Ikea warns of economic strain as rising unemployment and lower energy use prompt retail price cuts in a slowing market.

Various mainstream economic indicators suggest that companies like Ikea are not engaging in aggressive discount strategies due to consumer confidence and a booming labor market. Instead, there are clear signals of economic strain that are pushing these businesses to lower their prices.

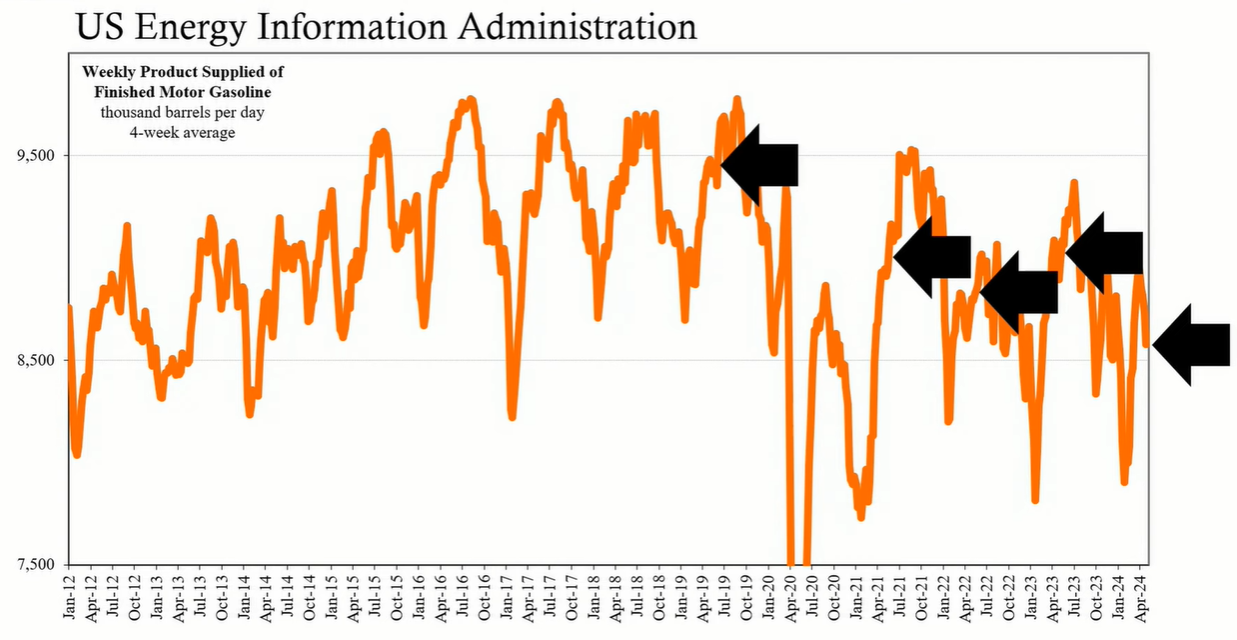

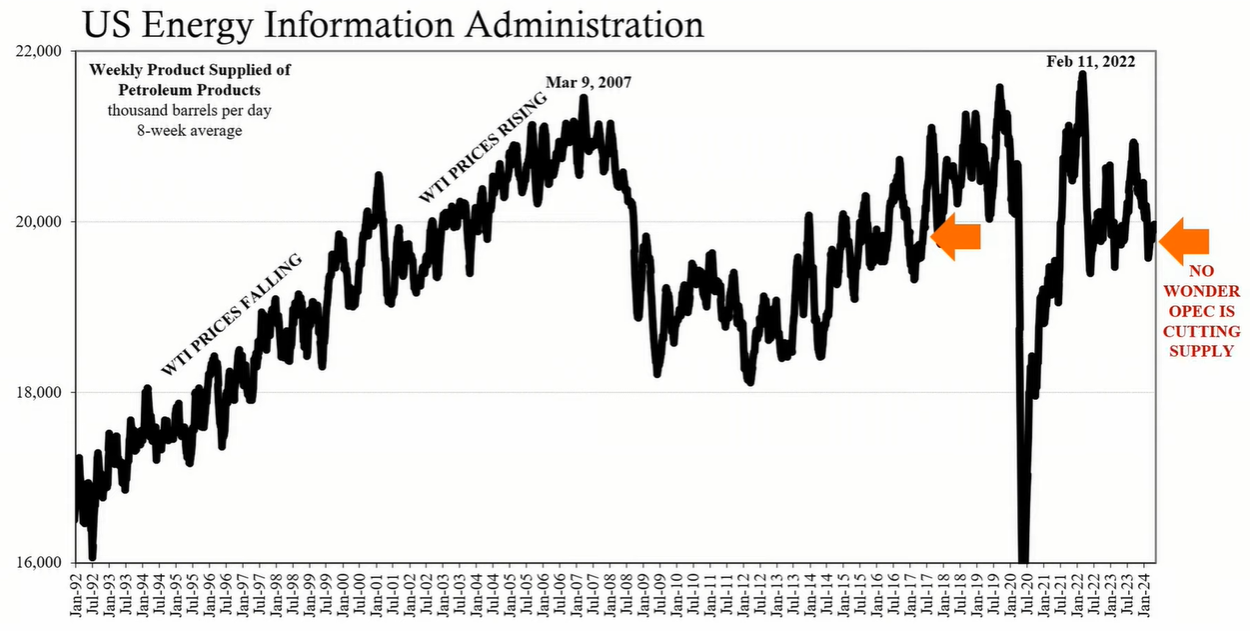

Recent labor market data has shown an uptick in unemployment claims, indicating potential cracks in what was deemed a strong labor market. This, combined with a significant drop in energy use, particularly gasoline, signals that the economy is not as robust as some might believe. Energy consumption is often directly correlated with economic health, and the current statistics are alarming.

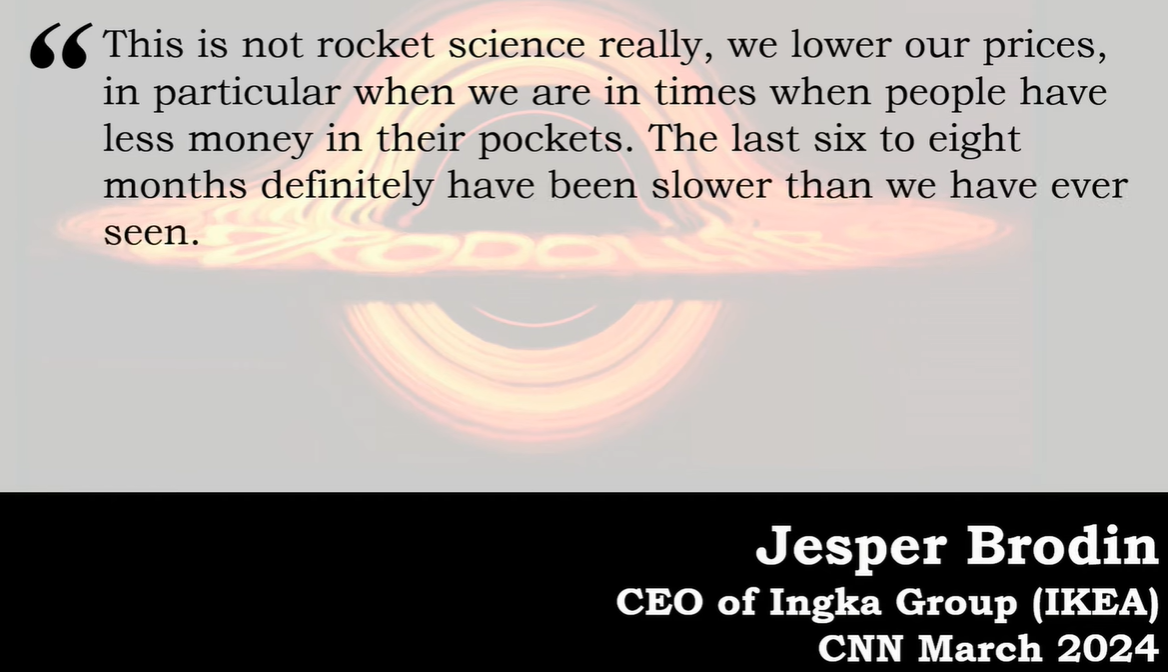

Retail giants such as Ikea, Michaels, and H&M have been forced to cut prices to adapt to the weakening purchasing power of consumers. Ikea's CEO has explicitly stated that price reductions are necessary during times when customers have less disposable income. This trend of discounting is a reaction to slower sales and the need to maintain volumes in a challenging economic environment.

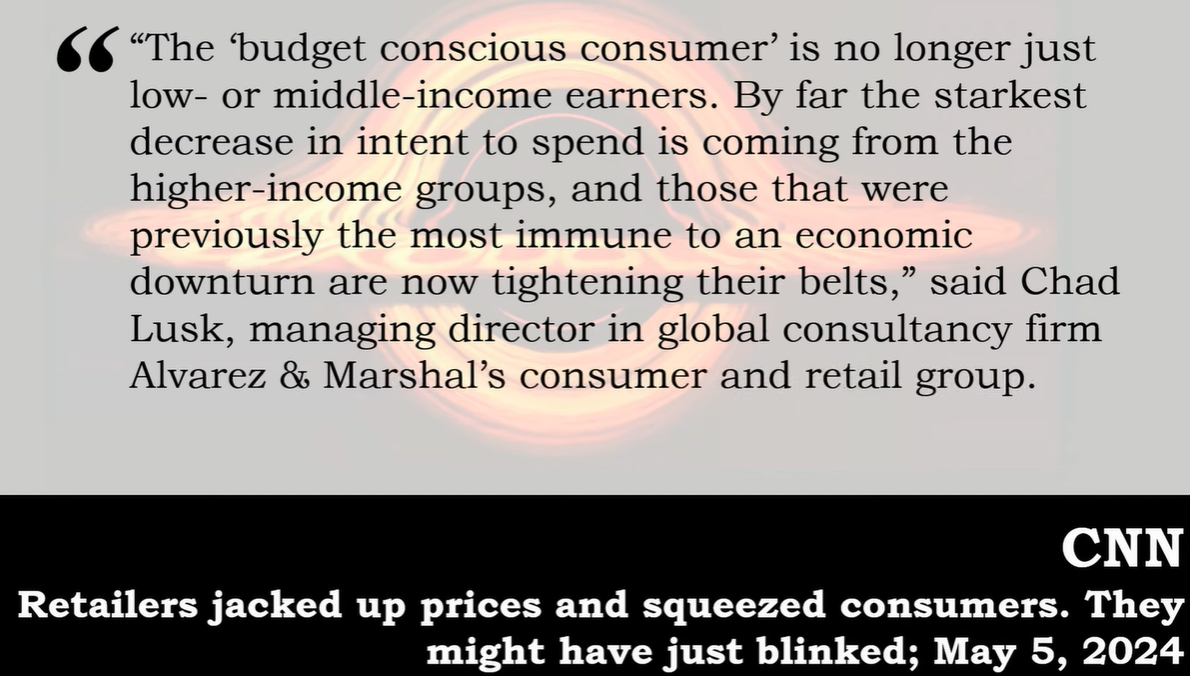

The pressure to reduce prices is not only affecting low or middle-income earners but also higher-income groups that were previously more insulated from economic downturns. The tightening of belts across various income levels points to a more pervasive economic downturn that is influencing consumer behavior and spending habits.

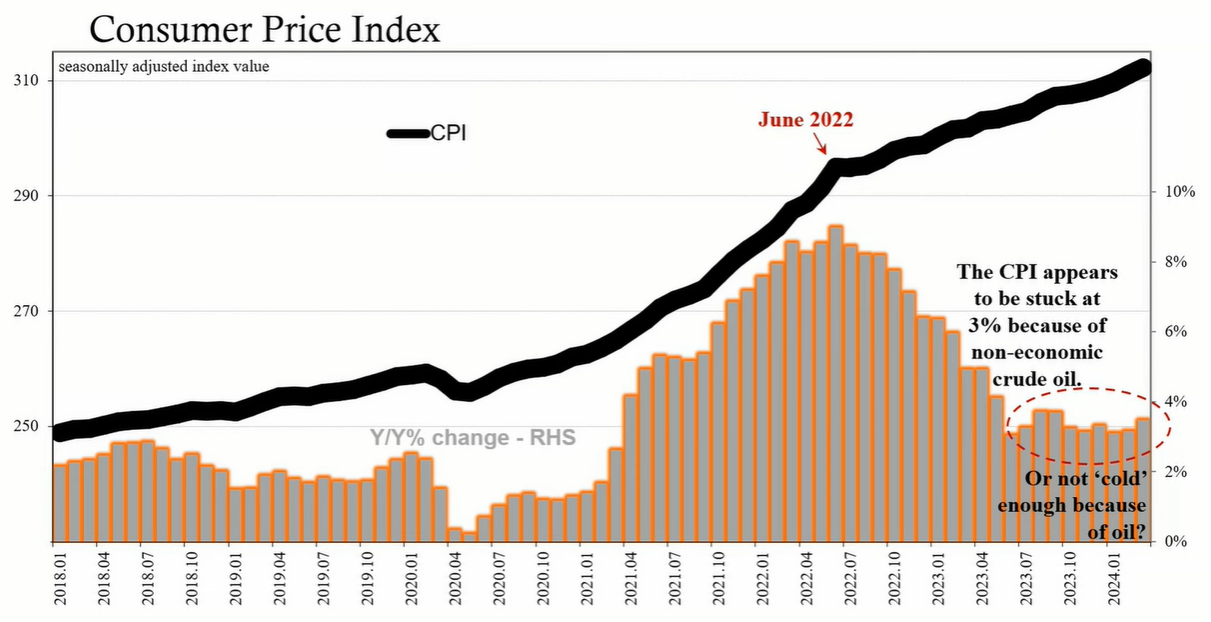

The CPI has been misconstrued as a sign of a hot economy, leading to a belief that persistent high numbers indicate economic strength. However, the reality is that the CPI is also reflecting the economic slowdown, with businesses and markets offering a different perspective than what is being portrayed by the Federal Reserve and mainstream media.

Energy consumption, especially oil and gasoline, is a critical metric for gauging economic activity. The recent data from the Energy Information Administration indicates a decrease in demand, with petroleum usage in the United States at levels comparable to several years prior, despite expectations of growth and population increase.

Numerous companies beyond Ikea, such as Starbucks and Tyson Foods, have publicly acknowledged the need to adjust prices in response to a struggling consumer economy. These announcements serve as additional evidence of the broader challenges facing the market.

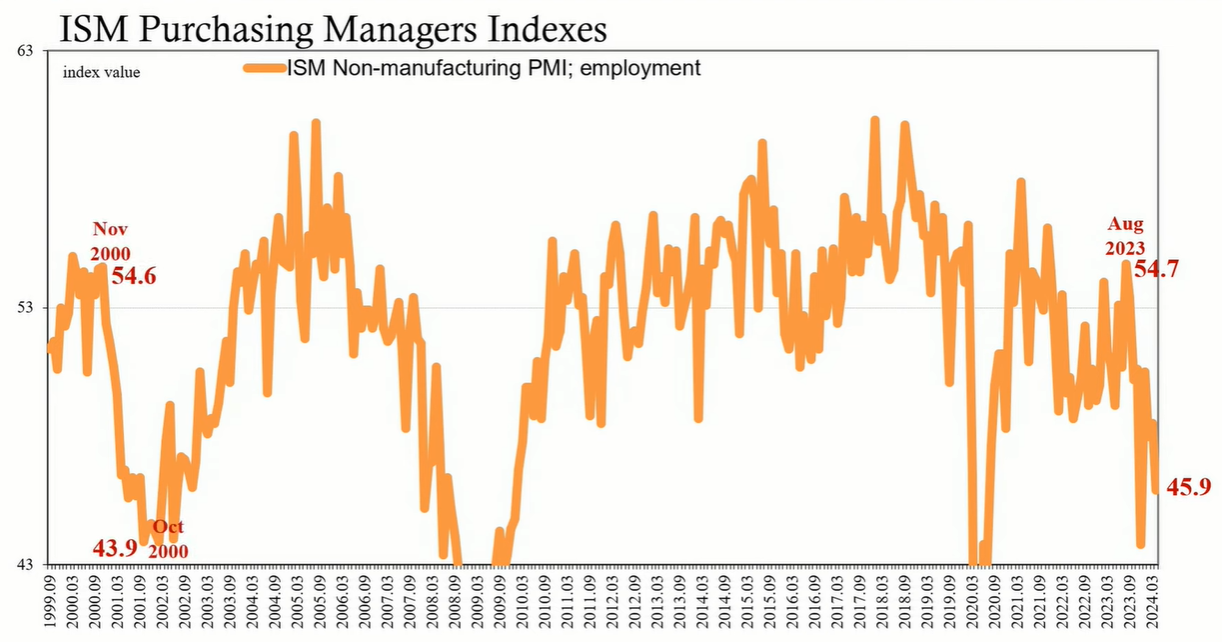

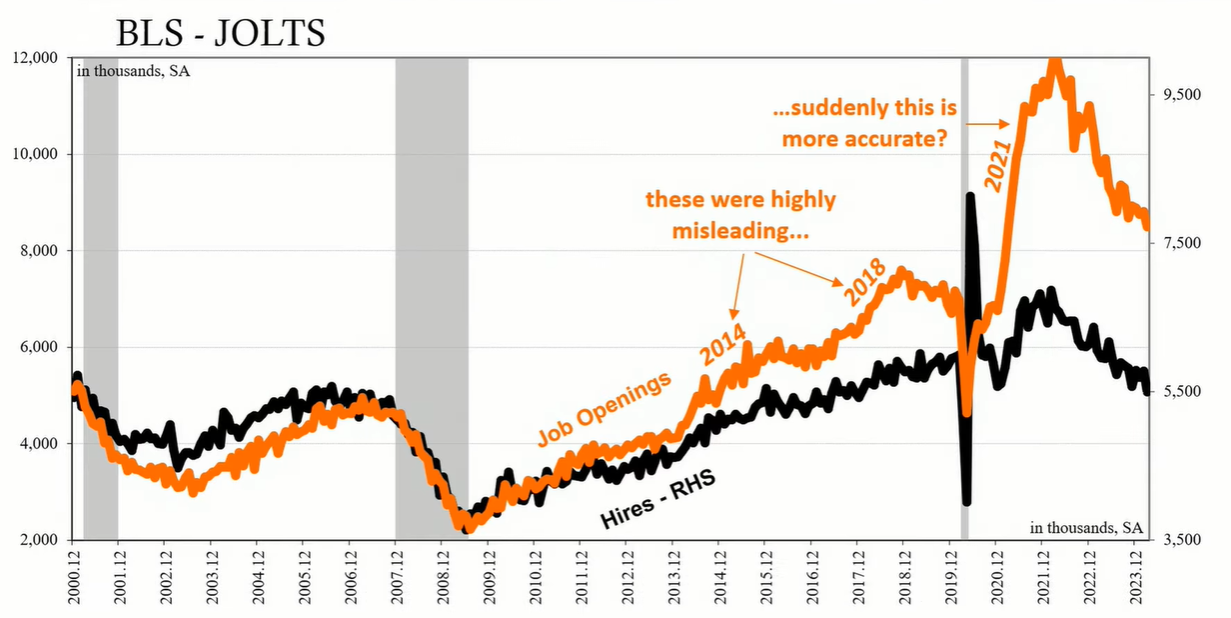

Job market data, including the ISM employment index and the JOLTS hiring statistics, suggest that the U.S. economy is experiencing a hiring freeze, with signs pointing towards businesses preparing for potential layoffs as they face a weakening environment.

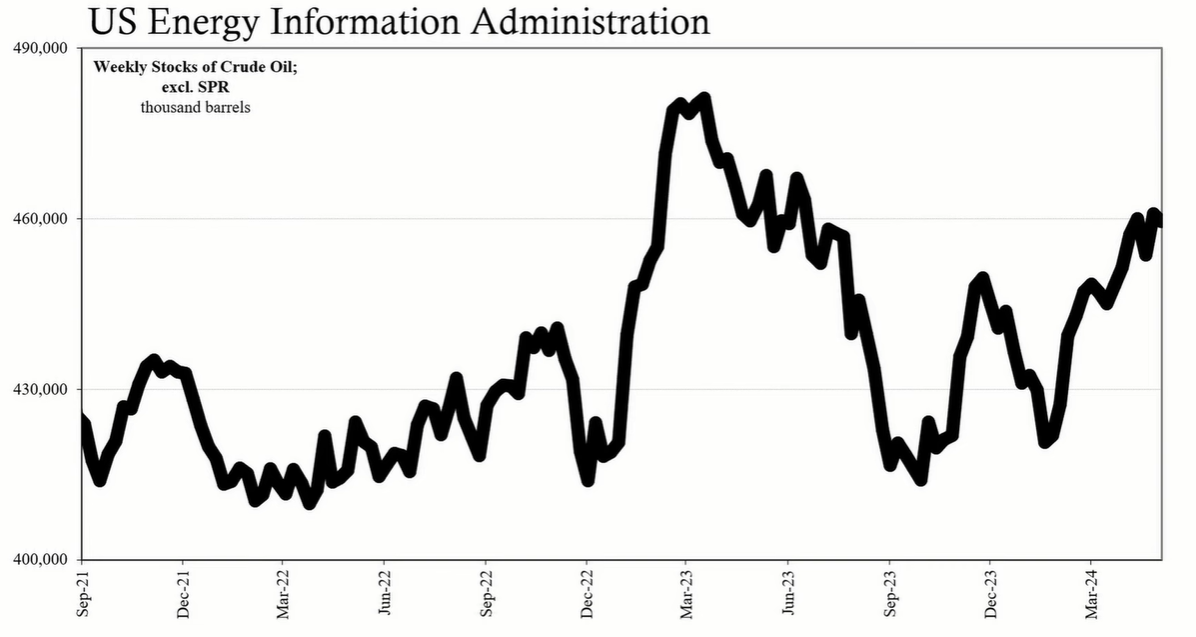

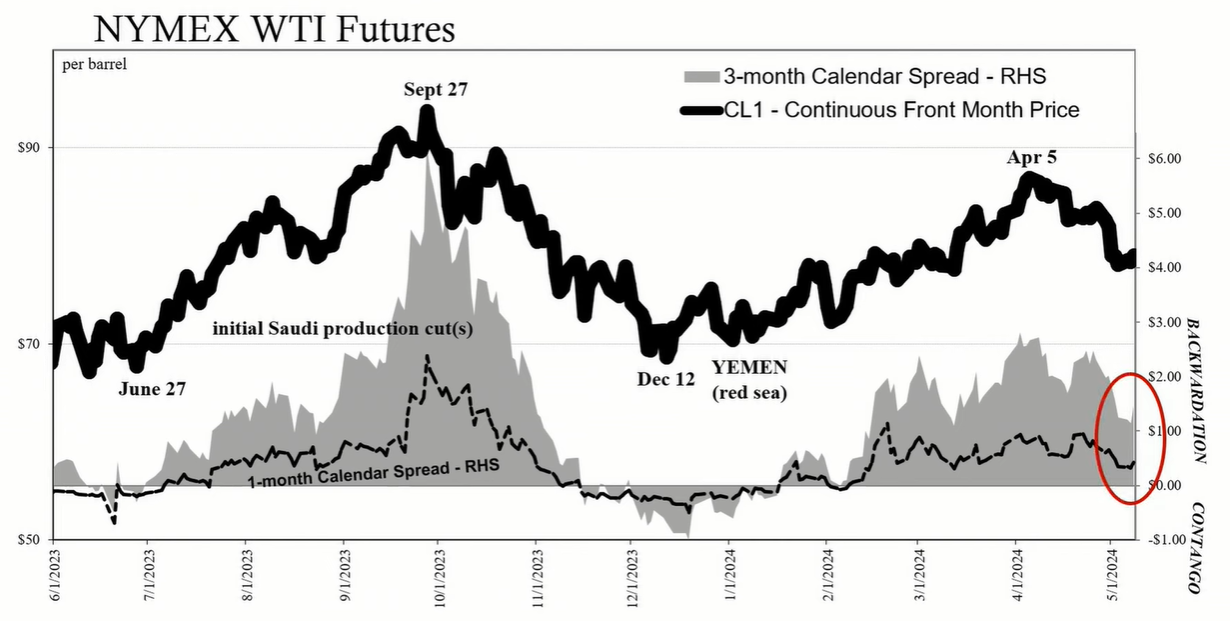

The fluctuation of crude oil prices and the structure of the WTI futures curve reflect market sentiment around supply and demand. Despite geopolitical concerns and production cuts, the market is increasingly focused on the lack of demand, which could suggest an economy that is not as robust as some indicators have implied.

The multitude of data points, from unemployment claims to energy usage, and from corporate price strategies to market dynamics, paints a picture of an economy that is not as strong as it may appear. Companies like Ikea are not reducing prices out of strength but rather as a necessary response to an economic climate that is showing signs of distress. The economy may be on the precipice of a downturn, with various sectors signaling caution for the future.