In a recent update from Porkopolis Economics, concerns regarding the economic stability of Argentina have been brought to light, as the nation grapples with significant devaluation of its currency, the peso.

In a recent update from Porkopolis Economics, concerns regarding the economic stability of Argentina have been brought to light, as the nation grapples with significant devaluation of its currency, the peso. The newly elected anarcho-capitalist President, Javier Milei, has taken a drastic step by officially devaluing the Argentine peso by over 50% in an attempt to address the country's monetary challenges.

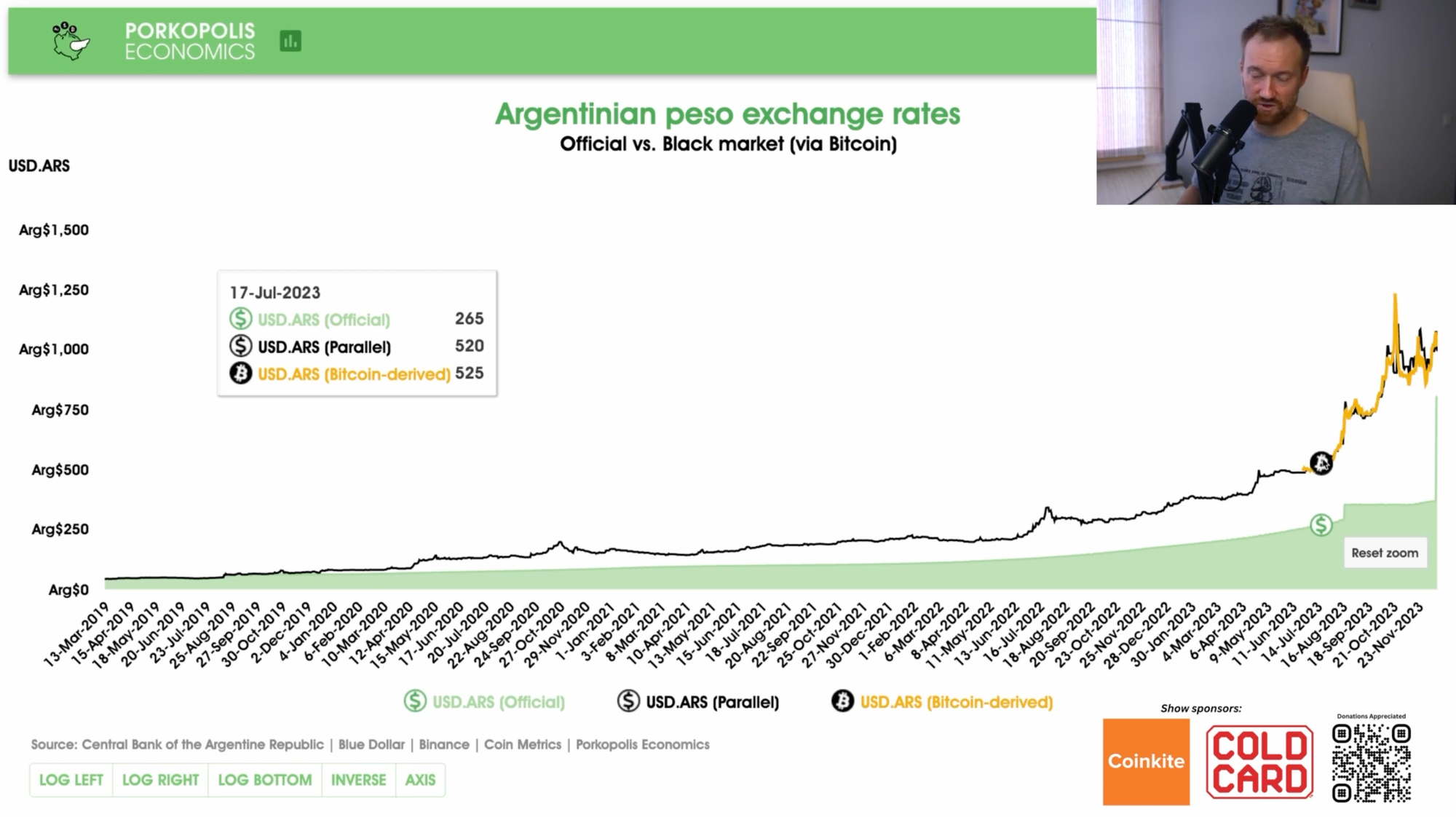

Just five years ago, the exchange rate hovered around 20 Argentine pesos per US dollar, but recent times have seen a steep decline, particularly exacerbated by the COVID-19 pandemic and ongoing issues with the International Monetary Fund. This summer, pre-devaluation, the rate stood at approximately 300 pesos per dollar, which further plummeted to 350 pesos per dollar. However, following President Milei's decision, the official rate now sits at about 800 pesos to the dollar — a staggering drop from its already devalued state.

It's important to note that alongside the official exchange rate, there exists a black market rate for the peso, which historically has been much worse than the official rate. Sites like Blue Dollar track this parallel rate, which currently is roughly double the official rate. Despite President Milei's devaluation, the black market still values the peso at approximately 990 to 1000 per dollar, indicating a persistent 20% difference.

President Milei has also taken bold steps in defunding numerous industries, a move criticized by some as the easier part of the economic reform process, with the more challenging aspect lying in monetary restructuring. The future of the Argentine central bank and the possibility of dollarization remain uncertain, with Milei's policies yet to prove their effectiveness.

In the midst of this economic turmoil, Bitcoin emerges as a relevant asset. The cryptocurrency's global market provides an alternative method for gauging the black market rate of the peso. By analyzing the global exchange rate of Argentine pesos per Bitcoin on platforms like Binance, and juxtaposing it with the Bitcoin price in dollars, one can triangulate the non-official rate of the peso. Currently, the cost to purchase one Bitcoin stands at 43 million Argentine pesos, which when divided by the Bitcoin price in dollars, reveals the black market value of the peso.

As Argentina faces these financial challenges, there is hope that under President Milei's leadership, the country can narrow the gap between the non-official and official exchange rates and ultimately bring inflation under control. The Argentine people, who have long been familiar with currency volatility, look towards a future that hopefully avoids the hyperinflation experienced by nations such as Zimbabwe and Weimar Germany. With free market reforms on the horizon, there is cautious optimism for economic recovery and stability.