Consumer confidence and employment trends in the U.S. signal a looming recession, with economic indicators like regional Fed surveys and a stagnant bond market highlighting increasing challenges.

Recent data points to potential demand destruction in a weak US economy. Consumer confidence has notably decreased, and sector updates from various regions have presented negative trends, including significant employment signals in the manufacturing sector. These developments raise questions about the state of the US labor market and the overall economy.

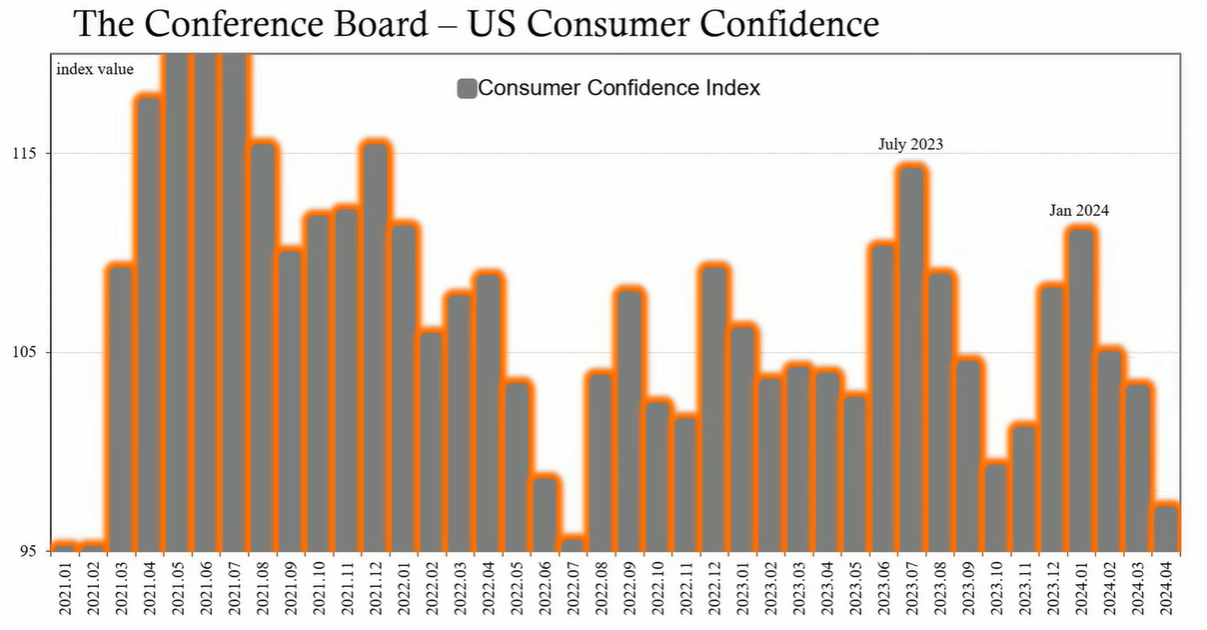

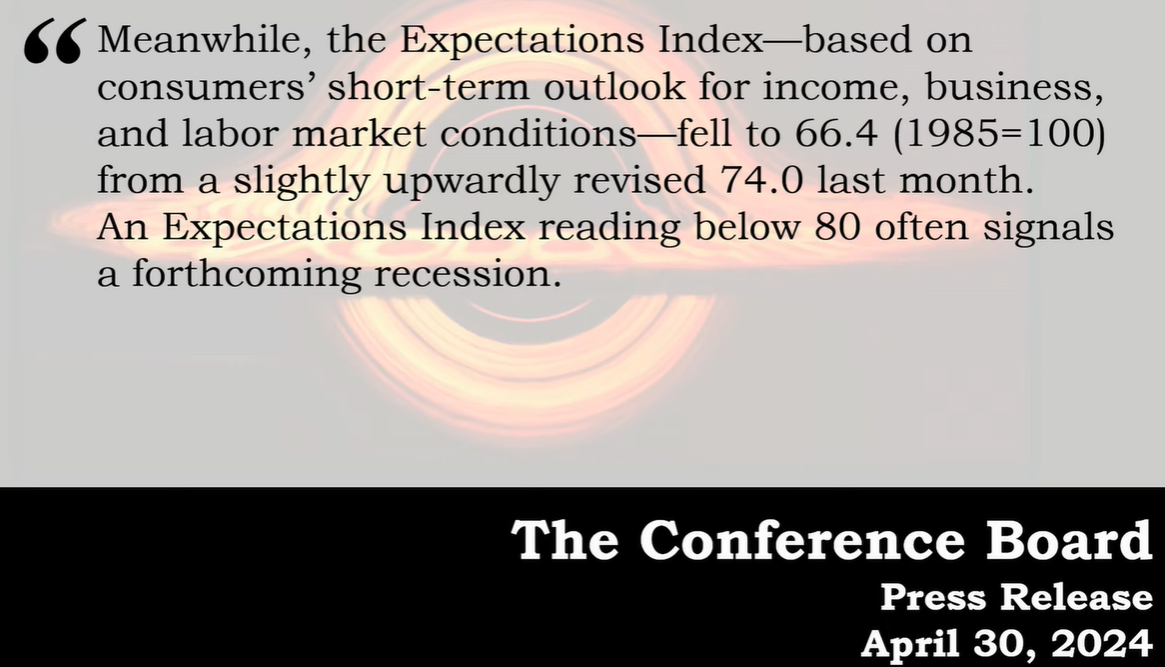

The Conference Board reported a drop in consumer confidence to 97.0 in April from 103.1 in March, reaching its lowest level since July 2022. This decline in confidence is alarming, as an expectations index reading below 80 often signals an impending recession. Currently, the index stands at 66.4, down from 74.0 last month, suggesting consumers are increasingly concerned about the future of business conditions, job availability, and income prospects.

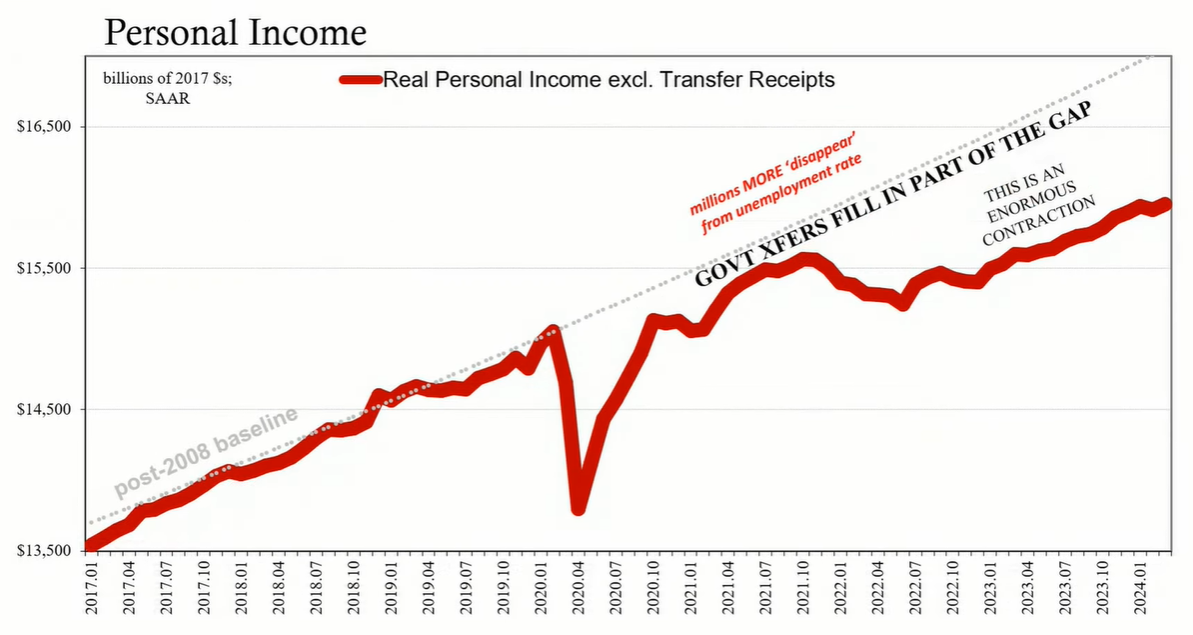

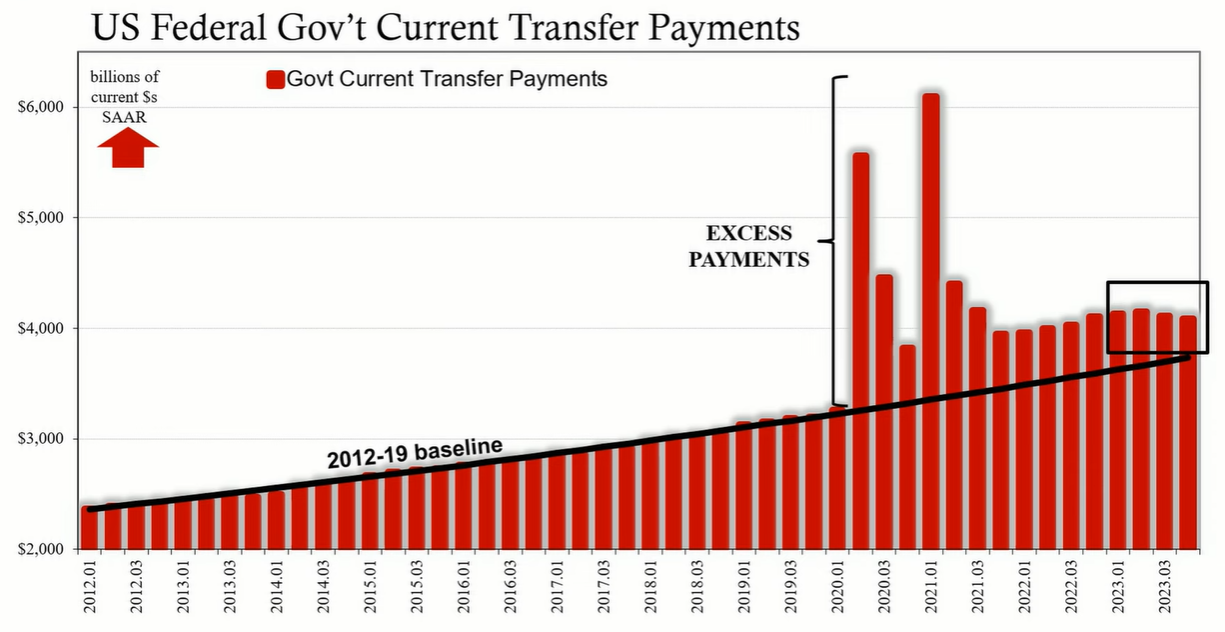

A key factor behind the weak sentiment is the disparity between government transfer payments and actual private incomes. Bureau of Economic Analysis (BEA) data on real private income, excluding transfer receipts, indicates a significant contraction in price-adjusted private incomes over the last several years. The reliance on government subsidies to maintain the appearance of a booming economy is waning, leaving consumers more dependent on their actual earnings, which have not kept pace with price changes.

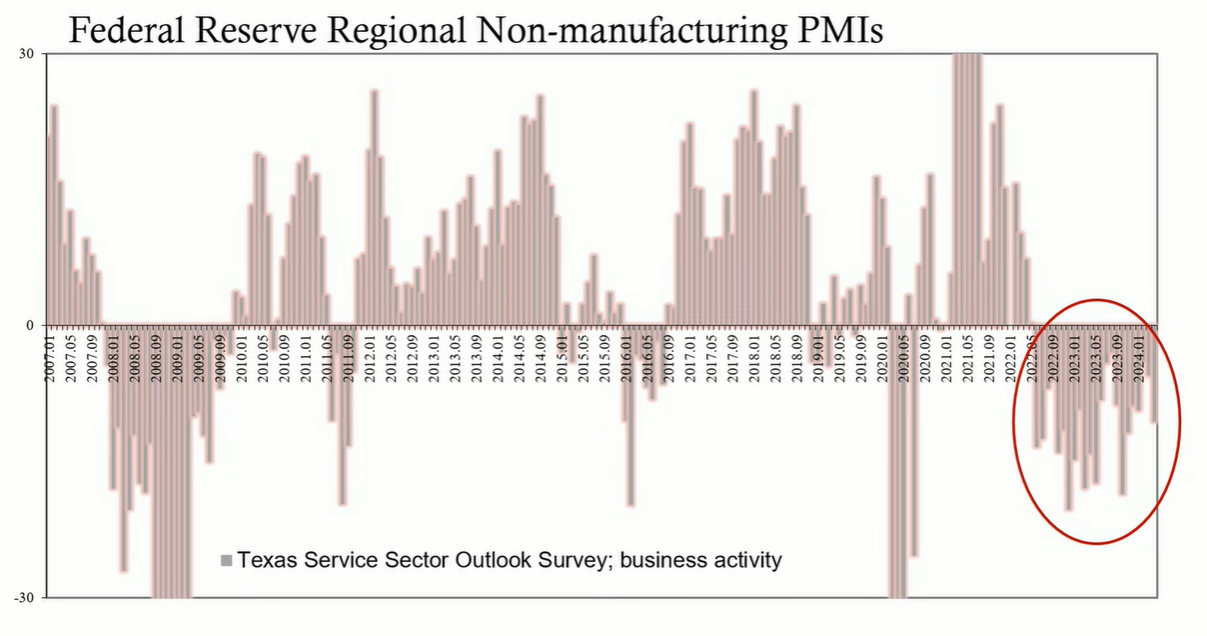

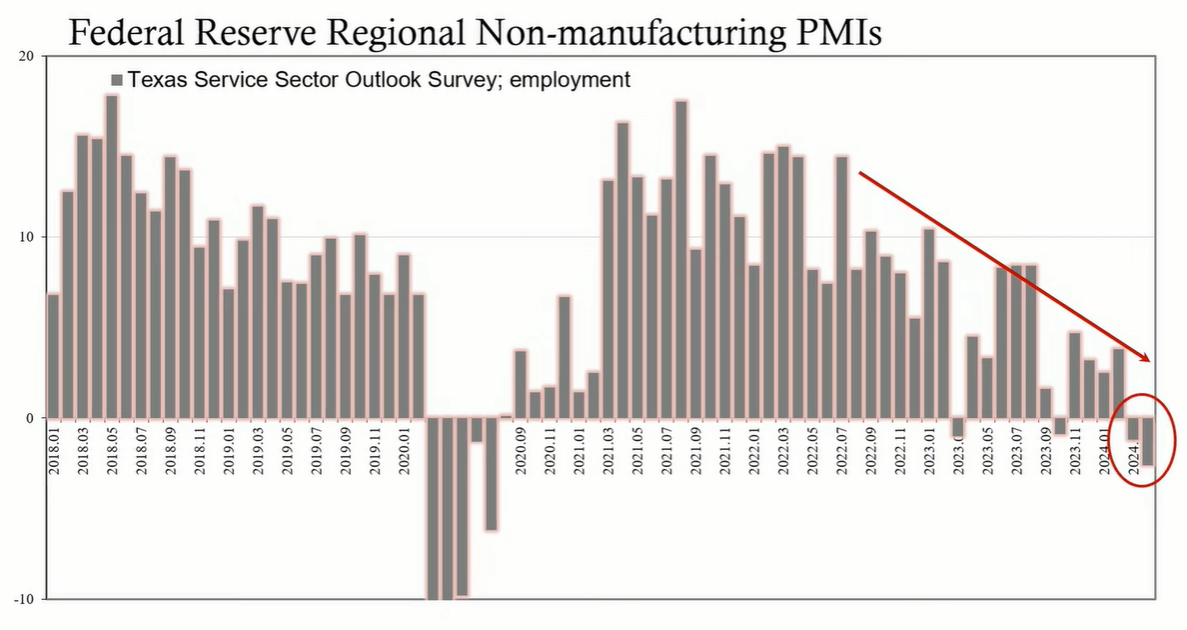

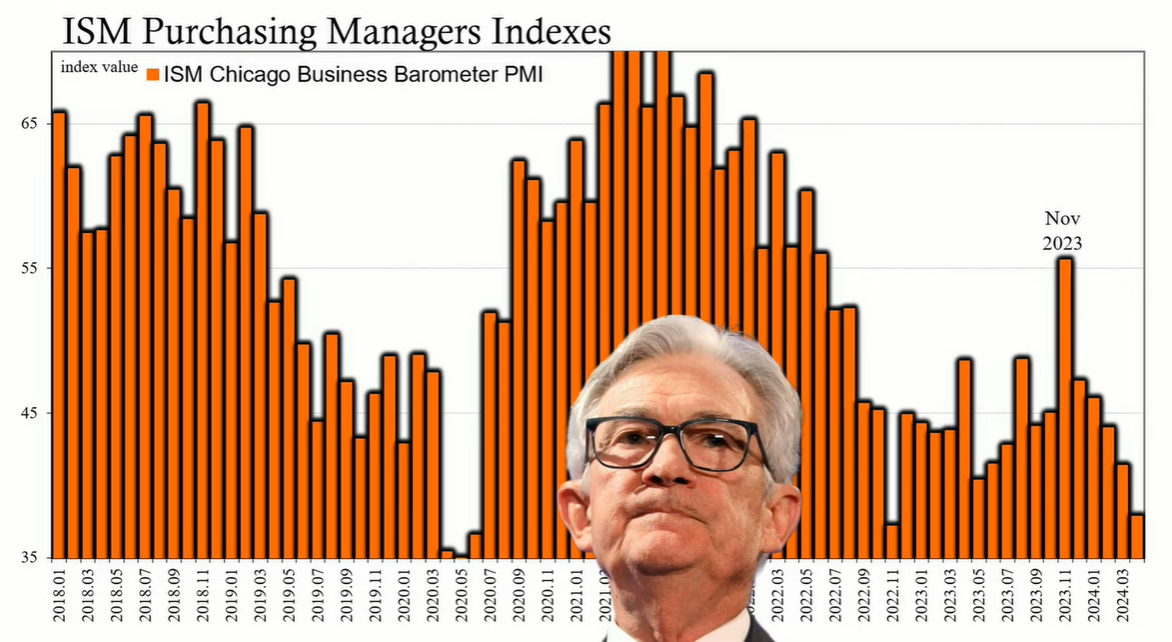

The Dallas Fed's Texas services sector outlook survey for April reveals a downturn in business activity and future business activity indices, with the employment number dipping into negative territory for the second consecutive month. This trend is a cause for concern as the Texas services sector employment metric is rarely negative. Similarly, the ISM Chicago business barometer, a measure of manufacturing conditions in the Midwest, dropped to 37.9, with a significant decline in the employment index, indicating broader challenges across different sectors.

Despite these economic signals, the bond market has not experienced the expected rally, with treasury yields not dropping as might be anticipated in such a scenario. The market is grappling with the Federal Reserve's stance on short-term interest rates and its focus on consumer price numbers. Until the Fed recognizes the extent of the economic slowdown, the bond market's response may remain muted.

The US economy is showing signs of strain, with consumer confidence falling and negative employment indicators emerging across different sectors. Weak private incomes, coupled with diminishing government transfer payments, are contributing to a potentially toxic mix. These factors, along with rising energy prices, do not suggest a soft landing but rather point towards a recessionary trajectory. The bond market's current behavior reflects uncertainty regarding monetary policy rather than a clear assessment of economic fundamentals.