is a summary of the logic:

Now, why is bitcoin able to function as a currency system without an issuer and what is the practical economic consequence of adding another currency (and why will that not exist in the future)? Bitcoin as system does all of the following:

A fiat currency, especially in a digital world, needs an issuer to serve each of these functions. The dollar needs the Fed & Treasury as collective issuers to function. It can't function without an issuer. Bitcoin does all of these necessary functions without an issuer. What other function is needed to make bitcoin viable as currency on its own? None. Issuers of currency historically served a purpose. But bitcoin performs every function that issuers of currency have historically performed to transform money into a working currency system and a greater utility. That has never existed before (or never been true before) when it comes to money.

With every other money that came before bitcoin, a standard unit was (practically) dependent on there being an issuer and the issuer also necessarily played a critical role in validation of the currency and enforcing against counterfeit (enforcing supply and ensuring validity). You can't just have 1 gold, like you can have 1 bitcoin (or 1 satoshi). Gold needed a standardized weight and measure (e.g. 1oz) to function as a currency, which was set by an issuer. A standard may have emerged on the market but weights and measures were set by issuers. The dollar also needs an issuer to validate and enforce the currency. In a past world, the dollar needed a standard measure ($1, $5, $10, $20, $100), less so in a digital world, but it still needs an issuer to validate transactions and set the supply. Bitcoin doesn't suffer any of these problems as a currency.

While bitcoin couldn't function without its collective ability to autonomously (as a closed loop system) issue supply, enforce supply, transmit currency and validate currency without dependence on an outside system, the native unit of measure is of critical economic importance. The market will set what quantity of bitcoin becomes the ultimate unit of account in a steady and stable future state that comes with mass adoption, but the existence of a highly fungible and divisible unit removes the need from an outside currency system. Gold needed coinage into standard weights & measures and ultimately fiat currency units (and technology) to scale, but that was also gold's reason for failure.

Bitcoin needs no such other unit. In fact, the introduction of another unit would only introduce unnecessary economic noise and friction. In theory, another currency could be pegged to bitcoin much like gold was pegged to the dollar. For example, gold was pegged to the dollar at 20:1, $20 to one ounce of gold. This peg failed. The contract was broken in 1934 when, by executive order, the US government effected a forced devaluation of the dollar to 35:1. Eventually and today, gold trades on the open market for dollars, with the value of the dollar floating. Currency pegs always fail due to market forces. Argentine pesos were pegged to the dollar. That failed. The Mexican peso was pegged to the dollar. That failed. Pegs always fail.

And say a government wanted to hold bitcoin in reserve, with its fiat currency "free floating" against bitcoin, fluctuating in price. If you were to hold the fiat currency, it would be the equivalent of you opting back into the system dependent on trust and subject to money printing. It would be the equivalent of having the government holding bitcoin rather than you, with you having no express claim on bitcoin and with no contract to convert at a fixed price. The government would just be another buyer in the market. They would be holding the money that can't be printed and you would be holding the money that they can print. If you opted out of that system and into bitcoin for the express reason that money can't be printed, the legacy currency would only serve to un-solve a problem.

Who would be the logical holders of the fiat currency? Who would hold the currency for the long term so you can convert into it just for the moment that you want to transact? No one. That's not the way money or economic incentives works. Governments will inevitably need to hold bitcoin too and there's nothing wrong with that. There's just no technical or economic need for a fiat currency to complement bitcoin, for any lack of currency function. Bitcoin can do everything a fiat currency can do, without needing the fiat currency issuer to play a part.

Water moves downhill, finding the path of least resistance. The idea that everyone will save their bitcoin and spend dollars is predicated on a greater fool to hold dollars long term. This can hold so long as very few people understand bitcoin because there are many dollar holders but in the end, it becomes an illogical and irrational economic position.

Humans need money to survive and just as water moves downhill with the least path of resistance, humans will use money to coordinate trade in the manner that introduces the least friction. Any and every attempt to box bitcoin in some regulatory framework or definition that does not fit will be routed around due to the economic gravity.

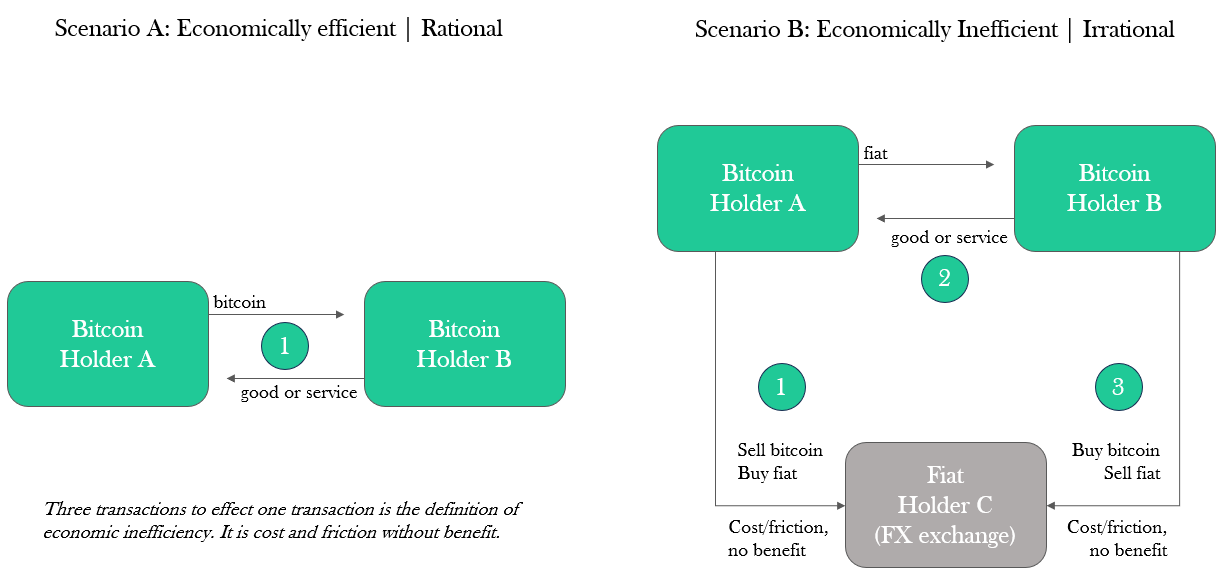

From a transactional standpoint, introducing a fiat currency on top (or in the middle) of an economic trade that could just as easily have been funded & settled directly in bitcoin introduces economic cost and friction. The direct cost comes from the superfluous incremental transactions that must be effected (3 vs. 1) and the friction comes in the form of a middle man as well as the economic consequence of managing multiple currencies in treasury and multiple pricing systems (as information).

The only reason such a scheme and market structure would exist would be to exert control and police access. There's nothing about bitcoin that prevents a country (and government) from regulating its financial system. But given how bitcoin works and because it is capable of effecting all of the functions of currency without an issuer, the only justification (or possible scenario) for having a fiat currency would be if a jurisdiction attempted to ban the transactional use of bitcoin.

But even then, water still moves downhill. It doesn't matter what impediment you put in its way. The government tried to ban booze during prohibition. Booze did not go away. Humans demanded alcohol and went to great lengths to get it. Eventually, the regulation had to change because the economic reality and incentives forced it. Bitcoin is 1,000x the utility of booze, and 1,000x harder to contain. Any attempts to arbitrarily restrict its use as currency from a regulatory perspective would be routed around because bitcoin is currency and eventually those regulations would be forced to change by the economic reality.

Save yourself the economic pain and heartache. Bitcoin is money, and it is the first money that is functional as a currency system. It is so because it has no issuer yet can fulfill the collective function and process of issuing new supply of the currency, credibly enforcing its fixed supply, validating currency transactions and transmitting currency transactions.

Bitcoin is the hardest money ever to exist. Never before has there been a form of money with a fixed and finite supply. In the end, no one will be able to produce any more bitcoin, and transactions can be sent between participants and confirmed with reliable final settlement without the need for a central third-party, over a communication channel.

Every country in the world should hold bitcoin and eliminate capital gains on bitcoin currency transactions. If any country doesn't do both, it will in the future, just at higher cost and with greater economic fallout. Don't be the people trying to prevent water from moving downhill.

“If this ends up just being digital gold, I think it’s failed. I don’t think it has a life. If it ends up being a currency people can use on a daily basis, then it’s succeeded.”@jack

If you and your business are interested in accepting bitcoin as payment, check us out at Zaprite.com.