Apple's iPhone sales drop signals wider economic struggles and rising consumer debt, hinting at a looming recession.

The recent earnings season on Wall Street has unveiled a torrent of warnings from across the business sector. This wave of caution is not just from technology behemoths like Apple but extends to traditional entities like Red Lobster.

Apple Inc. reported a nearly 10% drop in iPhone sales, totaling $45.96 billion. This decline suggests a faltering demand for the latest generation of smartphones. Despite a record share repurchase plan aimed at investor reassurance, the underlying message was clear: consumer spending power is waning.

Red Lobster has filed for Chapter 11 bankruptcy. The company cited a difficult macroeconomic environment and increased competition within the restaurant industry. This move underscores the broader struggles facing the sector—business models are cracking under economic pressures.

Home Depot attributed its diminishing consumer demand to high mortgage rates. However, mortgage and treasury rates have been relatively stable over the past year, suggesting that other factors may be at play, such as a general tightening of consumer budgets.

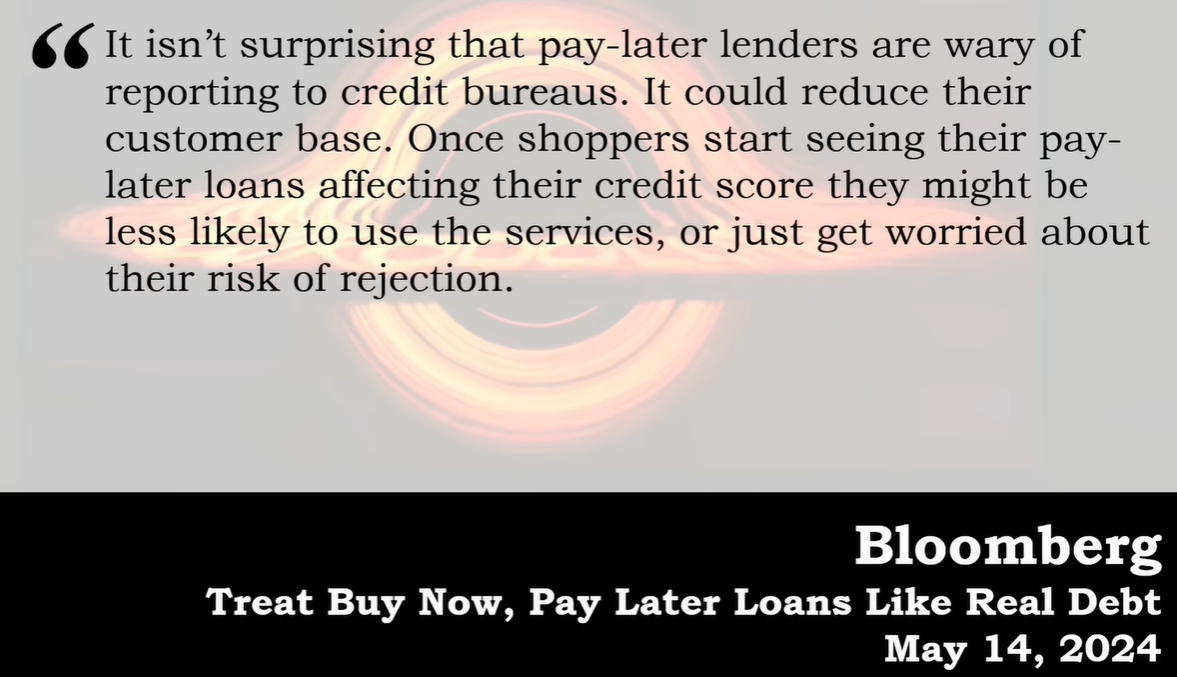

The popularity of 'buy now, pay later' options like Flex has skyrocketed, indicating that consumers are seeking ways to cope with insufficient incomes. Bloomberg labeled the situation a "vibe session," reflecting the collective sentiment of financial strain among consumers.

The average credit card debt has surged by 8.5% year over year. This uptick is worrisome as it coincides with a rise in delinquencies, signaling that consumers are exhausting their financial options. The shift towards alternative payment methods may serve as a stop-gap but potentially sets the stage for a debt trap if the economy does not improve.

Despite reports of a robust labor market, income growth has not kept pace with rising prices. The labor market's apparent strength has not translated into sufficient income, leading consumers to incur more debt. If this trend continues, a contraction in consumer spending is inevitable.

The corporate sector's earnings reports, coupled with macroeconomic data, reveal a troubling economic scenario. Incomes are not keeping up with expenses, leading to increased consumer debt and reliance on alternative payment methods. The narrative of a booming economy is at odds with the reality of stretched consumer budgets. These factors collectively point to the potential onset of a recession, challenging the notion of a gentle economic descent into a disinflationary period.