The bitcoin price is an alarm system if you've been paying attention for years.

Bitcoin is the best alarm system in markets today. This price dump is probably less about Mt. Gox coins being sold and more about some liquidity crisis on the horizon that is metastasizing behind the scenes.

— Marty Bent (@MartyBent) June 24, 2024

No better way to start off the week than a nice 8% dump in the bitcoin price. I kid, of course, but this price correction does provide a nice opportunity to explore the idea that bitcoin is a leading indicator, or an alarm system, that warns markets about an impending liquidity crisis. Many are speculating that the unlock and distribution of bitcoin that was caught up in the Mt. Gox collapse is driving the sell off, but I find it hard to believe that this is what's been driving today's price action.

There are a number of things going on in the world right now that signal to me that we may be reaching a critical tipping point. Whether that tipping point is geopolitical, financial or a combination of the two is yet to be determined. However, there are many things happening right now that lead me to believe that we are approaching some type of event(s) that could cause markets to take a downturn and bitcoin may be the first mover as people look to take risk off the table and sure up their balance sheets with cash. To anyone who understands bitcoin and why it exists in the first place this may seem like an insane move to make, but we've seen it happen in the past. Most memorably during the lead up to the COVID lockdowns in March 2020 when bitcoin was the first to move and dropped 50% overnight as market participants anticipated massive economic disruption.

Here is what has caught my eye over the last week.

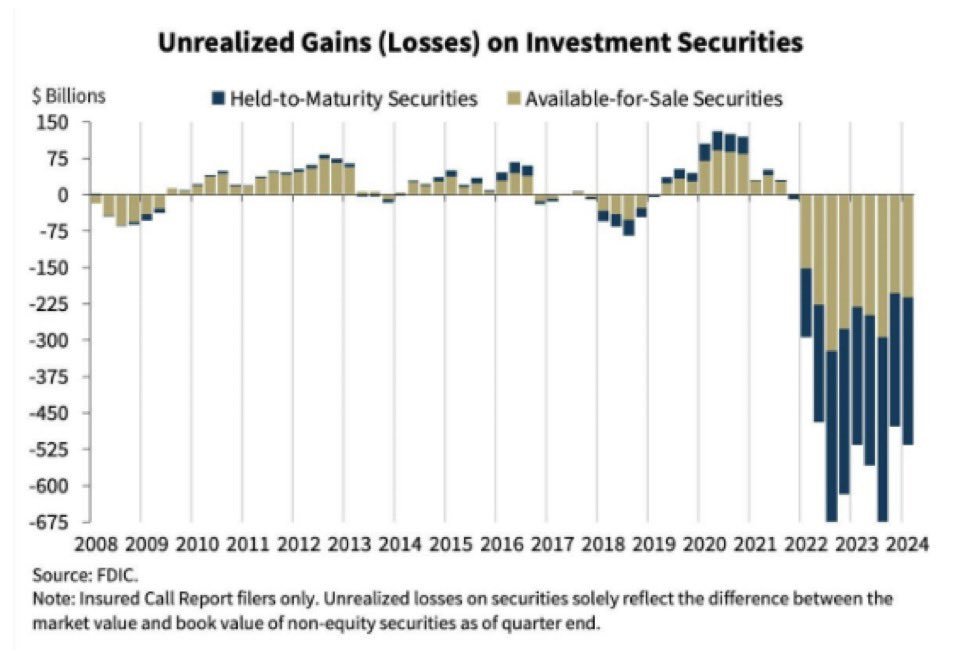

The Japanese yen is testing levels not seen since the early 1990s as the Bank of Japan continues to lose control of its yield curve and has made feeble attempts to defend the USD/JPY exchange rate. If all hell breaks loose, the BOJ loses any semblance of control over the yen, the cash-and-carry trade many have been taking advantage of for years turns sour, and confidence in the yen quickly erodes the BOJ could be a forced seller of US Treasuries, which would severely hinder the capital position of US banks that are being pushed closer to the point of forced selling of assets due to stress in the US commercial real estate market. Imagine what would happen if these losses go from unrealized to realized (as we pondered last week).

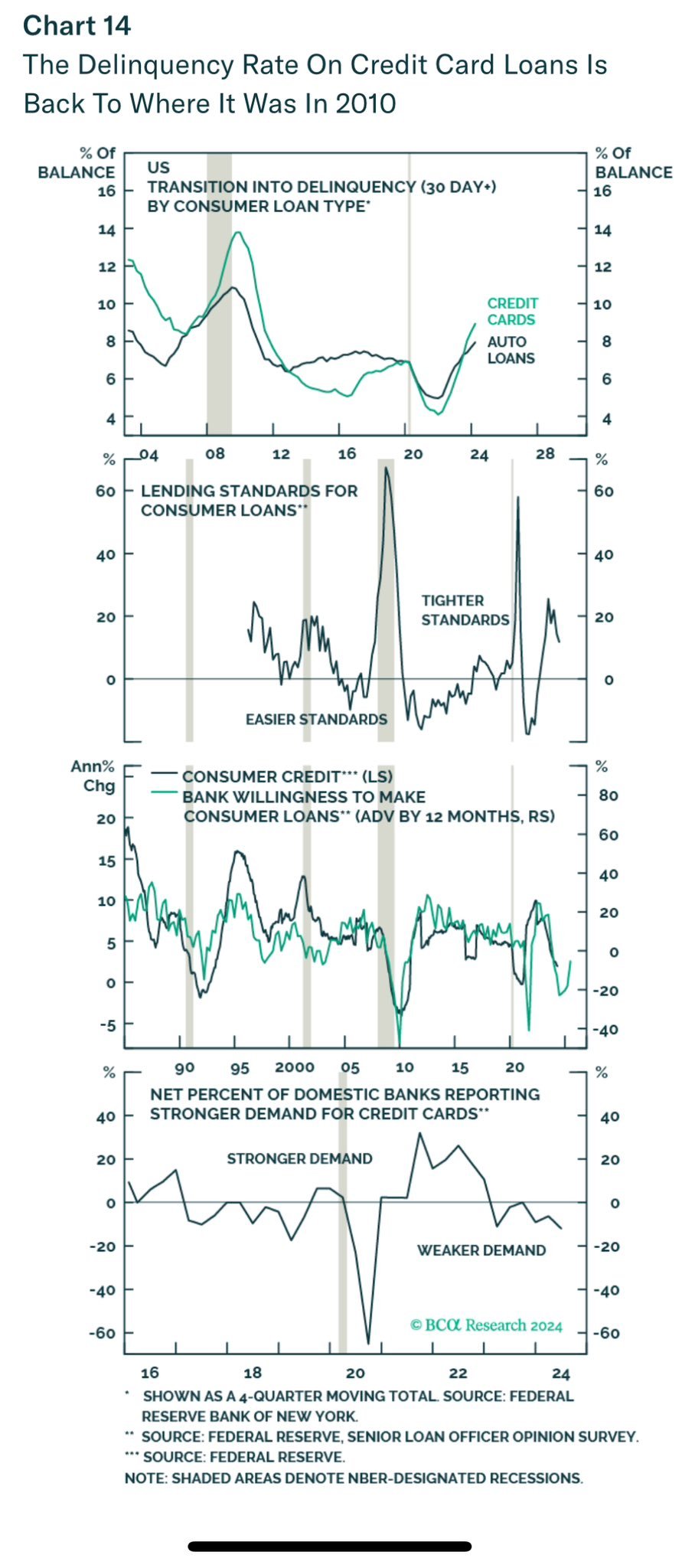

At the same time, the US consumer has hit a wall caused by inflation and a terrible jobs market that is causing them to forgo paying off their credit card debt, which hinders another revenue stream that banks depend on.

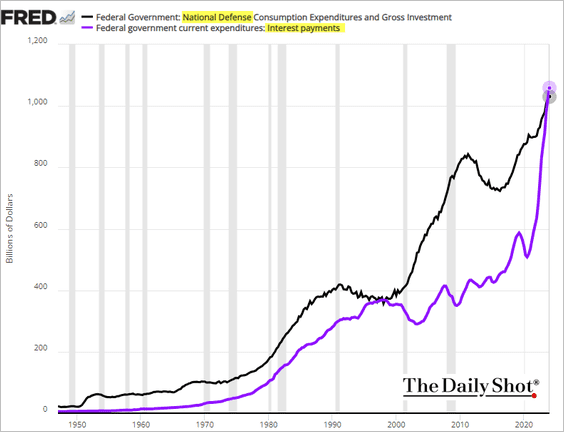

All the while, the US government has officially crossed the Rubicon in terms of it's runaway debt situation. It now pays more in interest expense on the $34.8T+ debt it has accrued than it does on defense spending (again, as we covered last week). This has historically been a marker of a point of no return for Empires. It may seem like a nothing burger to most, but it would be naive to think that our counterparts on the geopolitical stage are looking at this and thinking to themselves, "The US and the dollar are in a good position. Treasuries are still risk free."

On that note, I think this analysis from Luke Gromen (quoted by Larry Lepard) is spot on.

🎯

— Lawrence Lepard, "fix the money, fix the world" (@LawrenceLepard) June 23, 2024

"we think buying long term US treasuries at negative term premiums while global Central Banks buy record amounts of gold may come to be seen as buying AAA-rated subprime mortgage bonds in 2006, even as home prices were already falling nationally: Something that should have…

This becomes an especially enticing theory when you consider what happened over the weekend in Crimea with Ukraine bombing a beach filled with civilians using cluster munitions provided by the US government. Russia seems keen to retaliate in some fashion, which is particularly unnerving considering they just moved naval ships with nuclear capabilities just off the coast of Florida a couple of weeks ago.

BREAKING:

— Megatron (@Megatron_ron) June 23, 2024

🇷🇺🇺🇲🇺🇦 Russian Ministry of Defence regarding today's massacre in Crimea by Ukraine with cluster munitions:

"The US is responsible for this massacre, and they will get an answer"

"All flight missions for American ATACMS missiles are programmed by American… pic.twitter.com/h6NgUkubP9

Who knows exactly how everything plays out, but it is clear that all is not well and the bitcoin price may be sending the signal to the rest of the market.

Why would bitcoin be the asset to send the signal you ask?

I think the combination of it's liquidity profile and the fact that it is still seen as a riskier asset to many. Bitcoin's liquidity profile is such that it trades 24/7/365, can be transferred to an exchange within minutes, sold and cashed out within a couple of hours. In terms of market depth, bitcoin certainly isn't the deepest market (yet) but the properties mentioned above make it a very valuable asset to have during times when you want to get into cash. Investors could be pouring into cash to take risk of the table, prepare to service liabilities that exists in other parts of their portfolio or a combination of the two.

Does this mean bitcoin isn't a safe haven asset?

No. I don't believe so at least. Over the long term bitcoin has proven to be the best safe haven asset to protect individuals from currency debasement, censorship and governments getting absolutely plastered on debt. During times of financial stress people need cash and they will look to get into cash as quickly as possible and bitcoin is the asset that gives them the speed they desire. Those looking to get into cash because they need it to pay off other liabilities or want to simply sit in cash can do so and those who understand bitcoin, haven't taken too much risks in other parts of their portfolio and have cash to deploy are able to acquire more bitcoin.

The market is a spectrum filled with actors who have varying levels of deployed risk, risk appetites, time preferences and understanding. Right now we are witnessing those who may see a liquidity crisis or kinetic global conflict on the horizon dump their bitcoin for cash while hardened bitcoiners pick up more bitcoin on the dip. Unless they forgot to stay humble and stack sats and are currently having their levered longs liquidated.

Final thought...

The first peel of the season is happening as I type and it is very flaky.