This is one of the beautiful aspects of the bitcoin network. It enables truly novel ways of archtecting financial products and arangements.

Last November, in the midst of the FTX blow up and the ensuing fall out your Uncle Marty wrote a newsletter about the future of bitcoin custody at the financial services layer of the industry and why multisig quorums that distribute key risk across multiple institutions will be the standard moving forward. Here's an excerpt from that piece:

The dust is currently still whirling around winds that seem to be getting more turbulent, but it will eventually settle. And when it does I believe the winners who come out the other end are those who have heeded the warning that "trusted third parties are security holes" and implement it into their product stack. Particularly those who would like to offer financial services and products that touch bitcoin. The winning companies will be those who learn to leverage bitcoin's native properties, particularly the ability to construct multi-signature wallets. The era of giving your bitcoin to a company providing you bitcoin-centric financial services without multisig solutions should be coming to an end. There is no reason for bitcoiners to interact with the black box solutions that have dominated the market to date. - November 21st, 2022

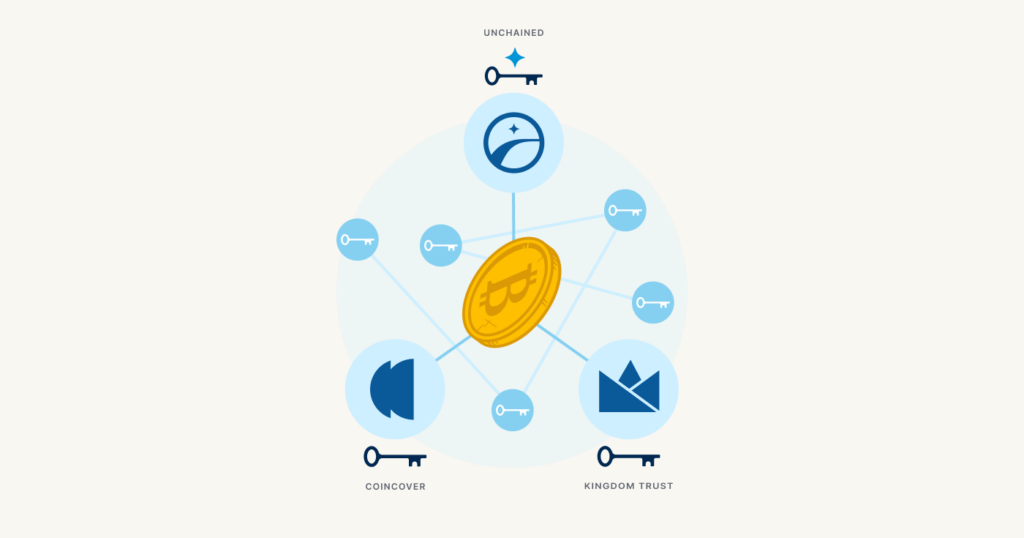

Fast forward to today and Sam Bankman Fried is sitting in court having his lawyer beg a judge to up his adderall prescription while he waits behind bars for the conclusion of his first trial and Unchained has just released an enterprise collaborative custody network. This new product gives Unchained customers the option of a "keyless" custody model in which they can secure their bitcoin in a 2-of-3 multisig address with the three keys in the quorum being held by three different institutions. In this case, Unchained, Kingdom Trust and Coincover. Clients will also have the option to hold one or two keys in the quorum themselves. Providing a level of optionality that can meet the needs of a spectrum of client archetypes, each with different risk appetites for holding keys.

You can even imagine a particular bitcoin holder who would like to distribute their custody risk across different types of key quorums. Holding a portion of their holdings in a 2-of-3 quorum in which they hold a majority of the keys, another portion in a 2-of-3 quorum in which they hold one key, and a 2-of-3 quorum in which they allocate the key holding to three institutions. The keyless quorum with Unchained, Kingdom Trust and Coincover seems like it will be the tip of the iceberg. Unchained is making it easy for other potential key signers to onboard to their key network. Seemingly in an effort to give their clients the ability to pick from a suite of key partners when constructing multisig quorums.

What Unchained has launched is an example of the standard custody set up that will be demanded by the market in the future, I believe. Whether the end goal is to secure bitcoin on behalf of retail clients, provide clients with financial services that leverage bitcoin as collateral, or B2B relationships in which bitcoin needs to be secured on behalf of a business; it is becoming clear that multisig quorums distributed across multiple institutions who would need to collude (and ruin their reputations in the process) to misappropriate bitcoin held on behalf of their clients is superior to the incumbent model that has dominated the industry today - one company securing bitcoin.

To be clear, I do believe that there are competent companies out there who are currently securing bitcoin on behalf of clients in ways that are sufficient and secure. However, I think the multi-institution model cuts out so much centralization risk that it will be demanded by the market at some point. Companies who do not leverage this standard will be seen as providing sub-optimal solutions in the eyes of potential clients.

This is one of the beautiful aspects of the bitcoin network. It enables truly novel ways of archtecting financial products and arangements. There are new business models that are arising from these primitives and there will be many more to follow.

We're already seeing this model proliferate. Onramp leverages multi-institution multisig to secure bitcoin within a trust structure. DebiFi is building a multi-institution multisig tool kit that makes it easy for institutions to apply this model to their bitcoin collateralized lending products.

The new standard is materializing right in front of our eyes and it can't spread fast enough.

Final thought...

One time when my cousin slept over our house in Northeast Philly, me, my brother and my cousin were being naughty by mooning my mom. At one point in the night, after about a dozen moonings on our end she shocked us by mooning us back.