The pensions are coming!

Bitcoin is the only way pensions will be able to fill their funding gaps in the coming decade. This is not priced in. https://t.co/SFbuDeBwyb

— Marty Bent (@MartyBent) March 19, 2024

One of the biggest elephants in the room of the global economy that no one wants to acknowledge is underfunded pensions. There are hundreds of millions of people across the world who believe they are going to retire comfortably with the support of a pension they paid into over the course of their careers and many of them are blissfully unaware that the pensions they plan on depending on are structurally insolvent at the moment. Let's focus in on US State pension plans for a moment to provide you with a snapshot of the situation.

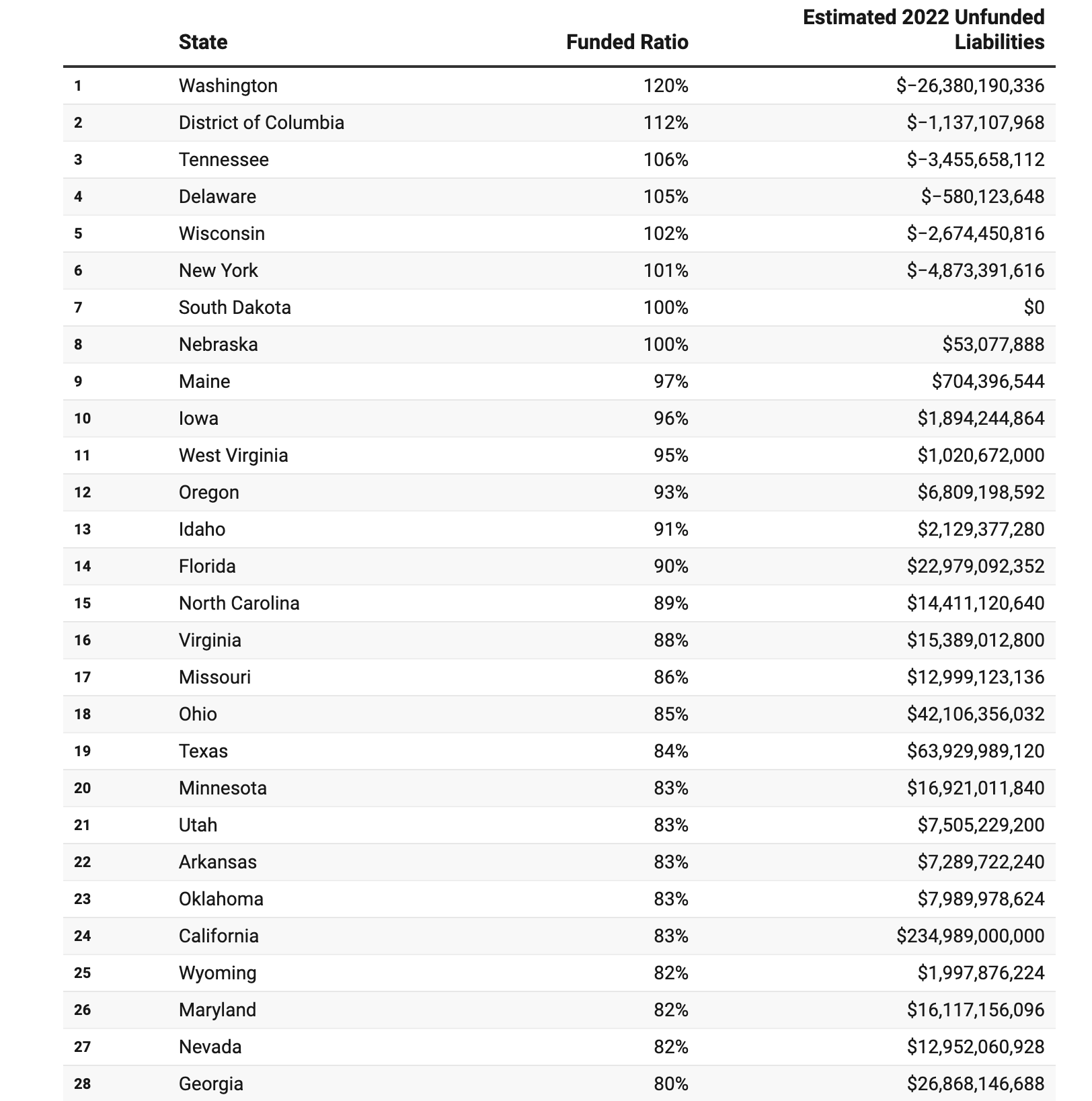

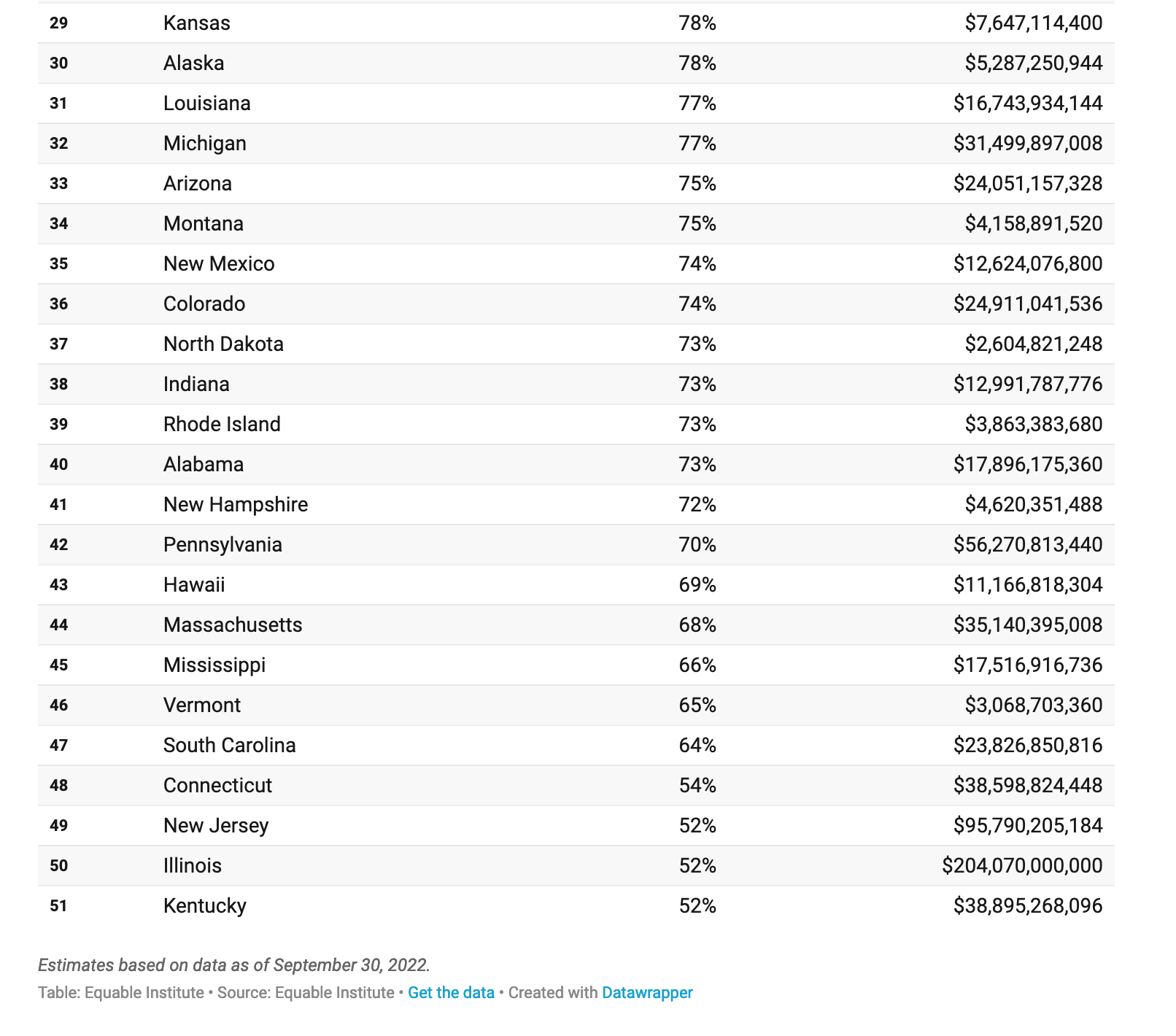

As of the end of September 2022, 43 out of 50 state pension plans were underfunded.

If you tally up the estimated 2022 unfunded liabilities by each state you'll find that, collectively, the United States pension system is underfunded by check notes $1,210,300,521,712. The average state pension fund was only 82% funded as of the publishing of this data. Now, a year and a half has passed since this data was published, so we can't be for certain if the numbers are exactly the same, but I think it's safe to say that these gaps have not been filled. Especially considering the fact that Americans have paid less in taxes as they attempt to stay afloat in a world drowning in inflation.

If those stats didn't make you queasy enough I highly recommend that you don't begin to contemplate the effect demographics will have on the assets managed by these pensions. You'll start to realize that baby boomers account for 20.5% of the population, but hold 50% of the wealth in the US and there are more of them retiring every day. Most of the boomers holding this wealth aren't depending on public pensions, they are likely depending on their personal portfolio of stocks, bonds and alternative assets that the pensions other people are dependent on are also allocated to. To survive and enjoy their life of earned leisure during their retirement they will have to sell off those assets over time. And as inflation remains elevated they will have to sell off those assets at a quicker pace than expected considering that those assets likely aren't appreciating faster than the real rate of inflation.

You'll then begin to think of the portfolio distribution of the boomers' retirement funds and realize that they were all encouraged to begin shifting it from a 60/40 stock/bond portfolio to an 80/20 bond/stock portfolio as they entered the later stages of their career. The next thing you'll do is open up Google Finance and search the returns for $TLT (iShares 20+ Year Treasury Bond ETF) and see that "risk-free" long-term government bonds are down by checks notes 25.6% over the last five years. At this point you'll begin to ask yourself, "Are the boomers as comfortable as advertised?" and you'll respond to your inner voice, "Well, they own a lot of real estate." This will remind you of the recurring conversation you've been having with your friends for the last two years about how it's almost impossible for anyone your age to buy a house without massively overextending outside of your financial comfort zone.

Your eyes will widen as you begin to realize that the boomers have no one to sell their real estate to. Millennials are barely scraping by. Even after taking on multiple jobs and developing a passion-driven side hustle that is bringing in a few extra cuck bucks every month.

"What about Gen Z?"

Unfortunately for us, much of Gen Z is either too busy trying to out influence each other in hopes of landing a big sponsorship deal from the next big direct to consumer brand with a sick affiliate program without realizing that high interest rates have soaked up all of the advertising liquidity, or shilling the next big memecoin. (This is probably a lazy over generalization, but this is honestly how Gen Z is marketed to the world.)

Once you hit the end of the road and visualize the state of the American economy through a multi-generational lens you'll come to the conclusion that the American pensions are absolutely fucked. The boomers are going to begin selling off their financial assets so that they can live, into a market made up of younger generations who cannot afford to pay the elevated prices the market demands right now. The magnitude of the selling due to the increasing rate at which boomers are retiring will over power any buying from younger generations. And all of the boomers (and anyone younger than them for that matter) who are dependent on pensions will bear the brunt of declining financial asset prices.

This is one scenario. The other is that the Federal Reserve and the federal government step in to backstop the whole system by printing a butt ton of money, which has an equal effect. Everyone will be a millionaire but a loaf of bread will cost $50.

The only viable solution to this problem is to get off the hamster wheel of the fiat system. Bitcoin is the antidote to this problem. It is a verifiably finite asset running on a distributed system that cannot be controlled by any central authority and its demand will only increase from here on out as individuals around the world rabidly search for the antidote to the fiat poison they've been free basing for a decades.

If pensions have any intention of closing the massive gaps between the money they've promised and the money they actually have, they better start allocating to bitcoin. Unfortunately for many pensions salvation via bitcoin won't be possible. By the time the recognize the gravity of the situation others will already be moving to fix their individual problems and the price of bitcoin will run away from them.

The goal for any pension should be to get a slice of the 21,000,000 before the other pensions do because once a few make public announcements that they're allocated to bitcoin, the copy cat trade will take hold and the flood of capital into the network will be awe inspiring. The glow from the green candles emanating on everyone's computer screens will light up entire cities.

In all seriousness though, the fact that a $1.2 Trillion pension fund out of Japan has begun the diligence process on bitcoin should be a sign to every other pension around the world that the tock is clicking. Bitcoin isn't going anywhere and one of the big pension dominoes is eventually going to fall. Once it falls, animal spirits will take hold and others will inevitably follow. As more and more pensions follow the first domino a virtuous cycle the likes of which you have never seen before will begin to take hold and there will be many pension managers kicking themselves because they didn't move early enough.

Final thought...

I need a new pair of shoes.