The simultaneous occurrence of Bitcoin's fourth halving and the Runes protocol launch led to record-high transaction fees.

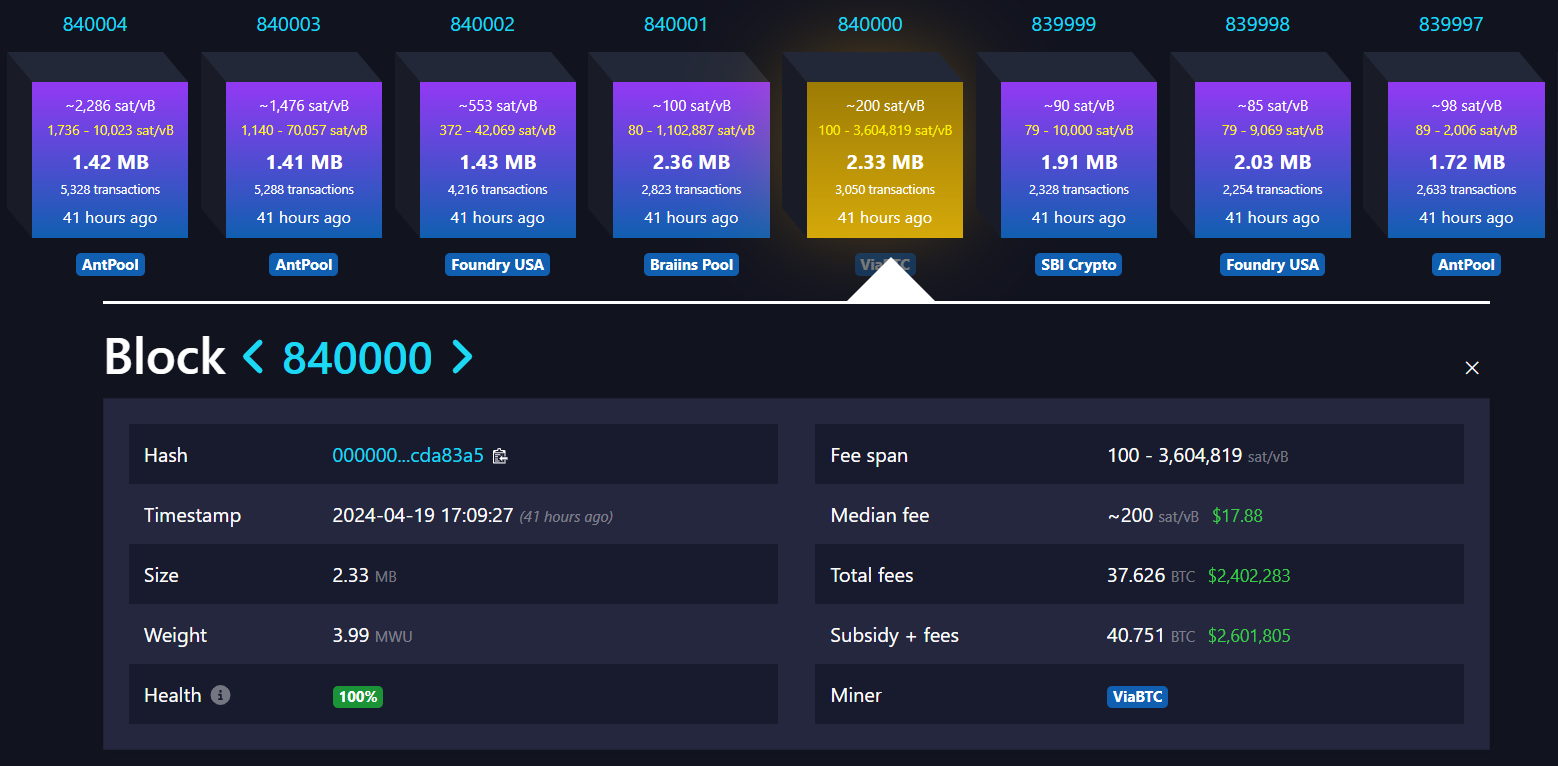

Bitcoin has undergone its fourth halving, an event that saw the mining reward cut in half from 6.25 BTC to 3.125 BTC. Occurring every four years, this event took place at exactly 00:09 UTC on Saturday when the 840,000th block was added to the Bitcoin blockchain. Despite expectations of a price fluctuation, the value of Bitcoin remained relatively stable above $63,000 following the halving.

Concurrently, the launch of a new Bitcoin-based system called Runes by developer Casey Rodarmor has sparked intense activity on the network. Runes is a protocol that enables the creation of fungible tokens on Bitcoin's blockchain, similar to the Ordinals platform which allowed for NFTs on Bitcoin. This surge in activity resulted in a massive spike in transaction fees, with the halving block itself carrying a 37.6 BTC fee, an amount exceeding $2.4 million.

The winning mining pool for the halving block was ViaBTC, which not only received the reduced mining reward but also the hefty transaction fees attached to it.

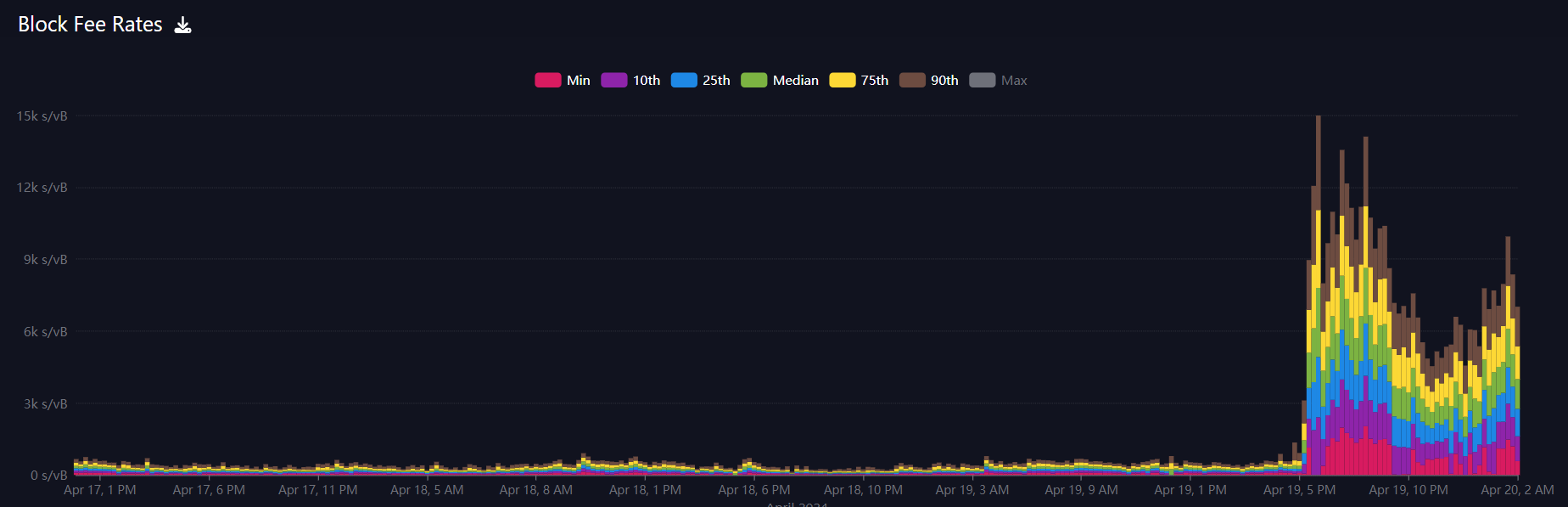

According to RuneAlpha.xyz, within less than an hour of Runes' launch at the same block, 853 runes had already been etched. The launch of the new protocol contributed to the unprecedented transaction fees, which skyrocketed to millions of dollars for several blocks following the halving, compared to the typical $40,000 to $60,000 fee for a block.

Bitcoin developer Jimmy Song expressed during a livestream hosted by Tone Vays that, "We've not had anything like this in the history of Bitcoin," recognizing the unique strain placed on the network by these events.

On-chain data showcased that the median satoshis per byte (sats/vByte) fee exploded to 1,805 sats/vByte post-halving, a significant increase from the pre-halving fee of around 100 sats/vByte. Given these conditions, transactions have become expensive, with medium-priority transactions costing around $146 and high-priority ones around $170.

With the halving reducing mining rewards, miners are expected to depend more on transaction fees and a potential increase in Bitcoin's price to balance the expected drop in revenue. Despite the current fee spike, there is speculation that this increase may be temporary.

The halving is celebrated as a testament to Bitcoin's design as an autonomous, decentralized monetary network, with a monetary policy governed by code rather than central authorities. The event is also closely watched due to its historical correlation with price rises, as fewer new bitcoins are produced, increasing the value of those in circulation. However, the effect of this particular halving is uncertain, with some predicting a price fall, while others anticipate a rally. The recent approval of spot Bitcoin ETFs in the U.S. and the introduction of protocols like Ordinals and Runes add to the complexity of predicting the outcomes of this halving.