The American housing landscape is undergoing a drastic transformation, with homeownership becoming a distant dream for many.

As the American Dream of homeownership becomes increasingly elusive, millions find themselves priced out of a market that has traditionally been a hallmark of middle-class stability. The Wall Street Journal highlights an alarming trend where the housing sector is slipping away from the grasp of not only the middle class but also the younger generation, who are particularly hit hard by recent economic shifts.

The past three years have witnessed a relentless surge in housing costs, a phenomenon driven by a confluence of factors. Soaring house prices have been largely attributed to the Federal Reserve's monetary policy, which included the injection of $6 trillion into the economy to ease the impact of COVID lockdowns. This unprecedented fiscal intervention contributed to inflation rates spiking, pulling house prices along in its wake.

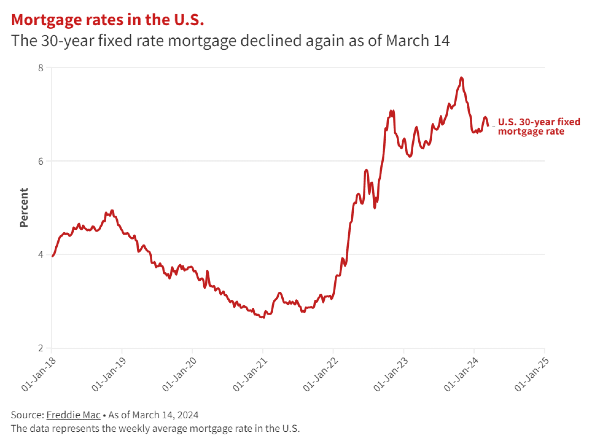

The Fed's subsequent response to curb inflation through aggressive interest rate hikes has seen mortgage rates leap from 3% to 7%, causing the average new mortgage payment to balloon to nearly $3,000—a figure that consumes almost half of the median household income. A stark illustration of the affordability crisis is that a mere 16% of homes are now within financial reach for the median American family.

Amidst this affordability crisis, new home sales have plummeted by almost 50%, signaling a housing market in distress. To compound the issue, Congress's mismanagement of natural disasters has left a significant portion of American homes vulnerable to catastrophic risks, resulting in a staggering 40% increase in home insurance prices. In states like Florida, homeowners now face annual insurance premiums nearing $8,000, while others, particularly in California, are opting to forego insurance altogether, accepting the risks this entails.

The real estate industry is also undergoing a seismic shift following the National Association of Realtors' recent settlement over alleged commission fixing. An industry analyst predicts a potential one-third cut in commissions, which could also lead to an 80% reduction in the number of realtors. The resulting commission structure changes might save sellers on fees, but new models, such as buyers directly paying agents, could place additional financial burdens on purchasers.

As the market continues to churn, studies reveal a disheartening reality: two-thirds of American renters have abandoned the goal of homeownership, with Generation Z emerging as the most pessimistic about their chances of ever buying a home. This sentiment reflects a broader issue where the housing market, influenced by the Fed's economic interventions, has transformed into a divisive landscape of winners and losers.

The trajectory of the housing market remains uncertain, with the Federal Reserve's policies and market forces shaping the future of American homeownership. As the market tightens and costs escalate, the possibility of a lifetime of renting looms large for those who missed the opportunity to buy during the pandemic's fleeting window.