Consumer confidence in the U.S. has dropped sharply in June, reflecting growing concerns over high prices, weakening incomes, and a disconnect between Federal Reserve projections and market sentiment.

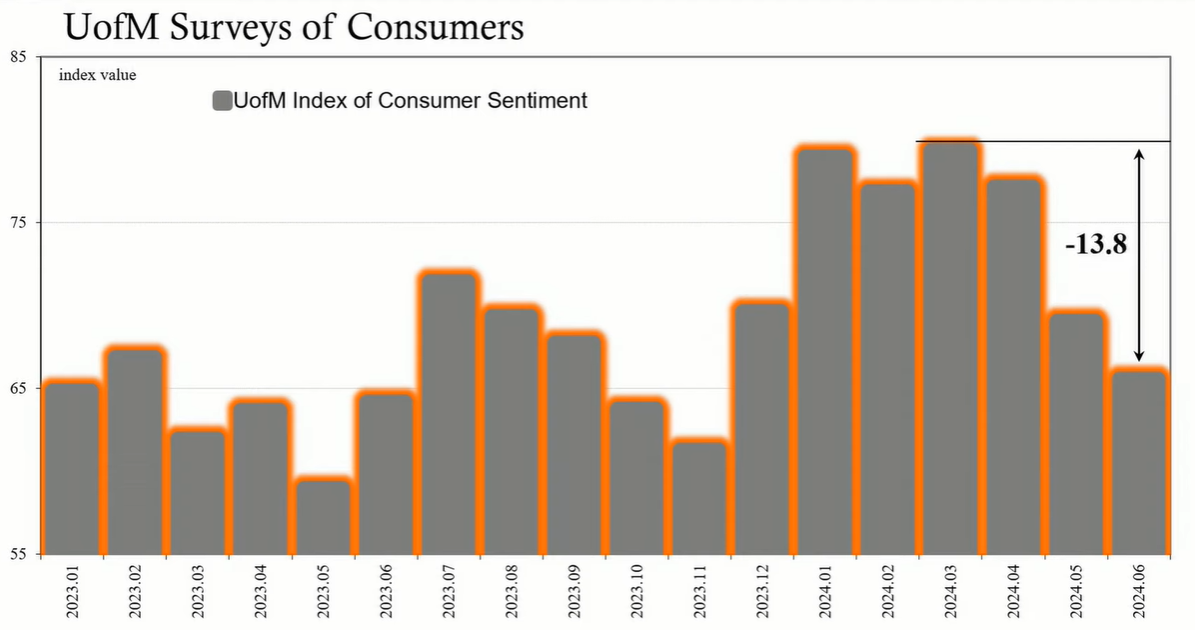

Consumer confidence in the United States experienced a significant drop in June, marking a continuation of the downward trend observed in May. According to the University of Michigan's Consumer Sentiment Index, confidence levels fell from 69.1 to 65.6, reaching the lowest point since November and showing a notable decline since March.

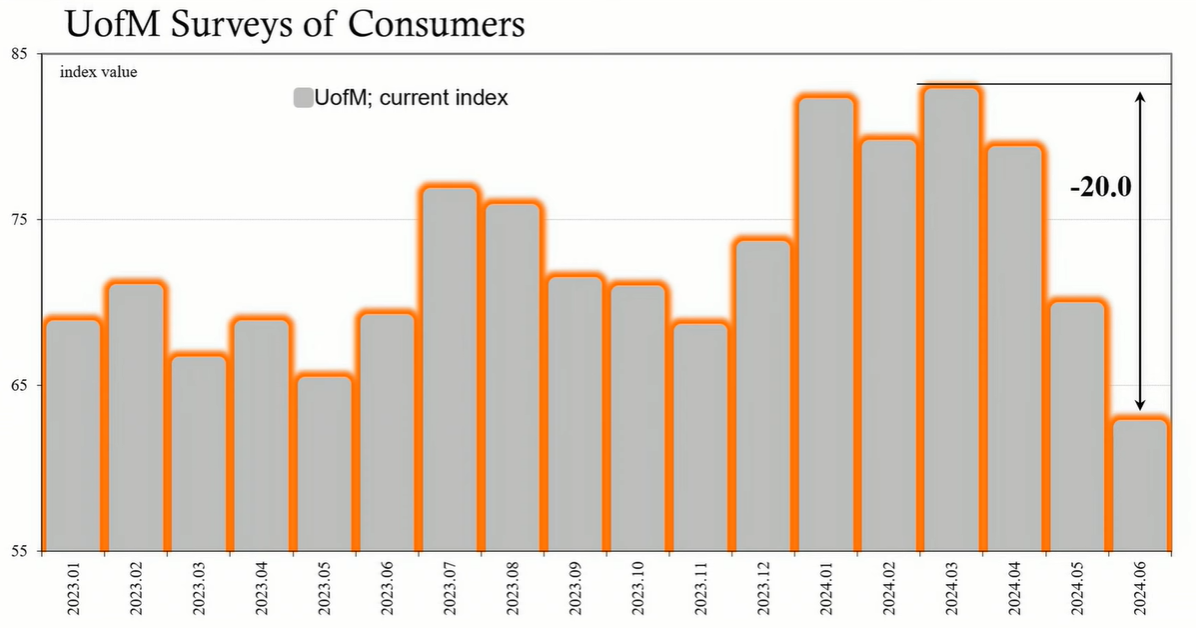

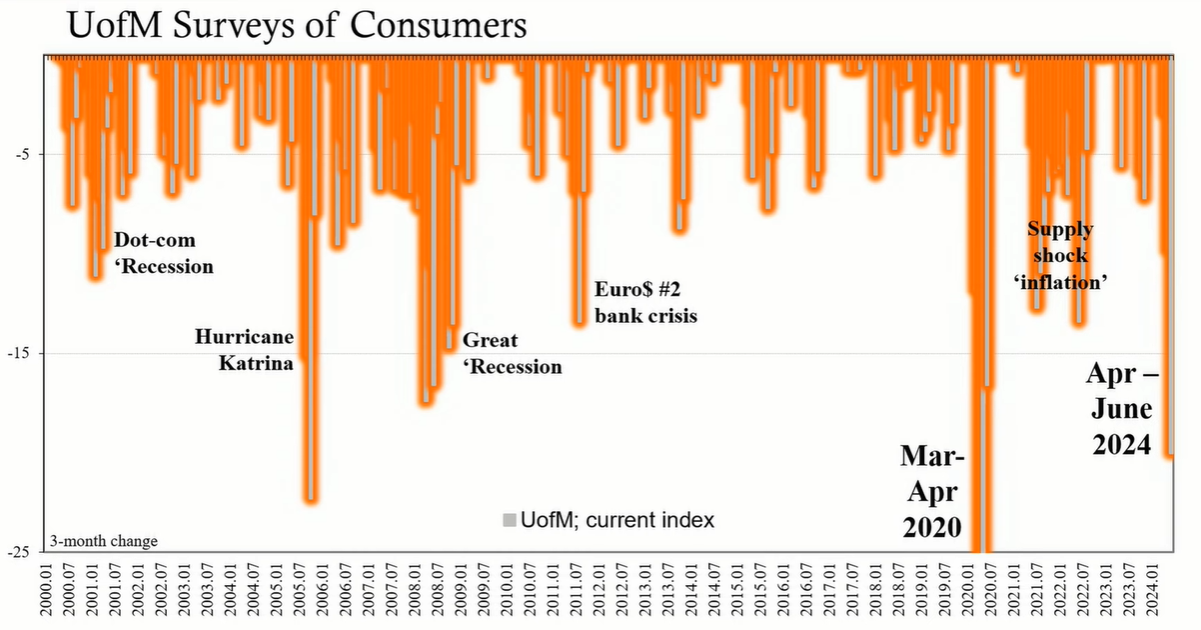

The assessment of the current economic situation by Americans revealed a stark decline. The index dropped to 62.5% from 69.6% in May, indicating the lowest level since December 2022 and a 20-point decrease over the last three months. Such a rapid fall in consumer sentiment has rarely been observed in the 21st century, with previous occurrences linked to major events like the pandemic lockdowns in April 2020 and Hurricane Katrina in the summer of 2005.

Amidst declining confidence, the Federal Reserve adjusted its projections, signaling a more hawkish stance on future monetary policy. Despite this, market rates have continued to decrease, suggesting a disconnect between the Fed's outlook and market sentiment. During a recent press conference, financial media posed challenging questions to Federal Reserve Chairman Jay Powell, seeking clarity on the Fed's position given the contrasting economic signals.

Reporter: "What's your message to Americans who are seeing encouraging economic data, but don't feel good about this economy."

— TFTC (@TFTC21) June 12, 2024

Jerome Powell: "We don't tell people how they should think or feel about the economy... In the meantime it's going to be painful for people." pic.twitter.com/tUCKJuYF2i

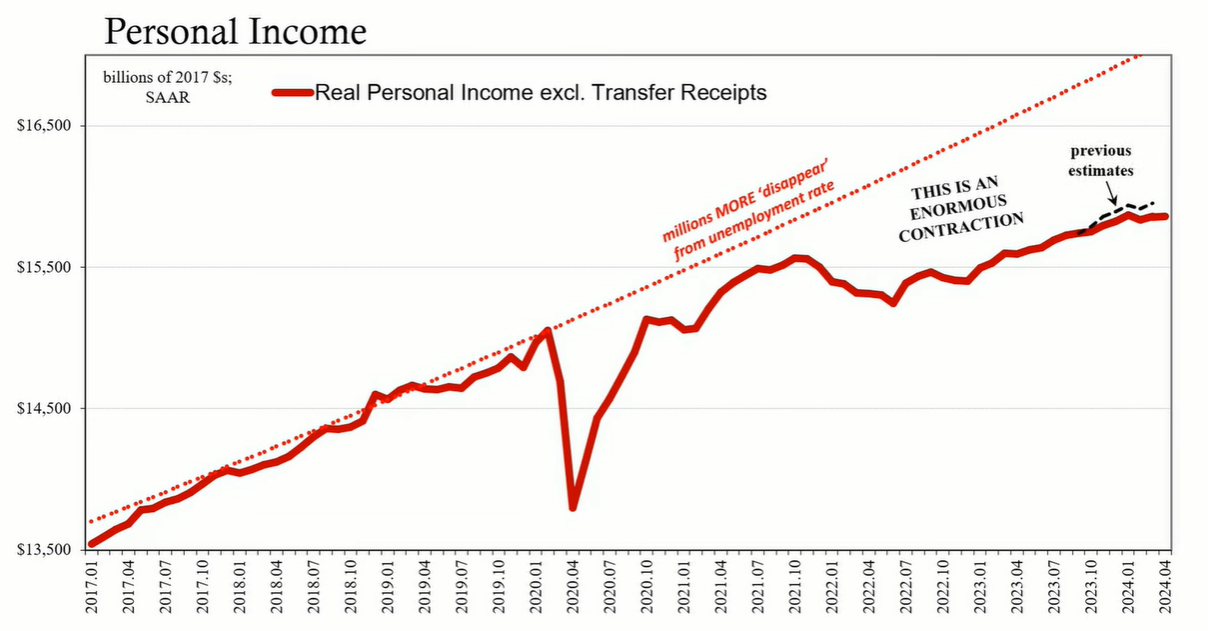

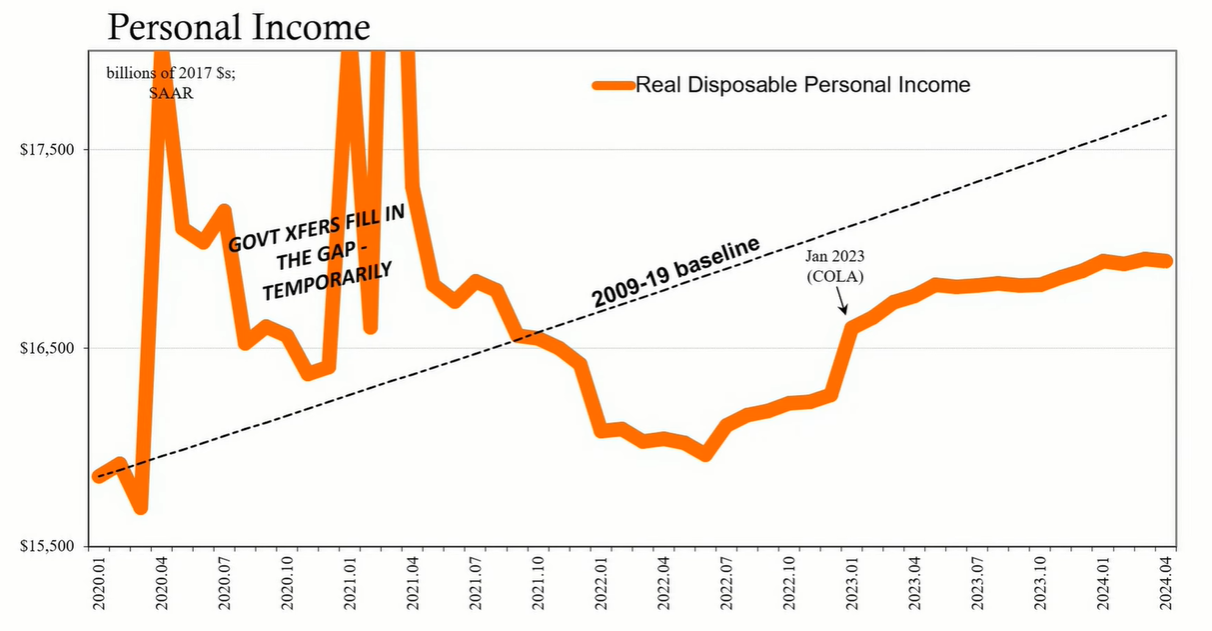

While the Fed maintains that the U.S. economy is resilient, consumer perceptions differ significantly. The fall in consumer confidence was unexpected as forecasters anticipated a rebound in June, which did not materialize. The drop in sentiment is attributed to concerns over high prices and weakening incomes, reflecting a broader unease about the overall economic strength.

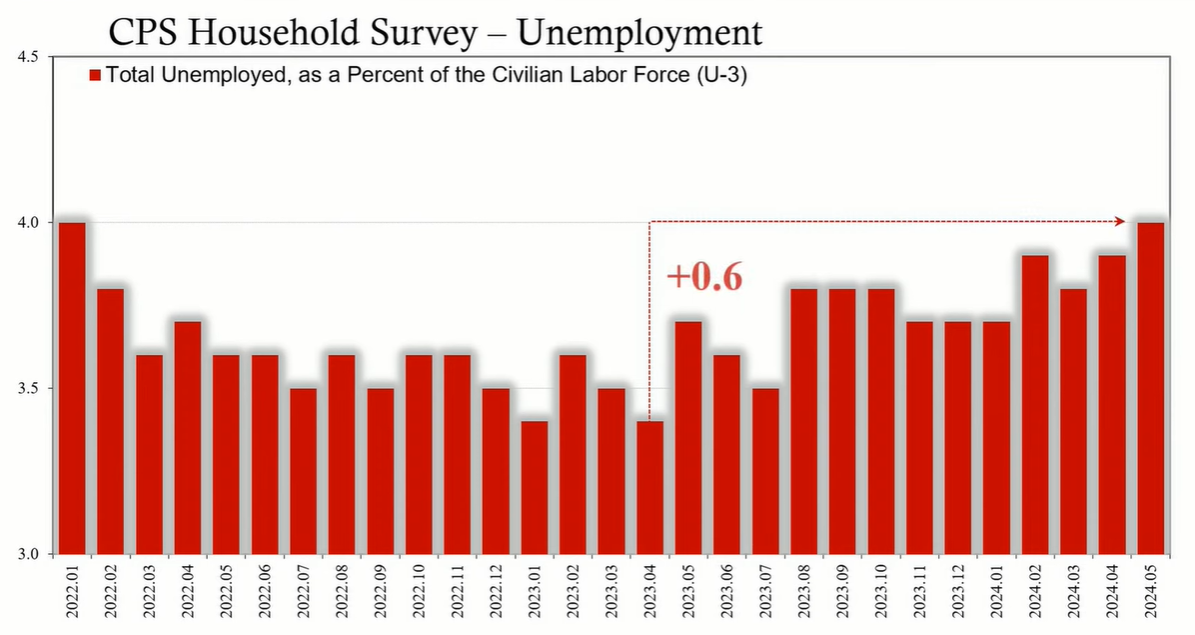

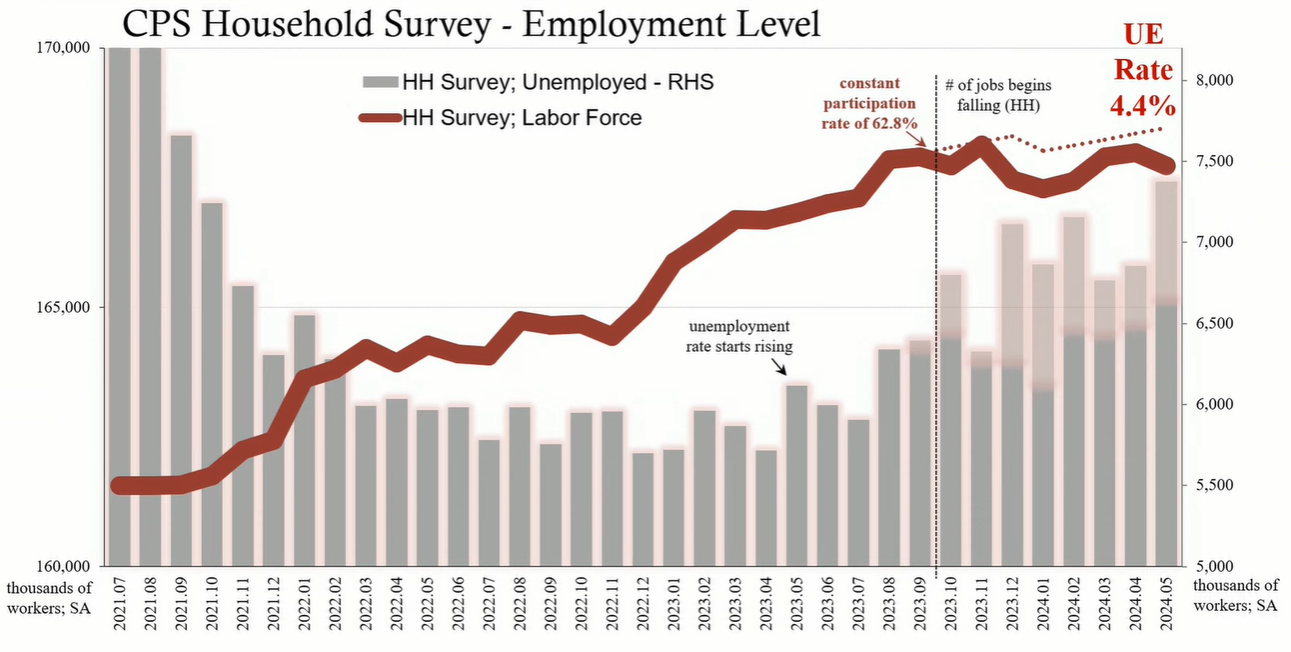

The labor market's condition is a critical factor influencing consumer confidence. There is evidence that the once robust wage gains are slowing, with some individuals facing reduced hours or challenges finding employment after unemployment. This shift in the labor market dynamics is fueling the decline in consumer confidence, as the prospect of getting ahead financially becomes uncertain for many Americans.

The University of Michigan's report is corroborated by other economic data, suggesting a broader economic downturn. Various indicators, including regional Federal Reserve surveys and reports from major retailers, point to a slowdown in demand and business activity. These developments raise questions about the future trajectory of unemployment rates and the overall health of the labor market.

The plunge in consumer confidence, combined with a series of challenging questions toward the Fed, highlights the growing uncertainties in the U.S. economy. Despite the Fed's hawkish projections and a strong labor market on paper, real-world indicators suggest potential weaknesses that could impact future economic stability. As American consumers grapple with high prices and income challenges, the true state of the economy remains a subject of debate and concern.