New data from the University of Michigan's consumer sentiment survey reveals a sharp decline in confidence.

As the specter of economic downturn looms, fresh data indicates that American consumers may already be grappling with a recession, despite inflation expectations surging to unparalleled highs during the tenure of President Biden. According to the latest reading from the University of Michigan's consumer sentiment survey—a barometer of Americans' attitudes toward current and future economic conditions—the outlook is grim. The survey, which is critical considering consumer spending accounts for approximately two-thirds of the economy, saw a sharp decline last month, dropping from a rating of 69 to a mere 65.6. Historically, a rating below 70 signals a recession, suggesting that, by this measure, the United States is indeed facing economic contraction.

Wall Street analysts, caught off-guard, had anticipated a more robust score of 72, resulting in a significant three-sigma deviation from expectations, an event with a probability of occurring by chance of just 0.27%. This stark discrepancy raises questions about the over-optimistic economic forecasts coming from financial pundits, or whether there's a deliberate attempt to paint a rosier picture of the economy.

Joe Consorti, an economic analyst, has highlighted the troubling trajectory of the economy, which has seen a rapid decline since last September, mirroring the precipitous falls of the 2008 crisis and the pandemic-induced lockdowns. This downturn has a striking correlation with the surge in inflation, which began in October, hinting at a potentially delayed formal recession announcement by the Bureau of Economic Analysis, likely post-election due to the political sensitivity of such declarations.

US Consumer Confidence Is Tanking, 5.3% Inflation Expected

— Joe Consorti (@JoeConsorti) June 17, 2024

the cliff-notes:

• the University of Michigan consumer sentiment survey tanked into contraction from 69.1 to 65.6

it was a huge, statistically impressive 3-sigma (standard deviation) miss below the mean analyst estimate… pic.twitter.com/BPgLEoEgV2

In a concerning twist, inflation expectations have spiked, with the University of Michigan survey respondents projecting an average inflation rate of 5.3% over the next five years—a rate surpassing the worst of the so-called "Biden inflation." This parallels the 1970s scenario when reductions in the headline Consumer Price Index coincided with climbing inflation expectations, which, historically, have proven accurate.

This enduring economic enigma underscores the uncanny ability of consumers to forecast inflation more precisely than government or Wall Street analysts, prompting a reevaluation of the reliance on these institutional predictions. The economic missteps in Washington are becoming increasingly apparent, with policies such as the Inflation Reduction Act seemingly exacerbating inflation and a focus on governmental expenditure that does not prioritize the average American's welfare.

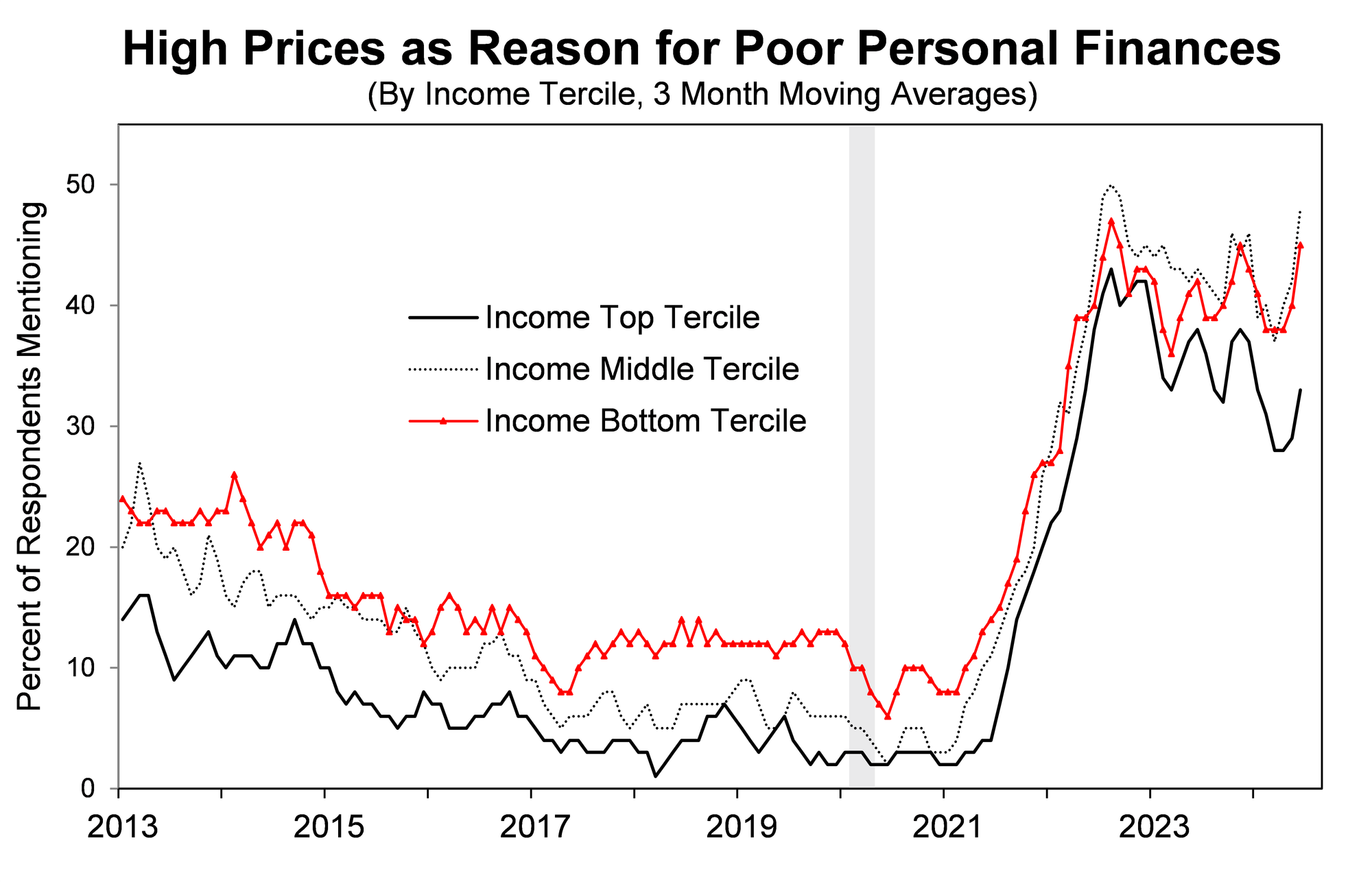

As the real economy falters—with real incomes dropping significantly and job growth predominantly in less stable sectors—the disconnect between official narratives and the lived experiences of citizens becomes more evident. With economic distress not confined to the United States, as seen in similar struggles among global counterparts and the plummeting approval ratings of G7 leaders, the message from the populace is clear: change is imminent, and it may very well be delivered at the ballot box.

Michigan's consumer sentiment survey