Since President Joe Biden's inauguration in January 2021, coinciding with the inflation spike, American households now require an additional $11,434 per year to maintain their pre-inauguration standard of living.

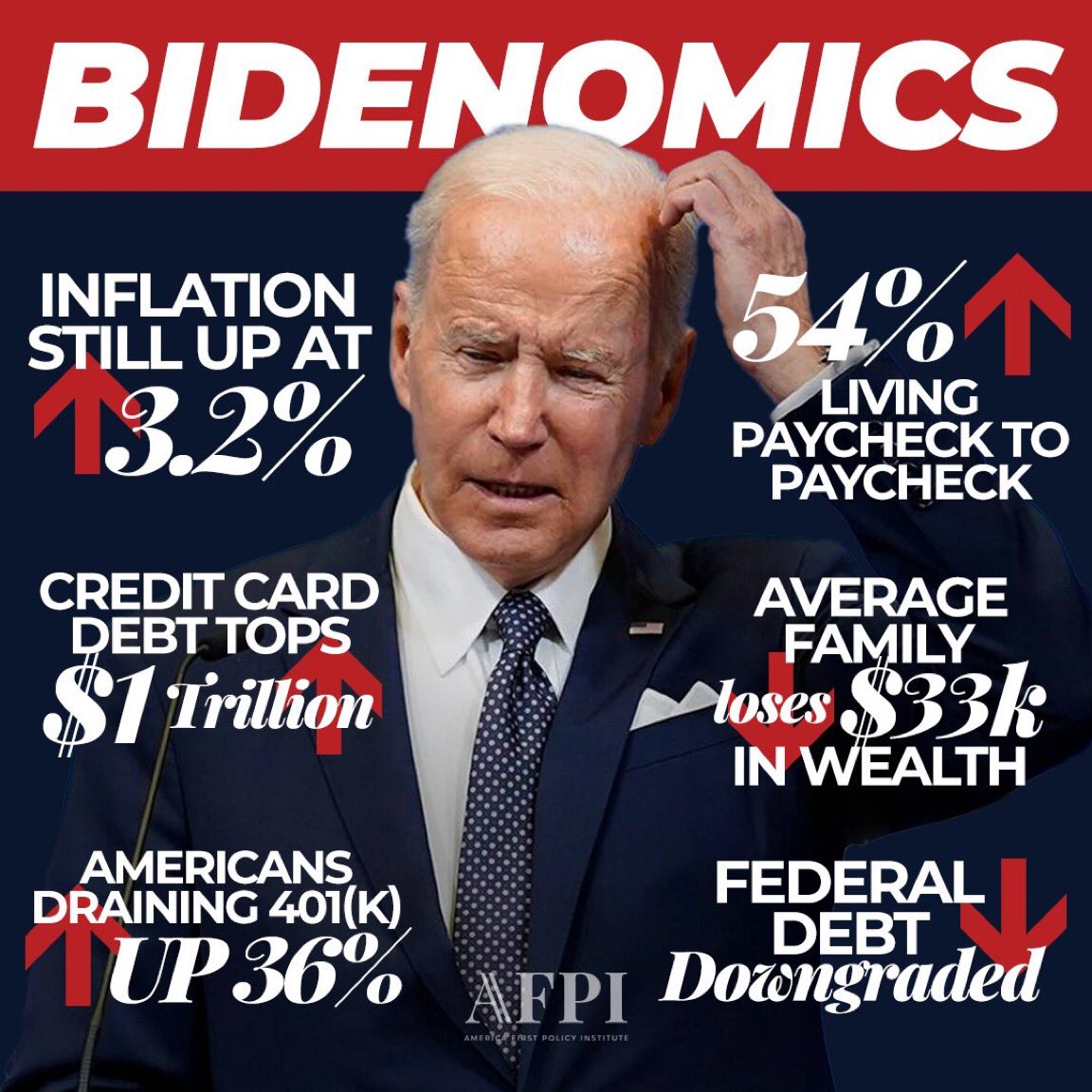

In the wake of the United States' grappling with a 40-year high inflation rate, a new study from the US Senate Joint Economic Committee has brought to light the financial strain on the typical American family. Since President Joe Biden's inauguration in January 2021, coinciding with the inflation spike, American households now require an additional $11,434 per year to maintain their pre-inauguration standard of living. This figure starkly contrasts the narrative of inflation being subdued at "very little cost," as suggested by economist Paul Krugman.

The report outlines that essential living expenses such as food, transportation, housing, and energy are the primary drivers of this financial burden, accounting for nearly eighty cents of every additional dollar spent by families. The Ludwig Institute's research posits an even more daunting scenario, estimating that American families may need close to $14,000 more annually to keep pace with the rising costs.

State-specific data reveals that the situation is particularly dire in regions like Colorado, Utah, and Arizona, which have seen an influx of residents from economically challenged "blue states." The cost of living increase in Colorado alone surpasses $15,000 in additional expenses per year.

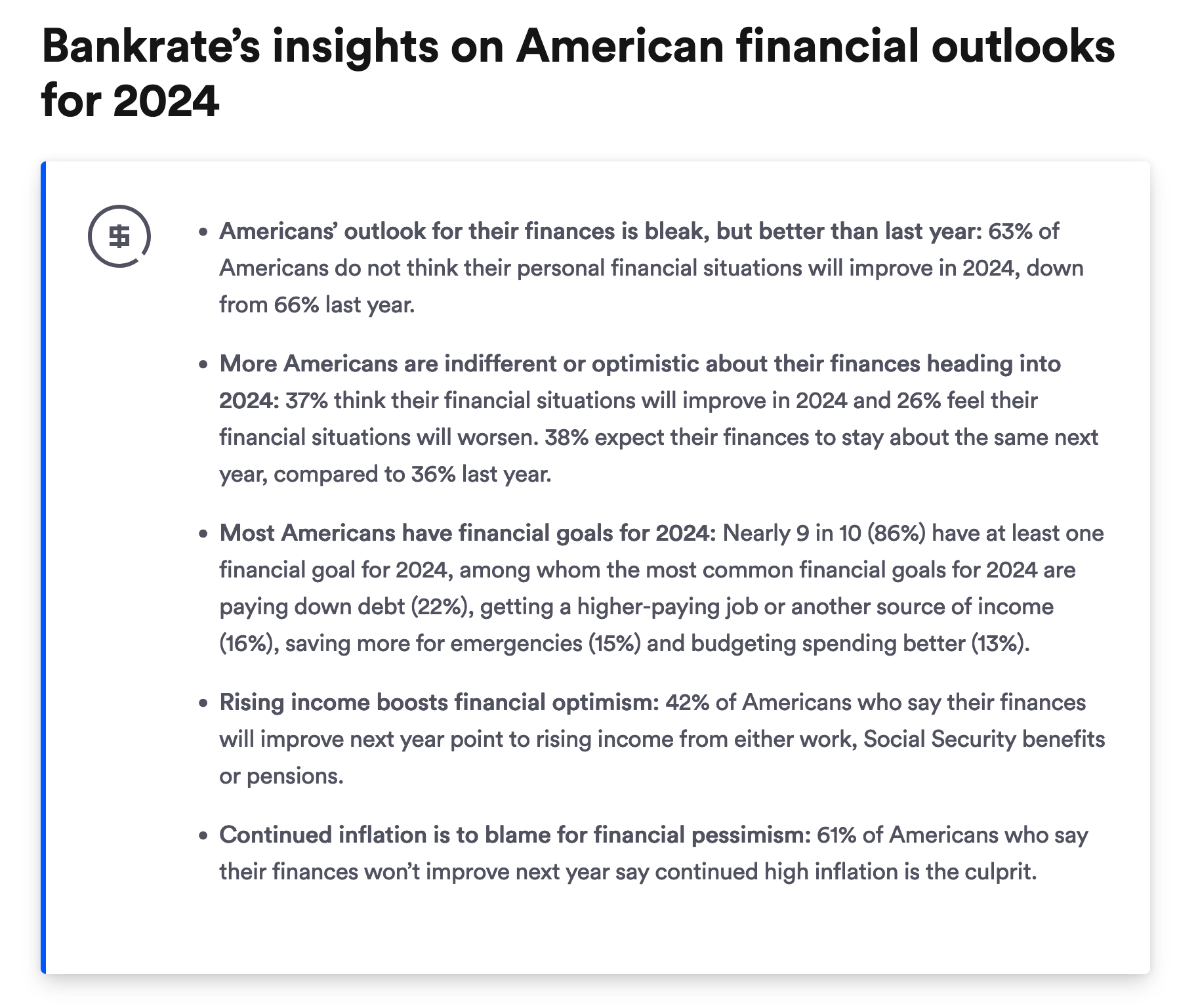

Despite CBS attributing some of the blame to government spending and the now-resolved supply chain disruptions, the inflation gap persists unabated. A Bankrate survey indicates that 60% of working Americans have seen their income fail to keep up with inflation over the past year—a trend even more troubling for those on fixed incomes.

Public sentiment reflects the economic discontent, with only 14% of Americans feeling they are in a better financial position since President Biden took office. A staggering 76% believe the country is on the wrong trajectory, mirroring the sentiment from the 2008 financial crisis.

The current economic expansion, propped up by government expenditure and personal debt, appears tenuous. With federal and personal debt levels escalating, the compounding interest threatens to exacerbate the financial predicament. The country stands at a crossroads: either Congressional intervention to curtail spending or an impending breakdown in financial markets or a wave of personal debt defaults.

In conclusion, as the nation observes the unfolding economic challenges, the question remains whether policymakers will take the necessary steps to avert a deeper crisis or continue on the current path, risking a significant financial rupture.