In an alarming report by the Committee to Unleash Prosperity, it has been revealed that the average American's retirement savings have been significantly eroded, with nearly a quarter of its value depleted over a span of two and a half years.

In an alarming report by the Committee to Unleash Prosperity, it has been revealed that the average American's retirement savings have been significantly eroded, with nearly a quarter of its value depleted over a span of two and a half years. The analysis indicates that this reduction translates to an average loss of $30,000 in buying power from individual retirement accounts (IRAs). For those with more substantial retirement plans, such as an $800,000 nest egg—which could typically yield a $40,000 annual income—the shrinkage is an estimated $200,000.

This financial setback could potentially postpone the retirement plans of millions of Americans by up to a decade, as suggested by economic analyst E.J. Antoni. The primary culprits for this predicament are identified as inflation and the Federal Reserve's subsequent interest rate hikes under the leadership of President Joe Biden and Fed Chairman Jerome Powell.

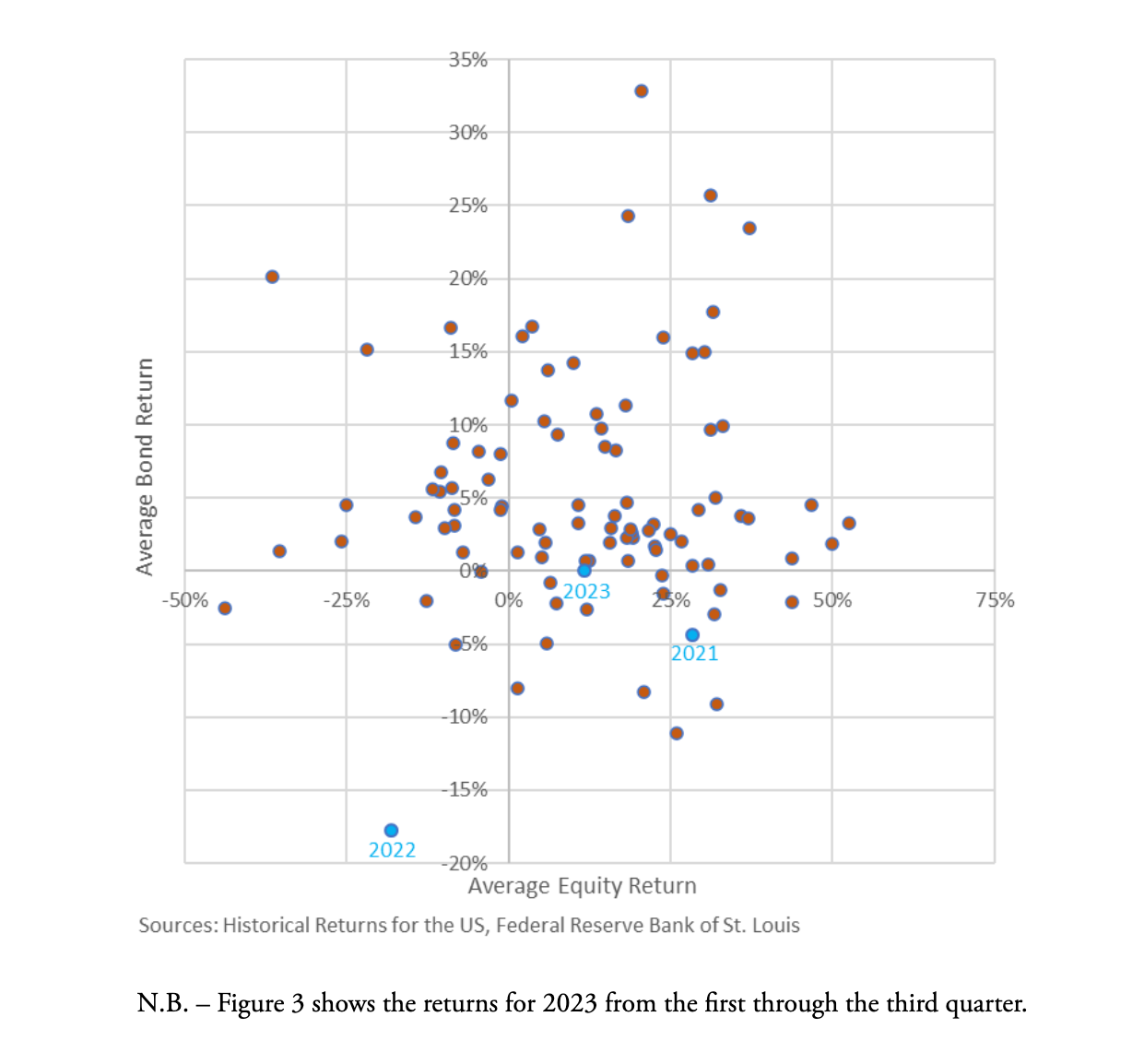

The year 2022 marked a particularly devastating period for retirement portfolios, delivering a rare simultaneous blow to both stocks and bonds—the foundational components of most American retirement savings. Traditionally, bonds serve as a counterbalance to stocks, but in an unprecedented turn of events, bonds experienced their worst performance since at least 1928, erasing 13%—approximately $17,000—of the average retirement account's value.

The onslaught continued as inflation further diminished the purchasing power of the remaining retirement funds, stripping away an additional $16,200 and bringing the total loss to an estimated $33,200, or about 25% of the starting balance for the average American.

Beyond the retirement savings crunch, a Senate analysis has found that the average American is now paying an extra $11,400 due to inflation and higher borrowing costs instigated by the Federal Reserve's rate increases. Consequently, many are coping by accruing record levels of credit card debt, borrowing against their diminished retirement accounts, and increasingly relying on "buy now, pay later" schemes, which have spiked by 14% within a year alone.

Amidst these challenges, the national debt has ballooned by $2.5 trillion in just six months, with the economy seemingly propped up on a precarious foundation of debt that continues to undermine the financial security of retirees.

For more in-depth analysis on the state of American retirement savings and economic policy, visit peterstonge.com to listen to the latest podcast episode.