In a recent report by Bloomberg, an alarming trend has surfaced: American workers are increasingly tapping into their retirement savings to cope with immediate financial pressures.

In a recent report by Bloomberg, an alarming trend has surfaced: American workers are increasingly tapping into their retirement savings to cope with immediate financial pressures. A study from Fidelity Investments reveals a stark 30% year-over-year increase in hardship withdrawals from retirement accounts. Last year alone, nearly one million American workers, or 2.3% of the workforce, took such a withdrawal.

The situation appears even more dire for those with 401(k) accounts, with 2.8% making hardship withdrawals, and inclusive of in-service withdrawals, this number rises to 3.2%. The primary reasons for these withdrawals are heart-wrenching: to avoid eviction or foreclosure and to pay for outstanding medical bills.

Currently, one in six American workers is burdened with an outstanding loan against their retirement savings, marking an increase of half a million from the previous year. As Bloomberg starkly puts it, Americans, especially the bottom 80% who are not among the wealthiest, have depleted the extra savings accumulated during the pandemic and are now left with less cash than when the COVID-19 crisis began.

This trend is not isolated to those without employment; these are Americans with jobs, leaving us to ponder the struggles of those without a steady income.

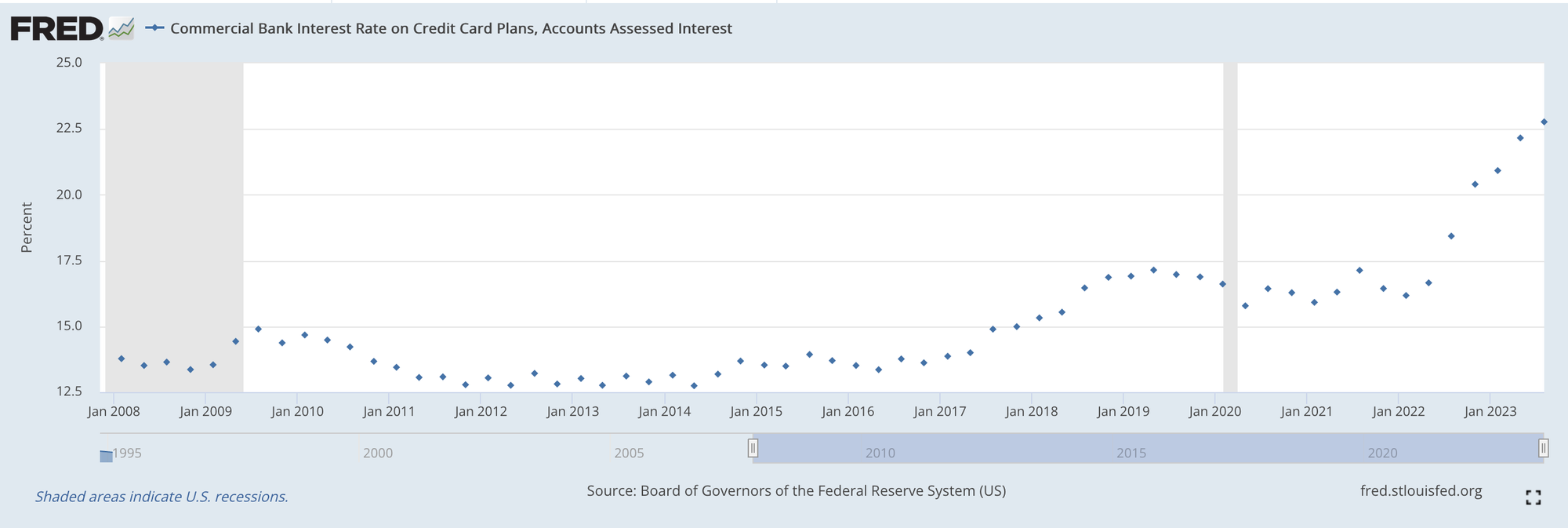

This financial strain is not only evidenced by hardship withdrawals. Record-high credit card balances, with interest rates as steep as 21%, also signal Americans' precarious financial state. A survey highlights that a staggering 57% of Americans are unable to handle an unexpected expense of $1,000.

The cumulative effect of these financial challenges could spell disaster for the economy. With millions more potentially exhausting their resources, consumer spending could plummet, affecting receipts across the economy and jeopardizing hopes for a "soft landing."

Moreover, the impact on future retirement is profound. With the average 401(k) balance decreasing by $4,000 in three months to a mere $107,000 last year, the projected monthly retirement income from this would be an insufficient $448.75. Even when factoring in Social Security, this amount barely crosses $2,000—hardly enough to survive without employment.

In a concerning development, Congress is considering legislation that would make it even easier to withdraw from retirement savings starting in 2024. While this could potentially stimulate consumer spending in time for the election, it risks leaving millions facing a financially insecure retirement.

These distressing data points, like "grains of sand," accumulate to foretell a potential economic catastrophe that, in hindsight, may appear blatantly obvious. As a responsible journalistic entity, we commit to keeping a vigilant eye on these developments. Stay tuned for further coverage on this critical issue.

Now we know why consumers are spending -- they're raiding the 401k.

— Peter St Onge, Ph.D. (@profstonge) November 28, 2023

Hardship withdrawals from retirement accounts soared last year by 30% to 3.6 million. The top reasons are avoiding eviction or foreclosure and unpaid medical bills.

This brought the average 401k balance down… pic.twitter.com/8rRjP4dcsk