Interest rate hikes fail to tame inflation or spark growth, debunking central bank myths.

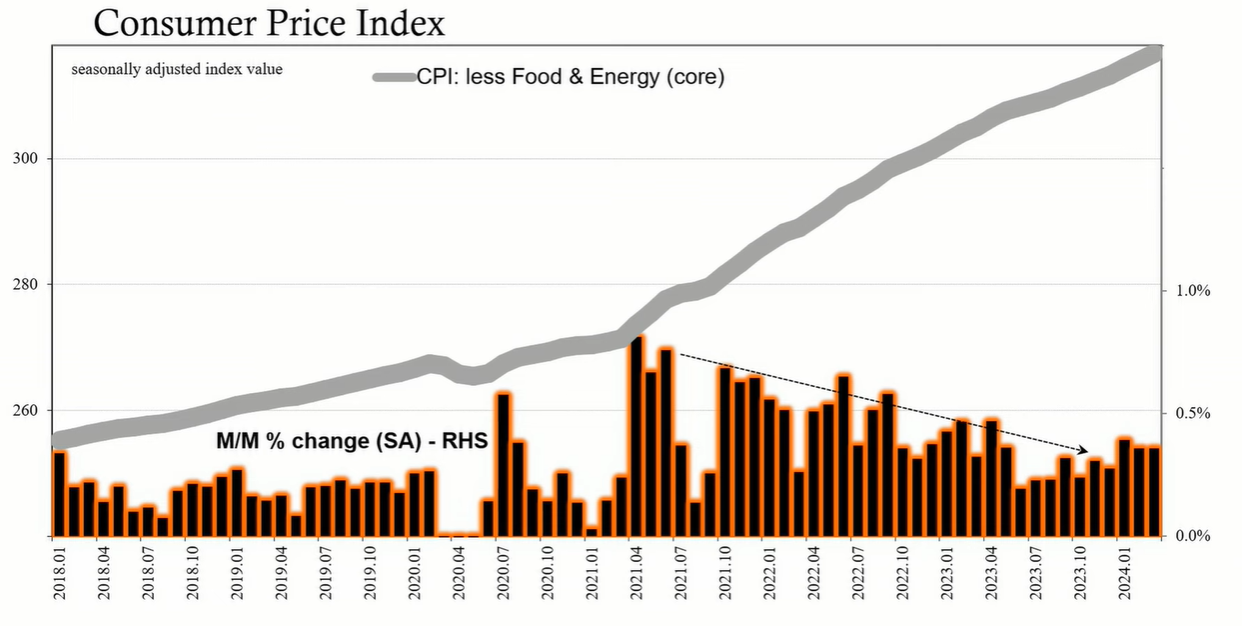

Interest rate policies have been a primary instrument for central banks worldwide to control inflation and stimulate economic growth. The Federal Reserve's aggressive rate hiking campaign is one of the most significant monetary tightening efforts in history, aiming to curb inflation. However, despite these efforts, the U.S. and global economies are still grappling with inflationary pressures.

The central premise behind interest rate targeting by the Federal Reserve and other central banks is that by adjusting the benchmark short-term interest rates, they can influence economic activity. Raising rates theoretically makes borrowing more expensive, slowing down spending and investment, and thereby cooling inflation. Conversely, lowering rates is supposed to stimulate borrowing and spending, leading to economic growth.

Central banks often aim to set rates above or below a so-called neutral interest rate, which is neither stimulative nor restrictive. However, determining the neutral rate is fraught with uncertainty. As Federal Reserve Chair Jay Powell acknowledged, the precise level of the neutral rate is unknown, making the assessment of policy restrictiveness challenging.

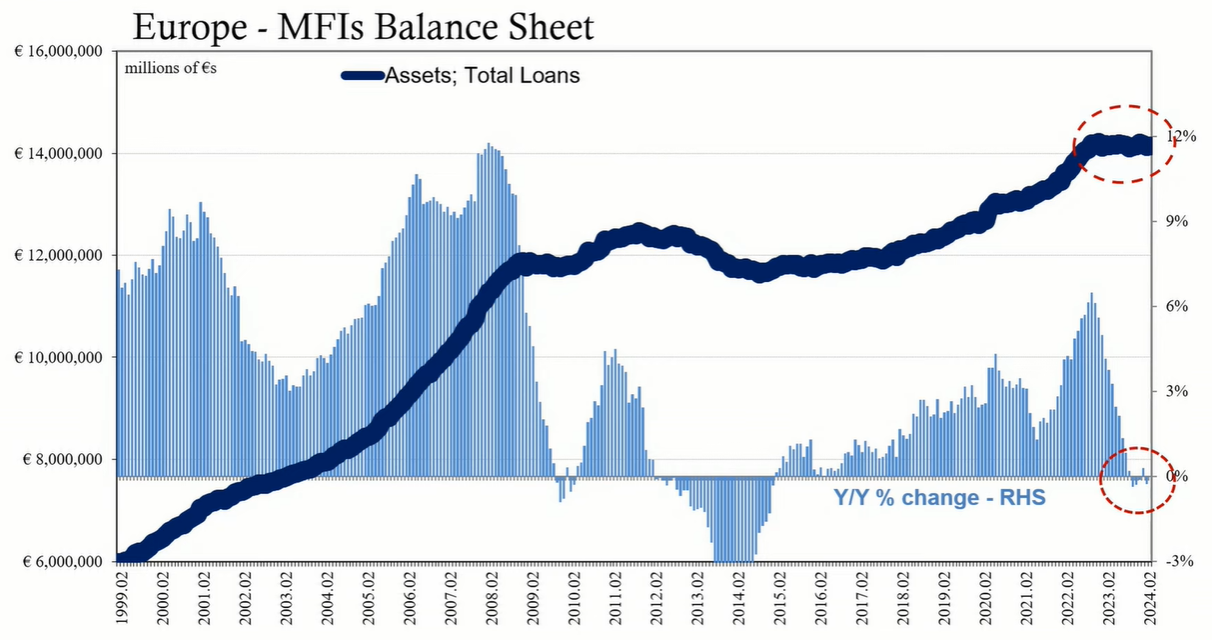

Historically, rising interest rates have been associated with periods of economic growth and inflation, while falling rates often indicate economic distress. This contrarian view suggests that rate hikes may not necessarily act as intended. Moreover, the transmission of rate changes through the banking system to the real economy is complex and not always effective, as evidenced by previous monetary policy exercises.

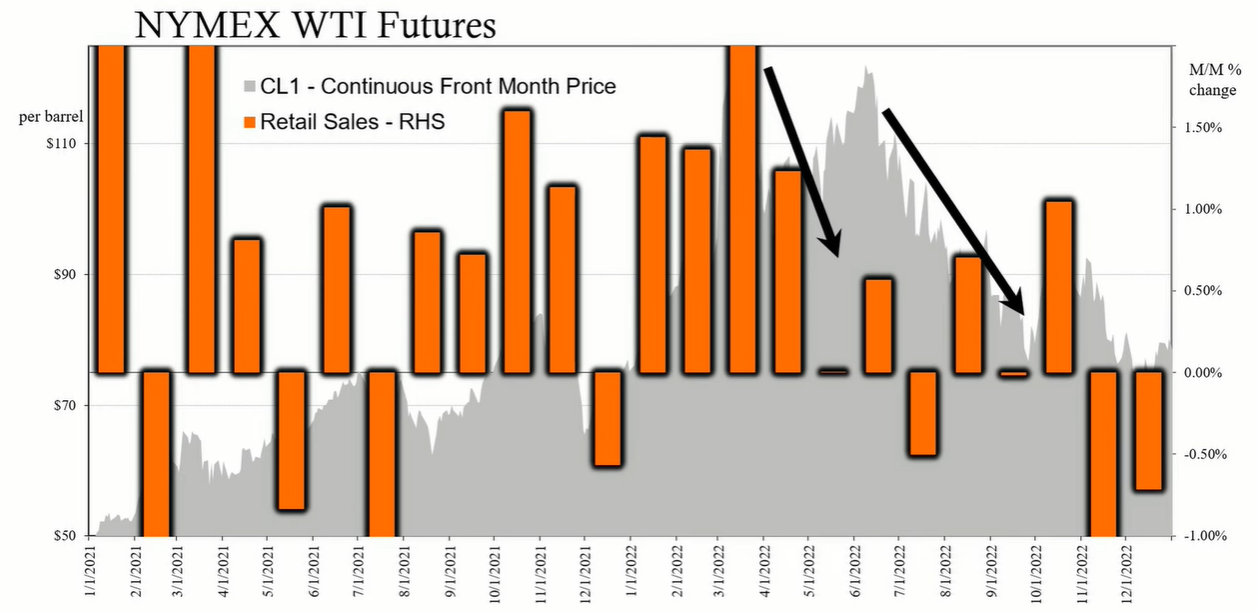

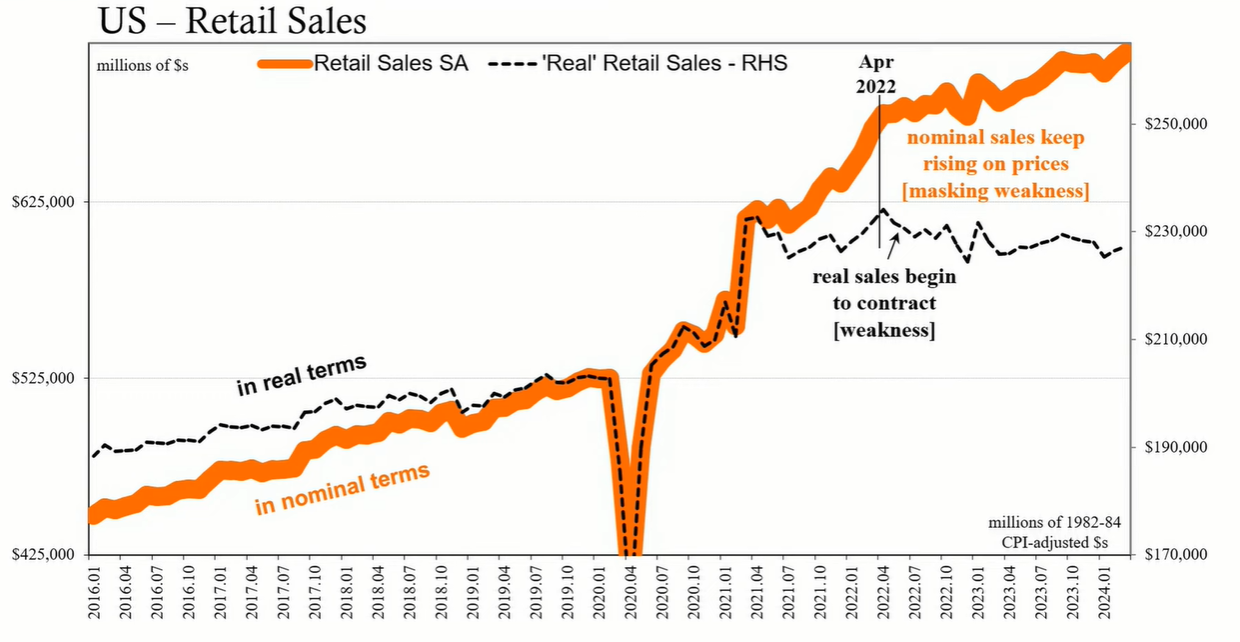

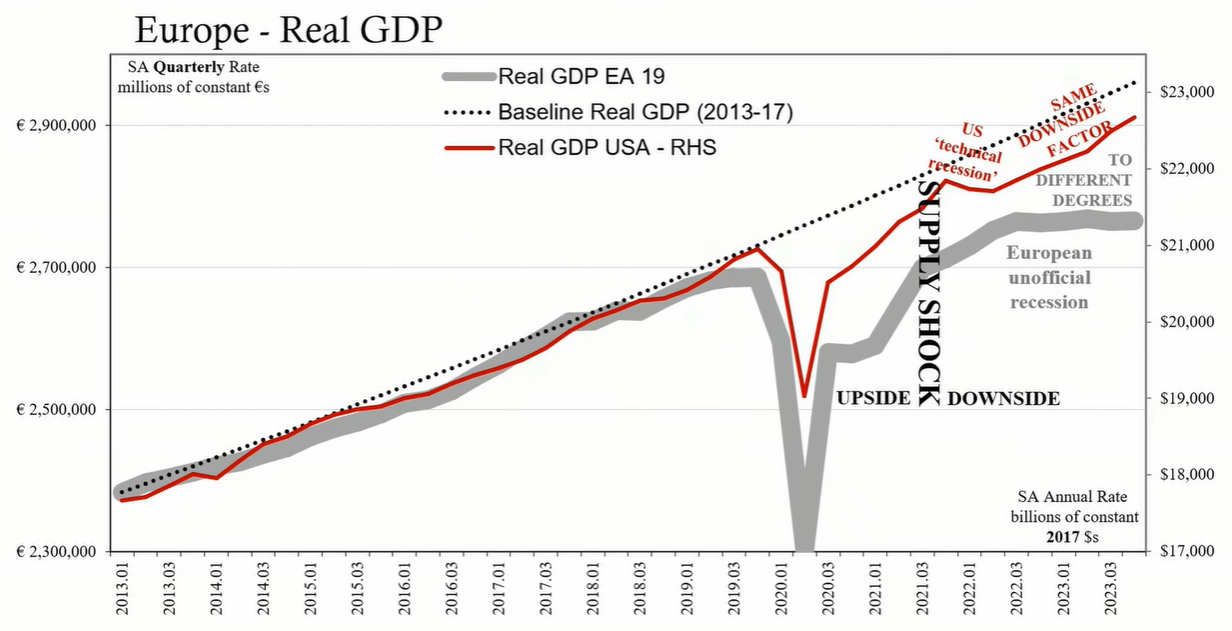

The current global economic situation is heavily influenced by the aftermath of supply shocks, such as the oil price surge in 2022. These shocks have their own timelines and effects, often unrelated to central bank actions.

The evidence suggests that while rate hikes do influence certain financial markets and sectors, their overall impact on the global economy is less significant than commonly believed. The current economic dynamics are largely driven by the resolution of supply shocks, not central bank interest rate policies. Despite the conventional wisdom that central banks control the economy through rate targeting, it appears that they, like the rest of the economic participants, are subject to broader global forces beyond their direct control.