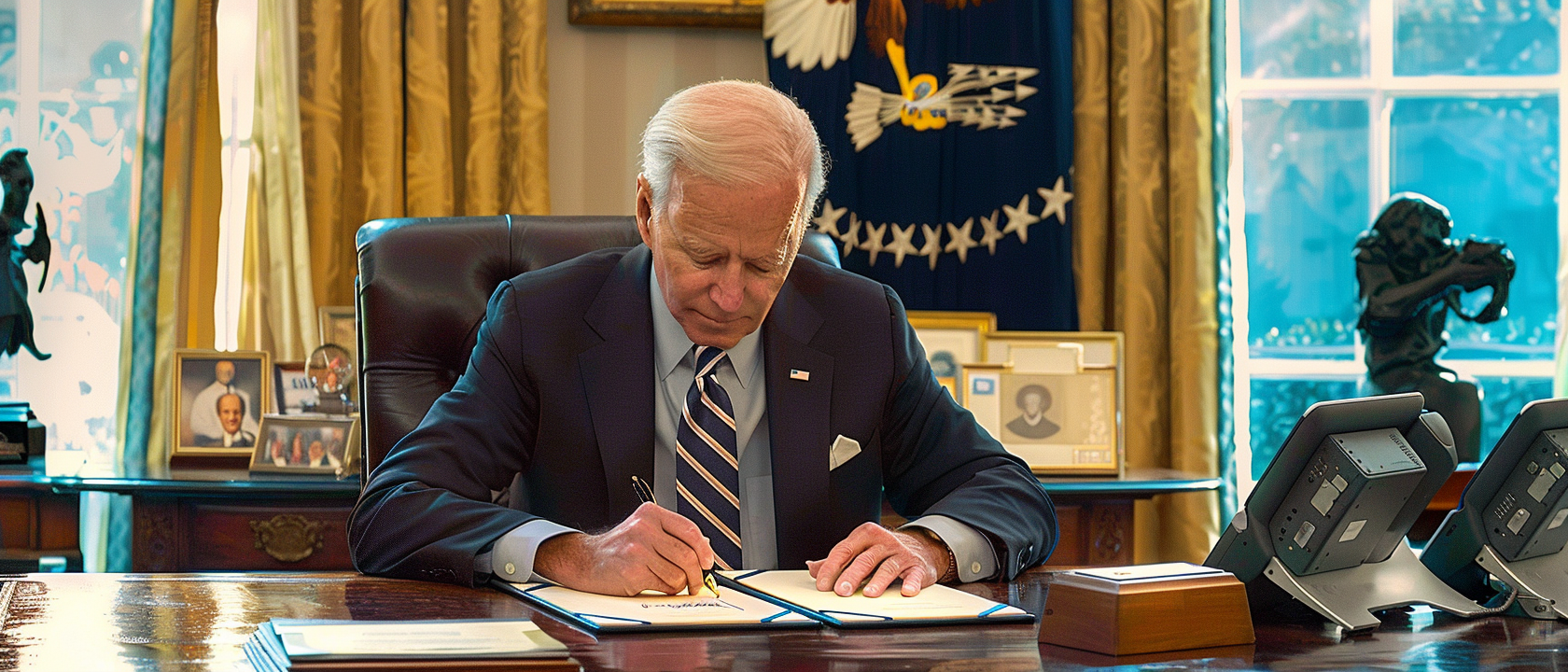

President Biden's $7.3 trillion budget proposal signals an unprecedented increase in federal spending and national debt.

President Joe Biden has unveiled a colossal $7.3 trillion budget proposal for the upcoming fiscal year, signaling a dramatic increase in federal spending that could significantly expand the government's role in the economy. This proposal marks a nearly 20% surge above the current year's already substantial expenditure and equates to approximately a third of the United States' annual economic output, as projected for the 330 million residents.

Critics of the budget have suggested that this plan does not correspond with the previous year's economic growth, which did not reach the 20% mark, thus indicating that the government may be seeking to claim a larger slice of the nation's economic pie. Over a ten-year horizon, the budget could introduce $12 trillion in new spending. Notably, the proposal conspicuously omits key expenses such as Social Security and child credits, suggesting that the actual budget could be even higher than initially stated.

The proposed fiscal plan is also projected to add a staggering $16 trillion to the national debt over the next decade, potentially pushing the total debt beyond the $50 trillion mark. This forecast comes at a time when American households are already grappling with an immense $17.5 trillion in debt, averaging $150,000 per family, compounded by unprecedented hardship withdrawals from retirement accounts and soaring credit card balances with interest rates as high as 24%.

The looming question remains: how will the government fund this ambitious budget? The answer appears to be a partial solution involving $5 trillion in new taxes, translating to an average of $36,000 per family. The administration's strategy includes repealing portions of the Trump-era tax relief, raising the corporate tax rate to 28%—effectively reaching nearly 33% when combined with state taxes. This rate would be among the highest globally, potentially prompting job losses and corporate migration overseas. Estimates suggest that such tax increases could result in the loss of 1 million jobs within the initial two years, followed by a decrease of 600,000 jobs annually for a subsequent decade.

Further tax hikes are proposed for individuals earning more than $400,000 annually, affecting numerous entrepreneurs while sparing the ultra-wealthy who can evade such taxes through sophisticated accounting or by moving funds offshore. Thus, the burden of taxation may fall disproportionately on the industrious middle-class rather than the billionaires who are often cited to justify these tax hikes.

As the budget proposal unfolds, it is important to remember that presidential budgets rarely pass through Congress without modifications. They are typically seen as vision statements rather than concrete fiscal plans. With the history of the GOP's compliance with Washington's bipartisan consensus and susceptibility to special interest pressures, some are concerned that actual spending increases could surpass even Biden's lofty proposal. And while immediate tax hikes may be stalled by lobbying efforts, the specter of ballooning deficits suggests that more taxes are an inevitable outcome.