A recent Intuit study highlights the alarming trend of 'doom spending' among Americans, particularly the youth, as economic stress drives tens of millions to spend beyond their means.

In an era of economic uncertainty, a new trend has emerged among tens of millions of Americans, according to a recent study by Intuit reported on by CNBC. Termed 'doom spending,' this phenomenon signifies the practice of expending beyond one's financial means as a coping mechanism for stress, particularly stress related to the economy. The alarming data underscores a bleak picture: a nation grappling with financial insecurity and a diminishing hope for the future.

Intuit's study reveals a staggering 96% of Americans harbor concerns about the current economic climate. Over half believe that economic conditions have deteriorated over the past six months. With 56% living paycheck to paycheck and less than $2,000 in savings, nearly one-fourth of Americans have no savings at all, painting a dire picture of financial preparedness.

The concept of 'doom spending' is not a marginal one; it affects approximately 27% of American households—that's around 35 million households or 90 million individuals—falling deeper into financial distress. The drivers of this trend are twofold: the relentless rise of inflation and the growing inaccessibility of housing, leaving nearly half of the population struggling to afford basic necessities such as food, clothing, and shelter.

The predicament is particularly acute among younger generations. A quarter of Generation Z report difficulties in locating well-paying jobs, and an overwhelming majority of both Gen Z and Millennials experience financial anxiety. In terms of 'doom spending,' young adults are at the forefront, with 35% of Gen Z and 43% of Millennials admitting to spending beyond their means to manage stress.

Additionally, the younger demographic reports the most significant increases in spending, indicating a shift away from long-term financial planning towards immediate gratification. This shift is attributed to a growing sense of hopelessness about the economy's prospects, with only a fraction of optimists believing in the leveling out of inflation or improvement in the job market.

The socioeconomic impact is evident as a quarter of Gen Z and Millennials are moving back with their parents, a stark departure from previous generations' milestones of starting a family and homeownership. The Intuit study points out that the age once prime for family formation is now marked by retreat and indulgence in ephemeral experiences, such as vacations, over long-term investments.

“When houses are a million dollar plus and an older couple will likely outbid us anyway, we’re gonna relinquish any lingering delusions about homeownership”

— Amy Nixon (@texasrunnerDFW) December 22, 2023

Gen Z doom spending is a *rational* coping mechanism pic.twitter.com/YWG5gp2yg4

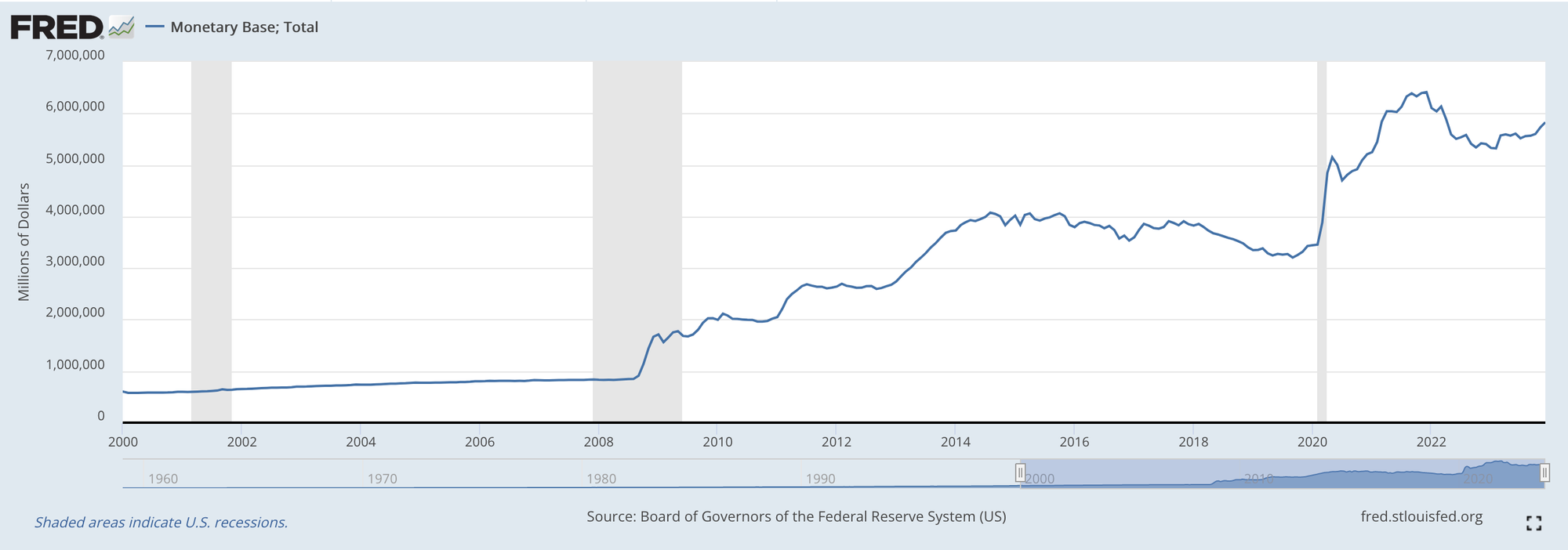

The roots of this economic dilemma can be traced back to the year 2000 when the economy began its shift towards a Federal Reserve-dominated system characterized by high expenditure and sluggish growth. This shift has resulted in a disproportionate increase in living costs compared to income growth. For instance, rents have climbed by 135% since 1999, outpacing the 77% rise in incomes. The median house price has skyrocketed to 274% of its 1999 value, according to the Census Bureau, leaving incomes lagging far behind despite many Americans taking on multiple jobs.

As the economic landscape continues to challenge the younger generations, there is a theoretical hope that this demographic might pivot towards advocating for smaller government, reduced regulation, and increased entrepreneurial activity. However, the study suggests that a significant shift in sentiment may require further hardship before such a transition occurs.

The Intuit study paints a concerning portrait of an American populace increasingly resorting to 'doom spending' in response to economic pressures. With the youth at the forefront of this trend, the long-term implications for the economy and society at large remain to be seen.

We need to fix the money.