Get the money.

Every billionaire in the world is going to realize the fastest way to build shareholder value and drive a massive premium on their stock is to adopt a Bitcoin standard.

— The ₿itcoin Therapist (@TheBTCTherapist) June 21, 2024

We’re watching it play out before our very eyes. Michael Saylor was the first to do it.

Many more will follow

Twitter (currently known at X) is currently speculating that Michael Dell, the founder, Chairman and CEO of Dell Technologies, is either going to personally announce that he is buying bitcoin, announce that Dell is adding bitcoin to its balance sheet, or a combination of the two. To be clear, all of this is speculation at the moment. People attempting to read between the lines of a tweet about scarcity, a retweet of Michael Saylor, and a picture of Cookie Monster eating bitcoin cookies.

Scarcity creates value

— Michael Dell (@MichaelDell) June 20, 2024

This is a great account to follow @MeCookieMonster. Very entertaining 😂 pic.twitter.com/RJFcNpCXrN

— Michael Dell (@MichaelDell) June 21, 2024

Now I have no idea whether or not Michael Dell has plans to personally allocate a portion of his $100B net worth or his company's cash position into bitcoin, but I think it would be a wise decision. Particularly for Dell Technologies. The company would join a growing list of publicly traded companies that have announced bitcoin treasury strategies over the last few years. With most of them coming in the last six months.

The giant in the public markets is Microstrategy, of course, which has used a combination of debt and share issuance to amass a bitcoin treasury that now totals more than 1% of all the bitcoin that will ever exist. Over the course of the last ~4 years, this has pushed Microstrategy's market cap from ~$600m to over $23B. Microstrategy shareholders seem to be extremely happy with this outcome.

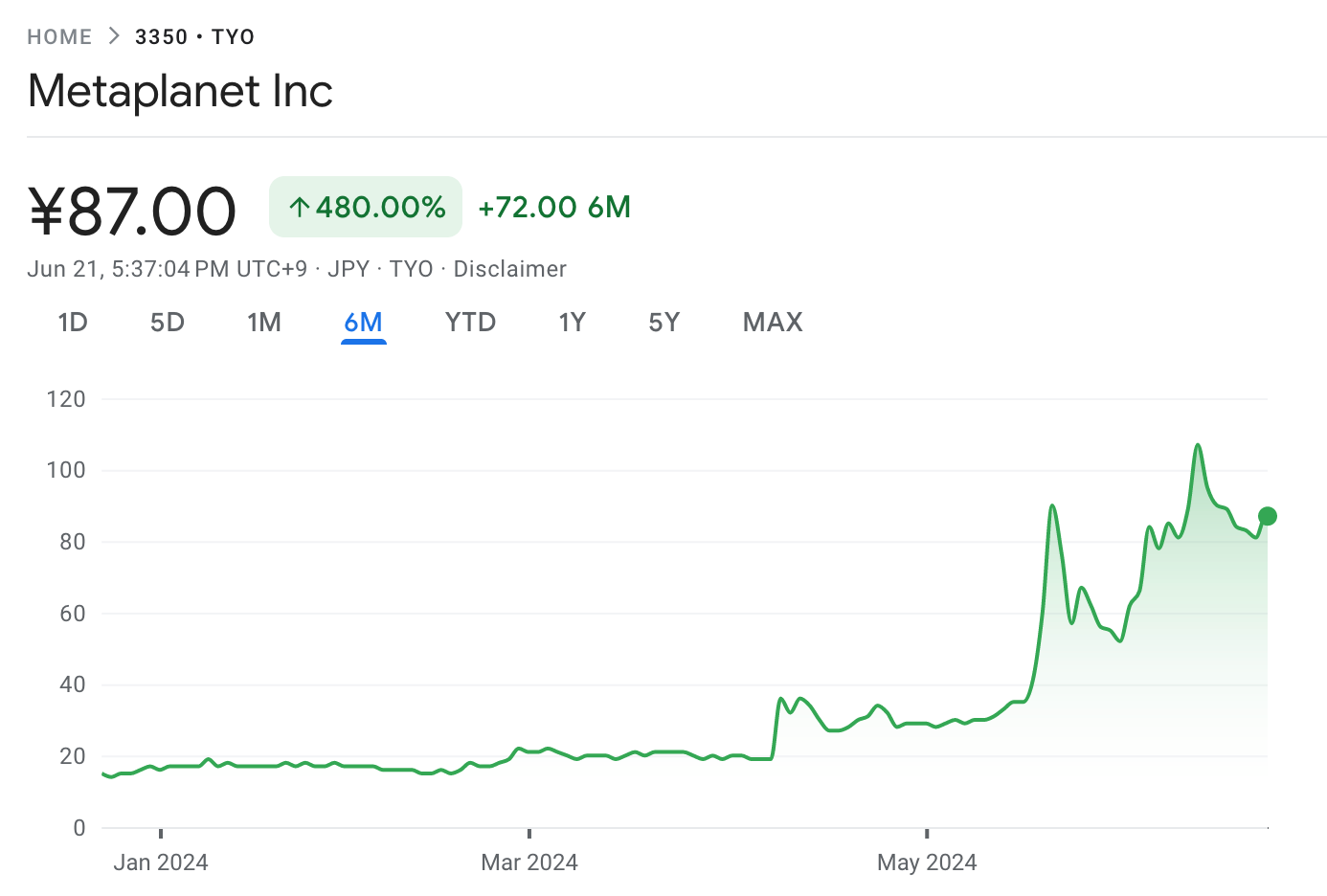

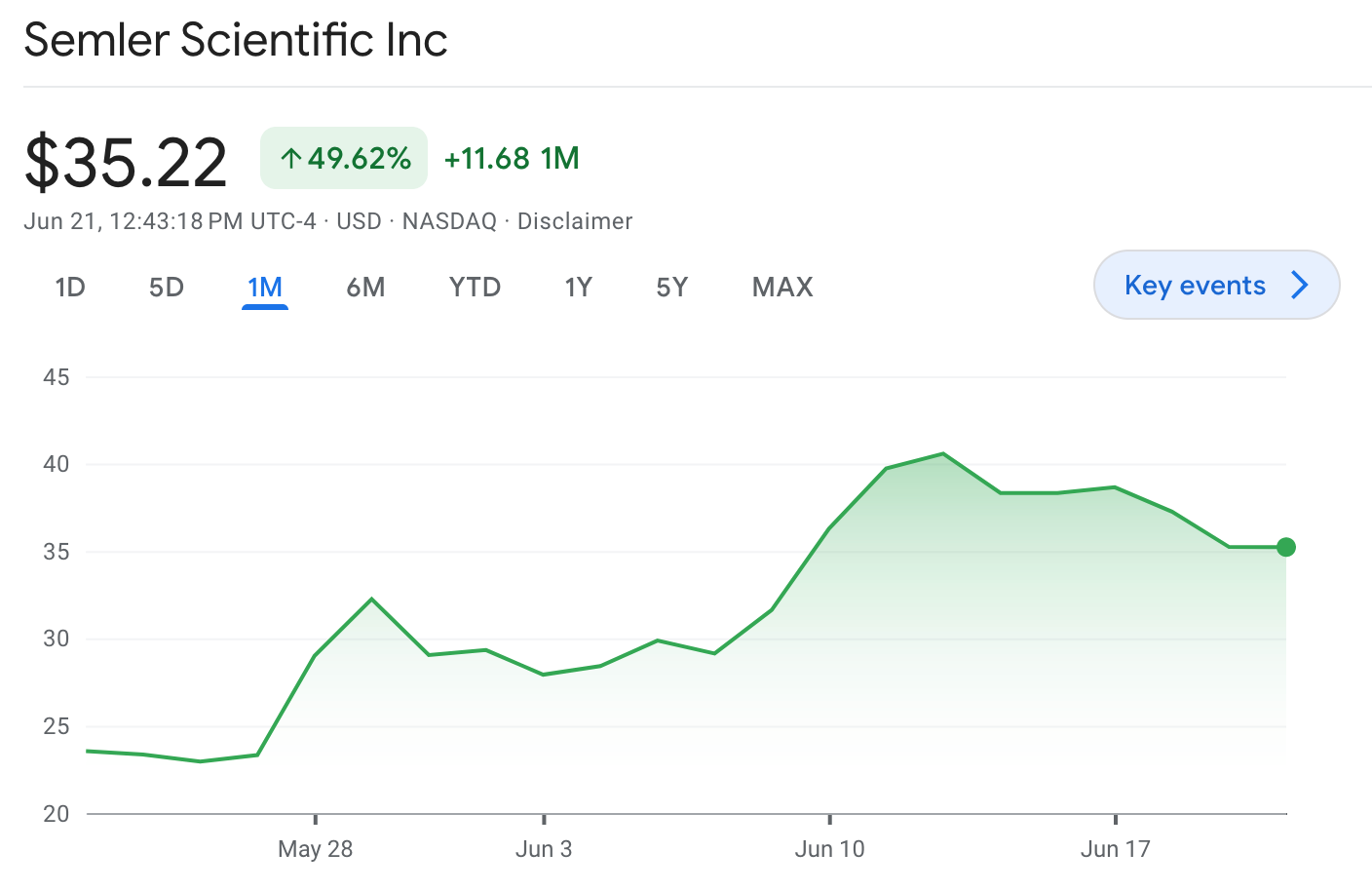

As we discussed a couple of weeks ago, more companies have entered the fray of publicly traded companies using bitcoin as a strategic treasury asset. And their stocks have benefited materially after the bitcoin was acquired and the announcements were made.

As our friend the Bitcoin Therapist points out at the top of this letter, it is only a matter of time before any competent leader of a publicly traded company recognizes that a bitcoin treasury strategy is not only prudent to protect against rampant inflationary pressures, but a way to deliver value to shareholders.

Sats flow, whether that be via directly selling goods and services for bitcoin or by converting dollars to bitcoin, rules everything from here on out. Most people do not recognize this yet, but it will be abundantly clear by the end of the decade. Shareholder value needs to be protected and the best way to protect value in the 21st century is bitcoin.

Don't think that this strategy only applies to publicly traded companies. It is just as imperative, if not more imperative, for privately held companies looking to avoid equity dilution while enhancing their capital base. My partner at Ten31, Grant Gilliam, has written about this in the past.

Most think of fiduciary duty primarily as managing risk and protecting the downside, but fiduciary duty goes both ways, encompassing both protecting against downside risks and pursuing opportunities for growth in equity value. In the context of a company, fiduciary duty includes both the executive leadership team and the company’s board of directors. The board of directors is responsible for overseeing the company’s management, setting its strategic direction, and ensuring the company is run in the best interests of shareholders, which includes corporate governance, appointing and incentivizing the management team, setting the strategic priorities of the business, and executing major financial transactions. The executive leadership team are responsible for day-to-day operations, executing the strategic plan set by the board, making operational decisions that impact the company’s financial health and performance, and managing the company’s assets, resources, and operations in a manner that maximizes shareholder value. Based on my descriptions above, I would assert evaluating the bitcoin treasury position is a responsibility of both the board and the executive team. - Grant Gilliam, Ten31 Co-Founder and Managing Partner

We've seen the bitcoin treasury strategy work beautifully for many of our portfolio companies over the course of the last two years specifically. 2022 and 2023 were notoriously horrendous years for startups looking to raise capital that weren't riding the wave of the AI hype cycle. Luckily for us, the founders in our portfolio are bitcoiners who understand the importance of holding a portion of their corporate treasury in bitcoin so they can pull on the fourth lever of equity value growth. Since they were holding bitcoin and the price appreciated by ~2.5x in 2023, many found that their runways actually extended despite the fact that they didn't raise outside capital.

Companies that hold bitcoin in their treasury are provided with optionality and rewarded with the ability to think longer term. Focus on building a bitcoin strategy, particularly for privately held companies with less access to capital compared to their publicly traded counterparts, also drives founders and their teams to be hyper focused on being as lean and efficient as possible. We've found that this leads to less bloat, less burn and better overall results because the team is focused on a singular goal of accumulating as much bitcoin as possible and the only way for them to do that is to provide the market with a high quality good and/or service.

As the mad dash for bitcoin becomes more intense, I believe that this will have profound effects on how companies operate and their overall quality. We're already seeing it at Ten31. Our portfolio companies are early movers though. Some of the earliest. It's only a matter of time before more companies catch on to this. It seems that Dell may be the next domino to fall. Once the floodgates truly open and everyone begins to funnel into bitcoin, one can only imagine what that will do to price and the quality of the businesses that adopt this mindset.

Final thought...

Ready for a nice bike ride to the beach with my youngest.

Enjoy your weekend, freaks.