Federal Reserve policies and swap spreads suggest U.S. interest rates may soon drop to around 1-2%.

Interest rates are a pivotal component of the economy, influencing investment, consumption, and inflation. Understanding their movement is critical for predicting economic trends.

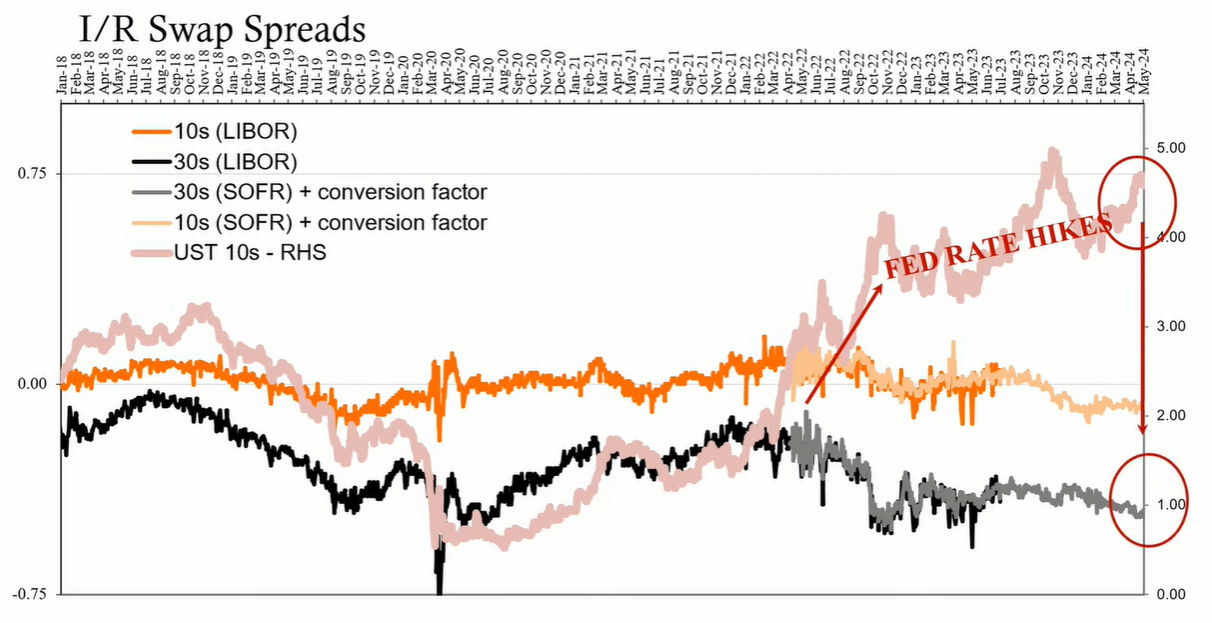

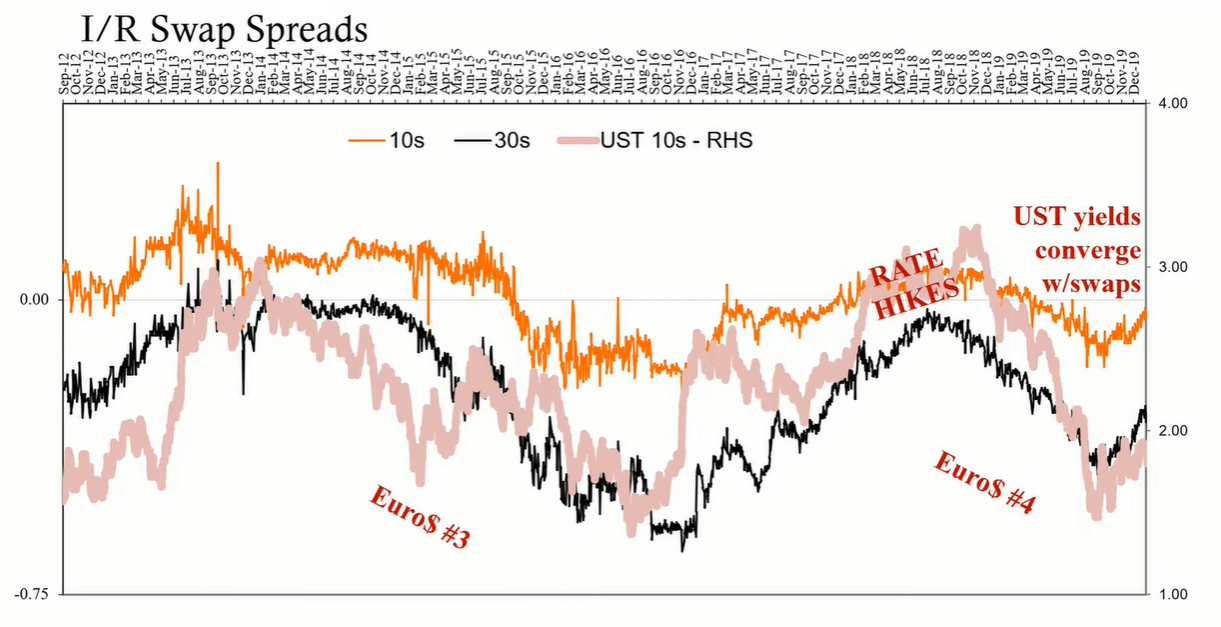

Historically, interest rates have shown an inclination to decrease. Towards the end of the previous year, this trend was noticeable, but the Federal Reserve's intervention at the short end of the yield curve prevented a further decline. If not for the Fed's actions, market indicators imply that treasury rates, particularly the ten-year rate, could potentially be as low as 1-2%.

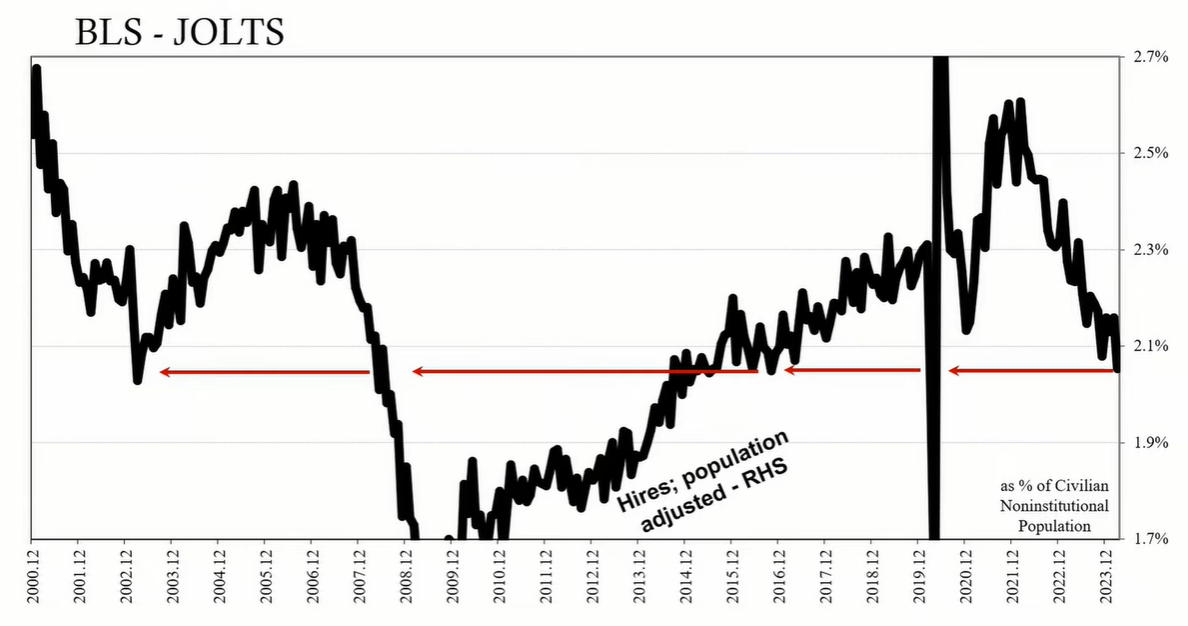

Recent data on the US labor market, including Job Openings and Labor Turnover Survey (JOLTS), unemployment rate, Institute for Supply Management (ISM) Non-Manufacturing Employment Index, and establishment surveys, have indicated potential weaknesses in the otherwise robust US economy. These data points have led to a reevaluation of the likelihood of a "soft landing," as previously anticipated strong economic growth and inflationary pressures might be easing.

The global economy is experiencing continued difficulties, and commercial real estate is among the sectors facing challenges with potential risks. Additionally, there might be unresolved issues within US banks that could contribute to future economic strain.

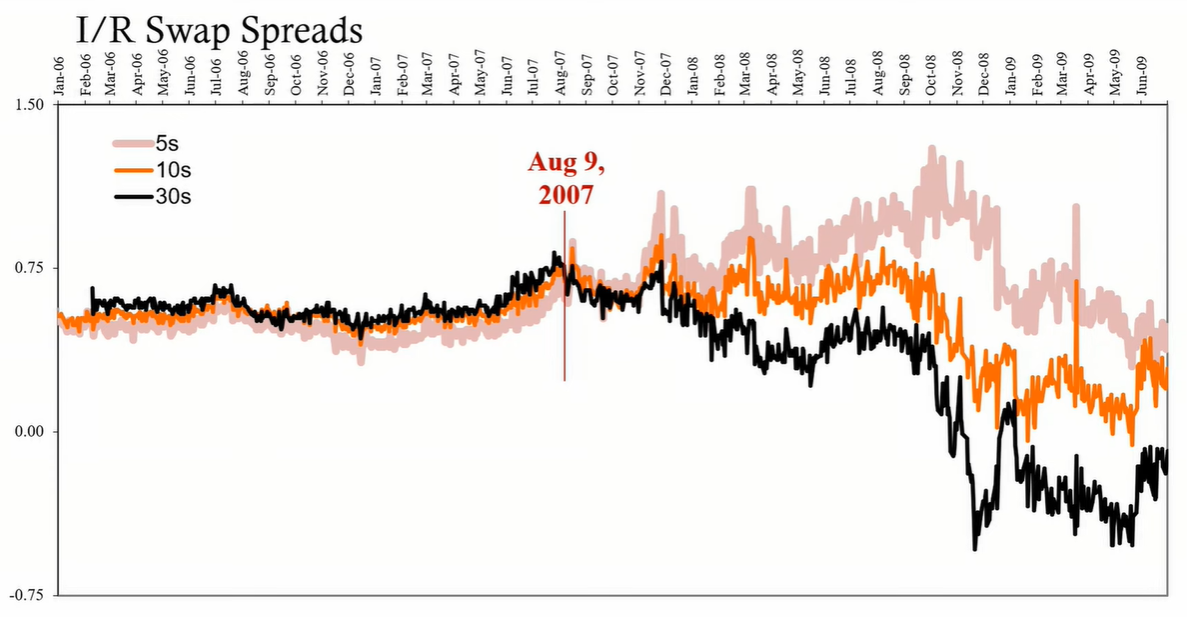

Interest rate swap spreads, particularly the ten-year and thirty-year spreads, have been consistently negative for several months, indicating deflationary pressures. Swap spreads are the difference between the fixed leg of a swap and the yield on a matching maturity US Treasury. A negative spread suggests dealers are balance sheet constrained, which is a deflationary signal. This constraint implies that money and credit are not circulating efficiently through the global financial system, impacting economic conditions.

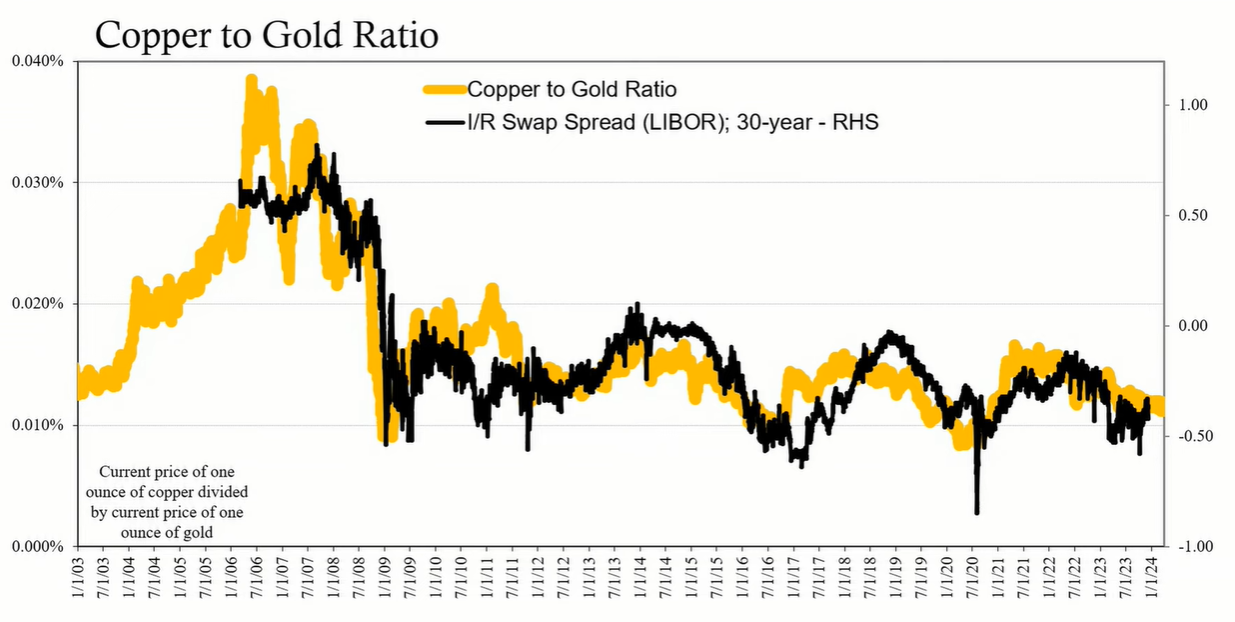

Mainstream explanations for negative swap spreads revolve around an oversupply of Treasuries, but this is contradicted by the fact that Treasury prices are rising, indicating high demand. Moreover, the correlation between swap spreads and various economic indicators, such as the copper-to-gold ratio and crude oil prices, challenges these conventional interpretations.

An analysis of market correlations suggests that swap spreads are closely tied to commodity prices and economic expectations. For example, a decrease in oil prices often coincides with more negative swap spreads, indicating a deflationary environment. Despite occasional supply-driven price hikes in oil, the underlying demand-side economics align closely with swap spread trends.

Nominal US Treasury yields typically follow swap spread trends, except during periods of divergence due to external factors like Federal Reserve policy changes or quantitative easing. Without Federal intervention, current swap spread data suggests that ten-year Treasury yields could converge around 1%, reflecting the fundamental monetary and economic conditions.

Interest rate trends, when analyzed alongside swap spreads and other financial indicators, provide a comprehensive picture of the underlying monetary and economic conditions. The current data suggest a deflationary environment, with interest rates potentially lower if not for Federal Reserve policies.