A deep dive into the contrast between the optimistic economic statistics presented by President Biden's administration and the pervasive skepticism among Americans.

In the midst of a seemingly robust economic landscape painted by official statistics, American sentiment towards the nation's fiscal health remains overwhelmingly negative. Despite President Joe Biden's statisticians reporting strong economic indicators, such as a brisk pace of consumer spending, a decrease in inflation from its peak during the Biden administration, and a solid 3.1% GDP growth for the year, the public's outlook is decidedly grim.

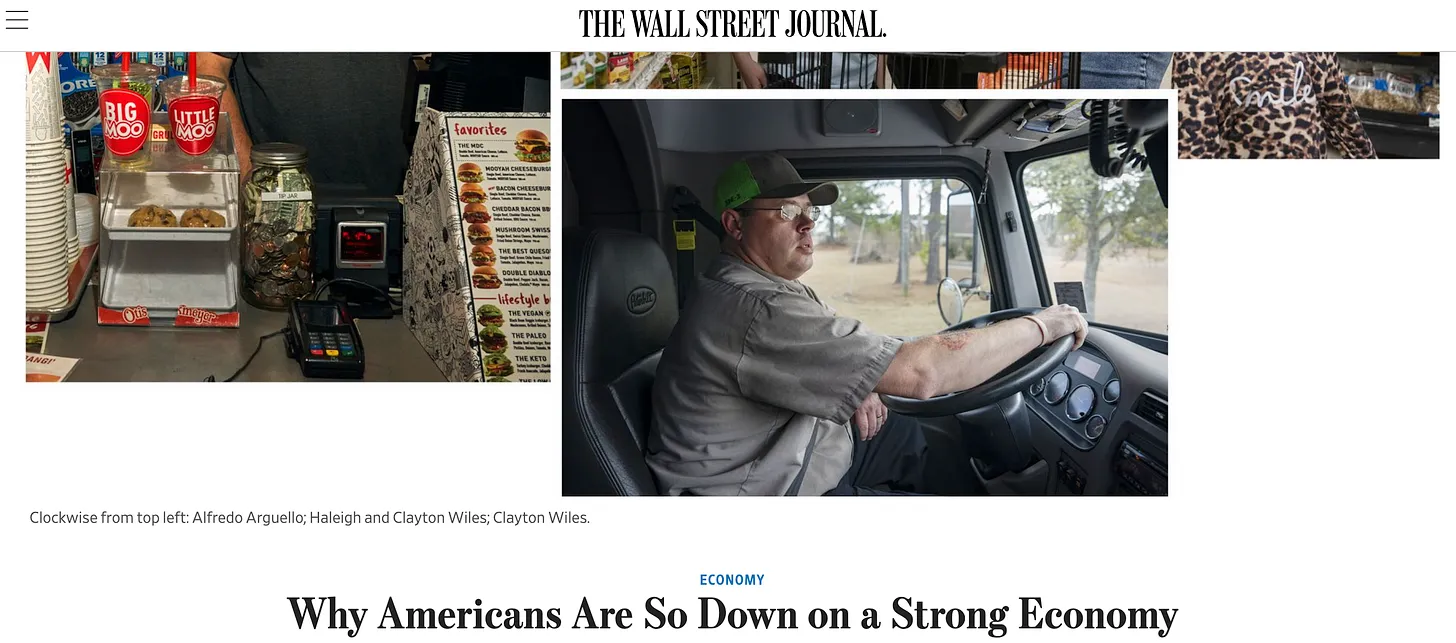

A recent 3,000-word essay by the Wall Street Journal, a publication often seen as a staunch supporter of Biden's economic policies, delves into this paradox. It highlights the fact that official unemployment rates have been below 4% for 24 consecutive months, marking the longest stretch of such low levels since the 1960s—a period that could be heralded as "morning in America." Despite these figures, a mere one in seven Americans believe they are better off since Biden took office, and the President faces historically low approval ratings for a commander in chief in their third year.

The Journal proposes several reasons for this disparity, pointing to a college degree's diminished guarantee of middle-class status, the toll of continuous military conflicts, and what is perceived as uninspiring leadership from a government deemed dysfunctional. These factors are exemplified by the ongoing border crisis and the deterioration of urban centers across the country.

However, the article suggests that perhaps a more significant issue is the inherent disconnect between the statistical data and the reality faced by many Americans. For example, the low unemployment rate does not account for those who have stopped seeking employment, including the millions who have left the labor force since the onset of COVID-19. If these individuals were considered, the unemployment rate would be notably higher, resembling the precursory conditions to the 2008 financial crisis.

Similarly, the strong GDP numbers are attributed to federal deficits and increased social spending—factors that contribute to growth but also foreshadow potential bankruptcy, rather than signaling genuine wealth creation. Consumer spending, buoyed by rising personal debt and default rates, is not necessarily a sign of optimism but rather a struggle to stay afloat.

Inflation, while showing some signs of abating due to supply chain improvements and energy costs, continues to rise concerning underlying rates. This persistent inflation undermines the narrative of economic recovery and contributes to the public's apprehension.

The essay implies that the "everything is fine" narrative may be a façade, supported by statistics designed more to obscure than to inform. It raises the question: Are Americans being misled by a regime more focused on maintaining power than serving its people?