Gold has ascended to become the world's second most held reserve asset, trailing only behind the US dollar.

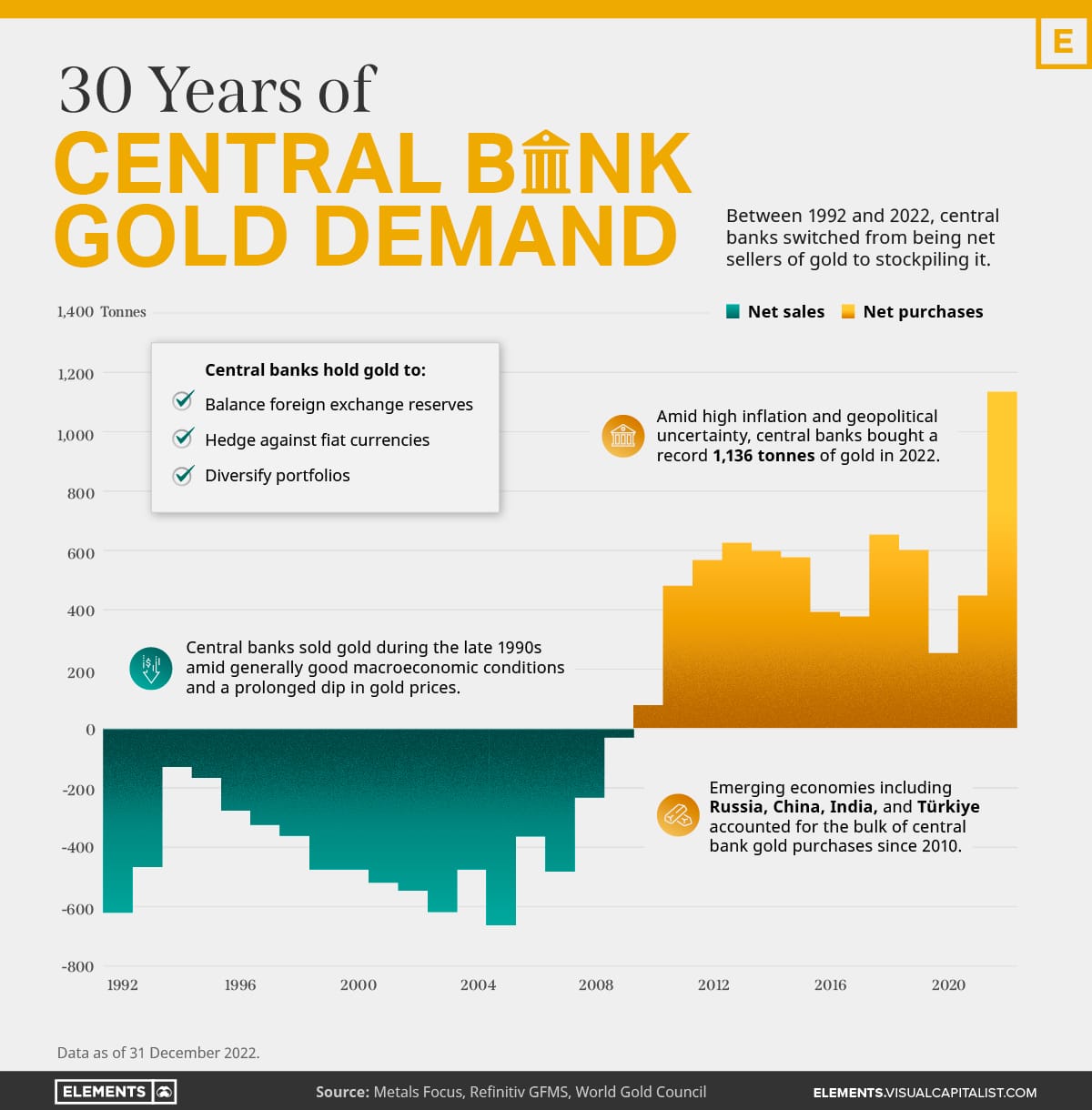

In an unprecedented shift in the global currency hierarchy, gold has ascended to the position of the world's second most held reserve asset, trailing only behind the omnipresent US dollar, according to recent data from the International Monetary Fund (IMF). This striking development comes after more than a decade of significant gold acquisition by central banks worldwide, with reports revealing that since the 2008 financial crisis, a remarkable one-eighth of all gold mined has been purchased by these institutions.

Speculation over the central banks' motive for this gold-buying frenzy has been rife, with theories ranging from strategic asset diversification to preparations for a potential global financial catastrophe—a notion that was given credence by a senior Dutch central banker's admission last year, affirming the latter as the reason behind their actions.

The ascent of gold to its newfound status has prompted a reevaluation of the longevity of the US dollar's dominance. While the dollar has remained unchallenged by other paper currencies, which are deemed equally if not more flawed, the surge in gold reserves presents a tangible threat. Historically, the sheer size of the gold market has prevented it from destabilizing the dollar's supremacy—its relatively small market size led to higher transaction costs, which in turn sustained the dollar's utility in international trade and commerce.

However, experts are now considering the possibility that the dollar's foothold could weaken if the friction of gold transactions is reduced—either through market growth or a technological shift to gold-backed stablecoins. Such a scenario could see the dollar's 'winner takes all' advantage swiftly reverse in favor of gold.

The implications of a dollar dethronement are far-reaching, particularly for the United States. Should the international community pivot from dollar reserves to gold, the vast number of dollars currently held abroad could flood back into the domestic market, potentially doubling the currency supply and igniting inflation rates to surge by 50 to 100%. Estimates suggest that there are between eight to ten trillion dollars—or possibly more—held overseas, a staggering amount that could inundate the US economy if repatriated.

As we stand on the precipice of a potential financial paradigm shift, the question remains on how the US will navigate the uncharted waters of a world where gold reclaims its ancient throne as the premier global currency. For now, the dollar's fate hangs in balance, and only time will tell if the glint of gold will outshine the greenback's longstanding dominance.