The recent dramatic rise in gold prices, surpassing 2011 highs, reflects a shift towards secure assets like gold and Bitcoin.

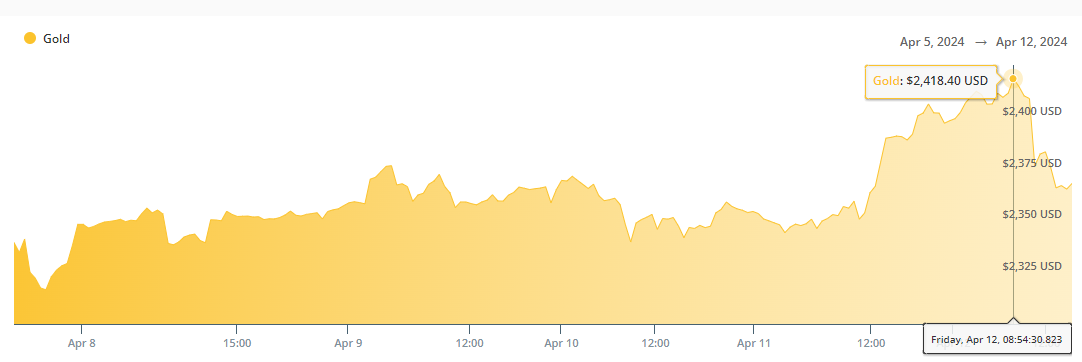

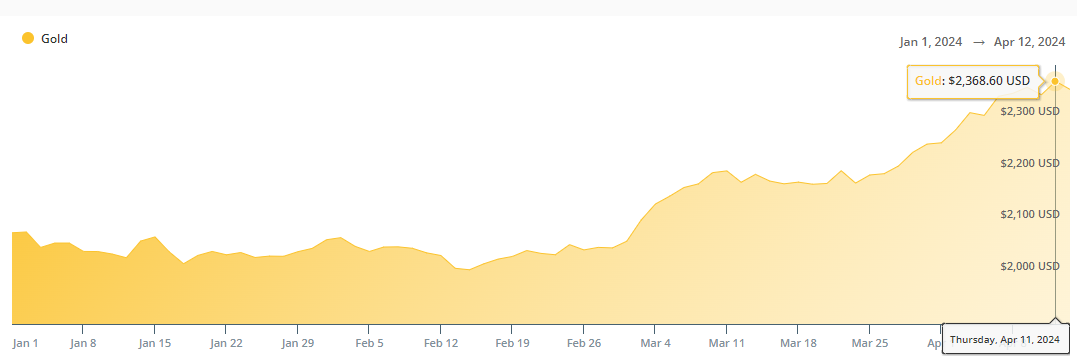

The price of gold has skyrocketed, breaking through long-standing resistance levels and entering a phase of price discovery. This surge in the value of gold is not just an isolated event of interest to precious metal enthusiasts; it is a harbinger of broader market shifts.

The dramatic ascent of gold prices, surpassing the previous high set in 2011, signals the onset of a secular bull market for the metal. In such markets, the strategy typically involves buying on dips rather than chasing rallies, as one might in a bear market.

The implications of this gold rally are multifaceted. On a technical level, the size and speed of the gold price movement are noteworthy, with significant weekly and quarterly chart moves indicating a decisive market shift. However, the true significance lies in understanding the role gold plays in the financial system.

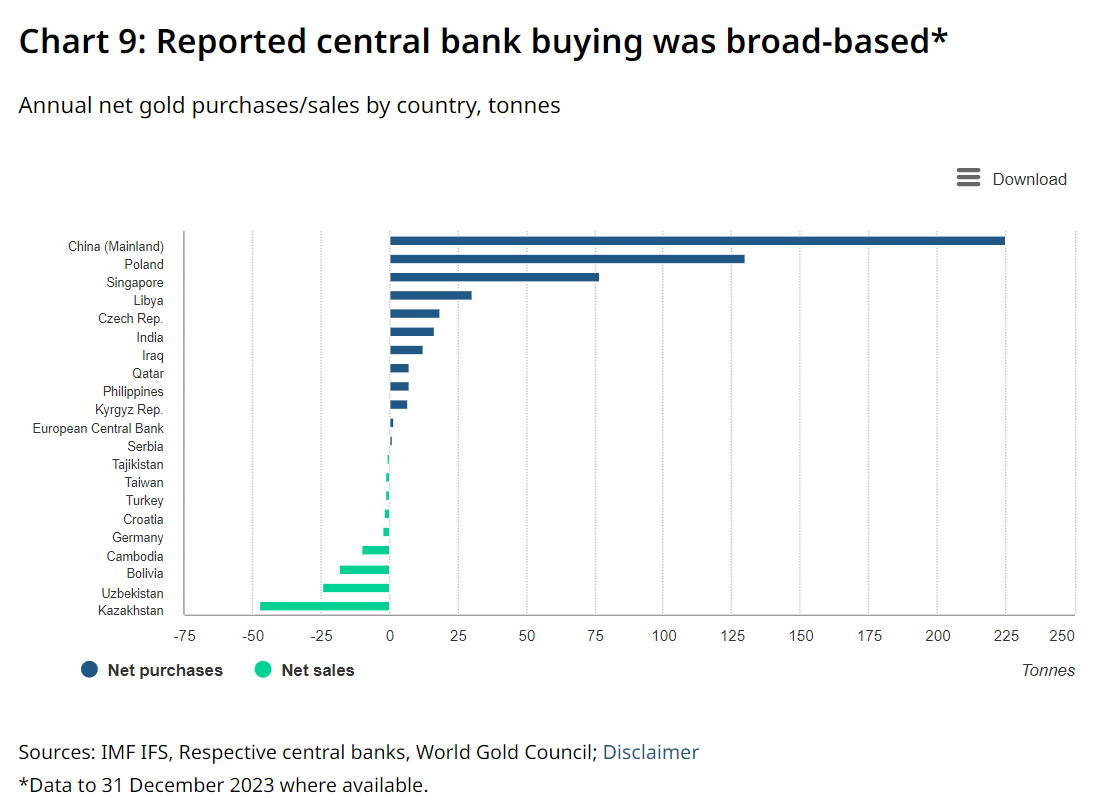

Gold is traditionally seen as a monetary metal, a staple of balance sheets for both individuals and nations. It acts as a balance between assets and liabilities, representing a tangible asset that stands in contrast to financial assets, which are often debt obligations. In recent times, nations have accelerated their gold acquisitions, with China and Russia notably reducing their reliance on U.S. Treasury securities in favor of bolstering their gold reserves. This trend became more pronounced following events like the 2021 trucker protests and the seizing of Russian bank assets in 2022, which underscored the vulnerability of nations' reserves in foreign currencies and treasuries.

The data indicates a significant uptick in gold purchases by countries, particularly by China, suggesting a strategic move to diversify reserves and reduce dependency on the U.S. dollar. This shift is driven by concerns over potential rate cuts and currency debasement by Western nations, which could lead to the erosion of the purchasing power of their currencies.

While gold's surge is a clear signal, it's not the only asset on the rise. Bitcoin, often referred to as digital gold, has exhibited a correlated increase, further indicating a trend toward safe-haven assets amid fears of inflation and financial instability. Major financial institutions, including Goldman Sachs and JPMorgan, have suggested that Bitcoin's market capitalization may eventually surpass that of gold.

The historical context provides a stark reminder of the consequences of currency debasement. Looking back at hyperinflation scenarios, such as the Weimar Republic, it is evident that converting fiat currency to gold or other hard assets could protect and even enhance wealth in times of monetary expansion and inflation. Yet, the volatility of prices can lead to panic selling, causing individuals to lose out on the long-term benefits of holding real assets.

The current gold price surge is a clear message from the markets, anticipating a significant phase of monetary expansion and currency debasement. As central banks and savvy investors turn to tangible assets like gold and Bitcoin, it is a critical time for individuals to consider their investment strategies and potentially hedge against impending market volatility.