Recent spikes in US Treasury yields, contrasted with stable German yields, suggest an 'uncertainty premium' in US markets.

Treasury yields have experienced a sharp increase, raising questions about the potential for a government debt crisis. A notable divergence has emerged between US Treasury rates and their German counterparts, which may hold the key to understanding the current market dynamics. This article explores the relationship between these two bond markets and what the recent movements in Treasury yields could signify.

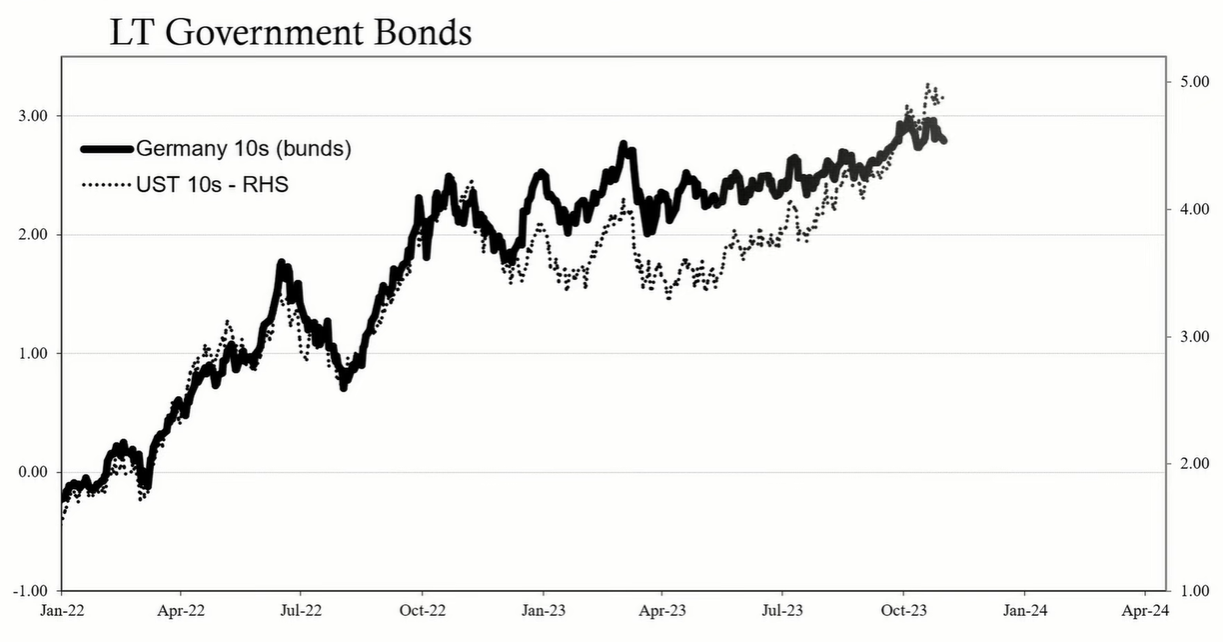

Historically, US Treasury and German bond yields have often moved in lockstep, reflecting similar market conditions and investor sentiment. This correlation suggests that, despite differences in fiscal policy and economic conditions, the bond markets are influenced by common global factors such as growth and inflation expectations.

In December 2022, US Treasuries began to outperform German bonds, indicating a divergence likely driven by differing expectations on central bank policy. This pattern continued into the early part of 2023. However, by mid-2023, Treasury yields started to align once again with German yields, suggesting a return to convergence.

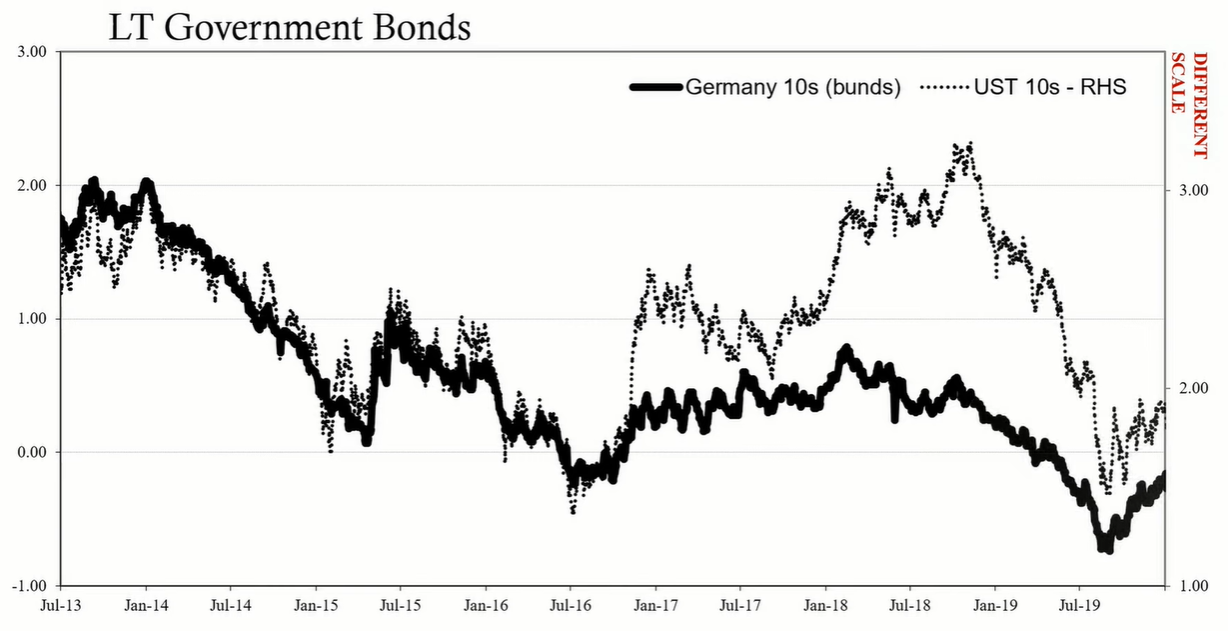

The divergence between US and German bond yields can often be attributed to the Federal Reserve's actions, particularly concerning interest rate hikes or cuts. The premium seen in Treasury yields relative to German yields during 2017 and 2018, for example, was largely due to the Fed's rate hike cycle, which was not mirrored by the European Central Bank (ECB).

As the Fed shifted from rate hikes to cuts, Treasury yields fell back in line with German yields, highlighting the impact of central bank policy on market dynamics.

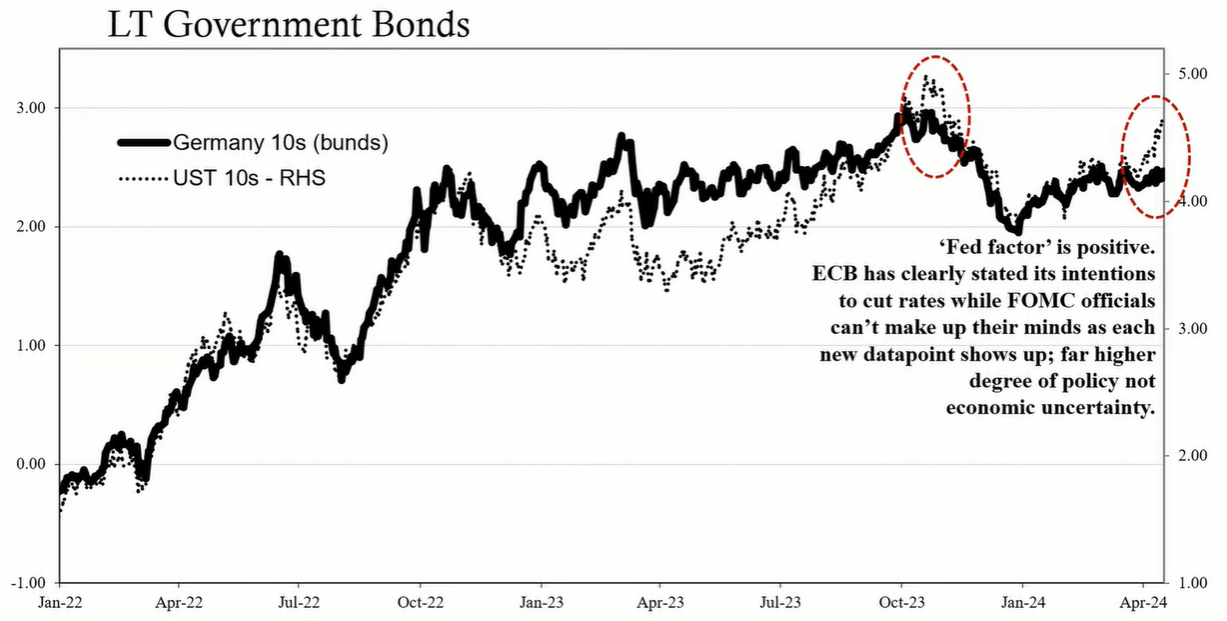

In early April 2024, US Treasury yields surged upwards while German yields remained stable. This divergence is not indicative of reflation, as German yields would also reflect such a trend if it were the case. Instead, this movement appears to be driven by uncertainty surrounding the Federal Reserve's future interest rate path.

The current difference in yields between the US and German markets can be understood as an 'uncertainty premium' in the US market. This premium reflects the market's difficulty in pricing the future actions of the Federal Reserve amid unclear signals and economic data.

The recent surge in US Treasury yields should not be interpreted as a sign of a government debt crisis or a reflationary environment. The stability of German yields suggests that fundamental growth and inflation expectations have not undergone a significant shift. Instead, the rise in Treasury yields is more closely tied to uncertainty regarding the Federal Reserve's policy direction. The bond markets, US and German alike, are primarily driven by these fundamentals, with occasional deviations caused by central bank actions.