China's declining CPI and PPI have heightened global concerns about deflationary trends and their impact on the world economy.

Recent data on consumer and producer prices in China have reignited discussions about global inflation. The United States Consumer Price Index (CPI) stirred debates about rising inflation, but China's CPI and Producer Price Index (PPI) data may provide a clearer picture of the global economic environment. China's consumer prices experienced a significant drop in March, and despite rising oil prices, producer prices continue to fall. Moreover, the Chinese yuan is facing ongoing challenges. These factors are not isolated to China; they have implications for the global economy.

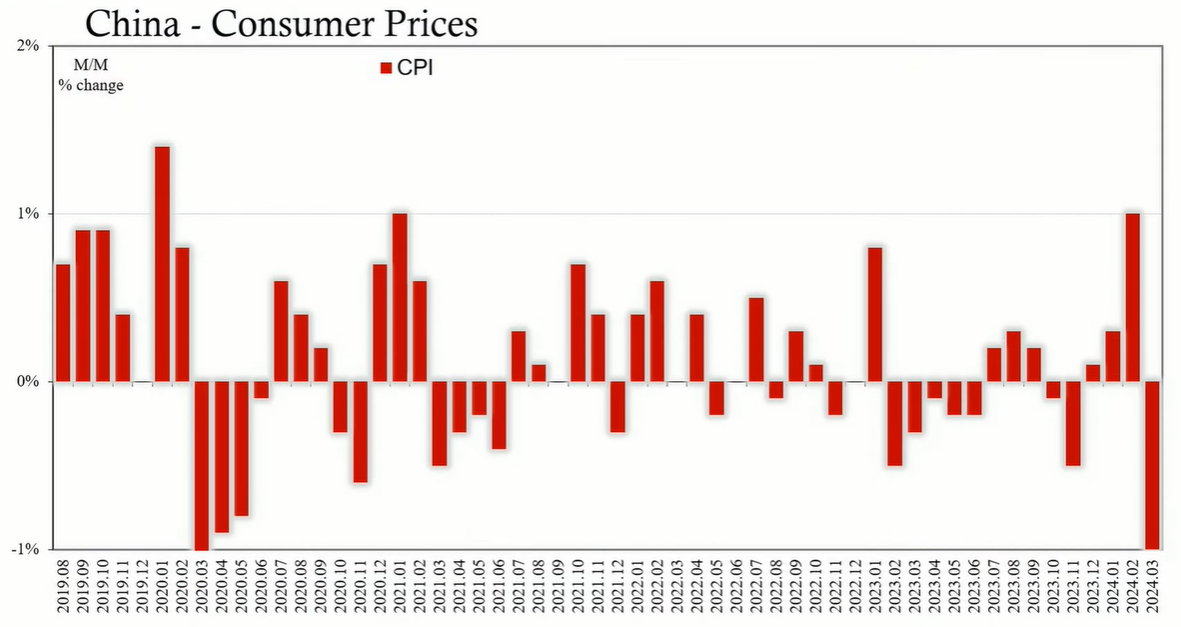

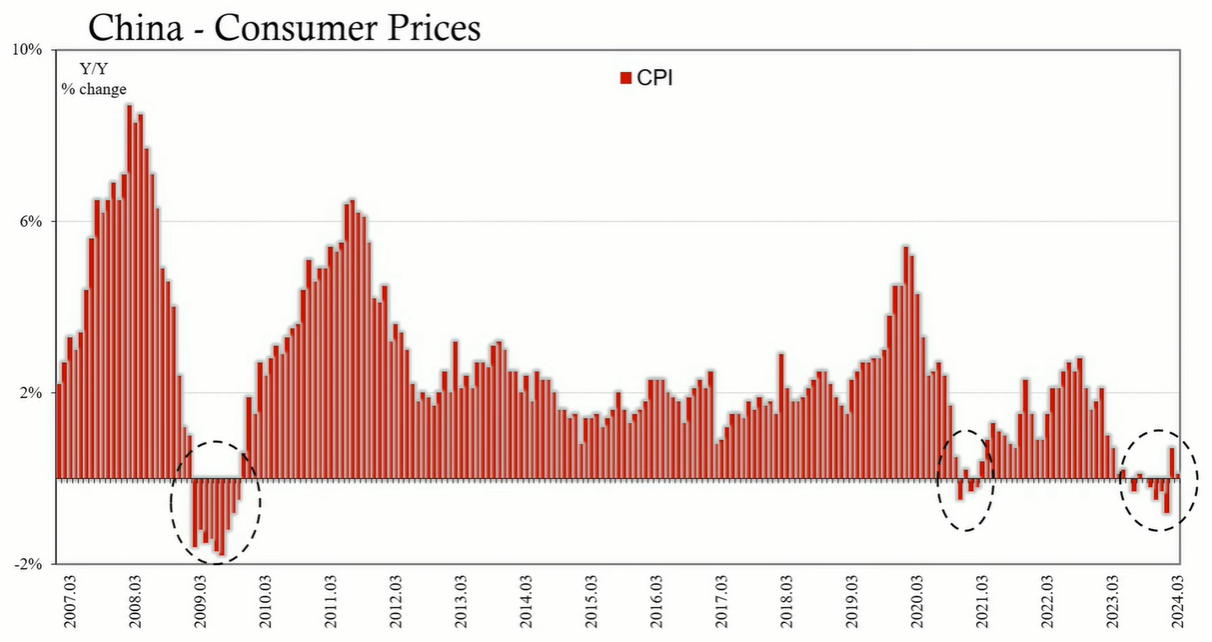

China's CPI fell by 1% in March, the third-largest monthly decline in the past two decades. This decrease follows a 1% increase in February, which is typically attributed to seasonal spending during the Spring Festival and New Year holidays. The March decline suggests that consumer spending did not carry over post-holiday, indicating potential economic weakness. Food prices notably dropped by 3.2%, with non-food prices also decreasing. The core CPI, excluding food and energy, fell by 0.6%, and the year-over-year rate was barely positive at 0.1%.

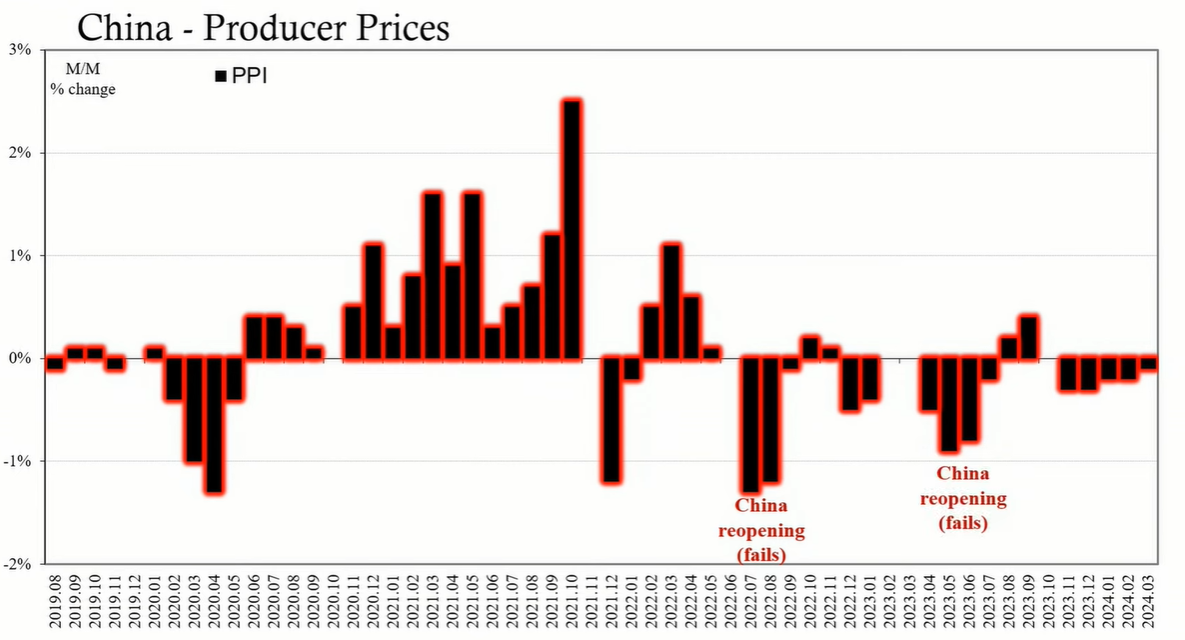

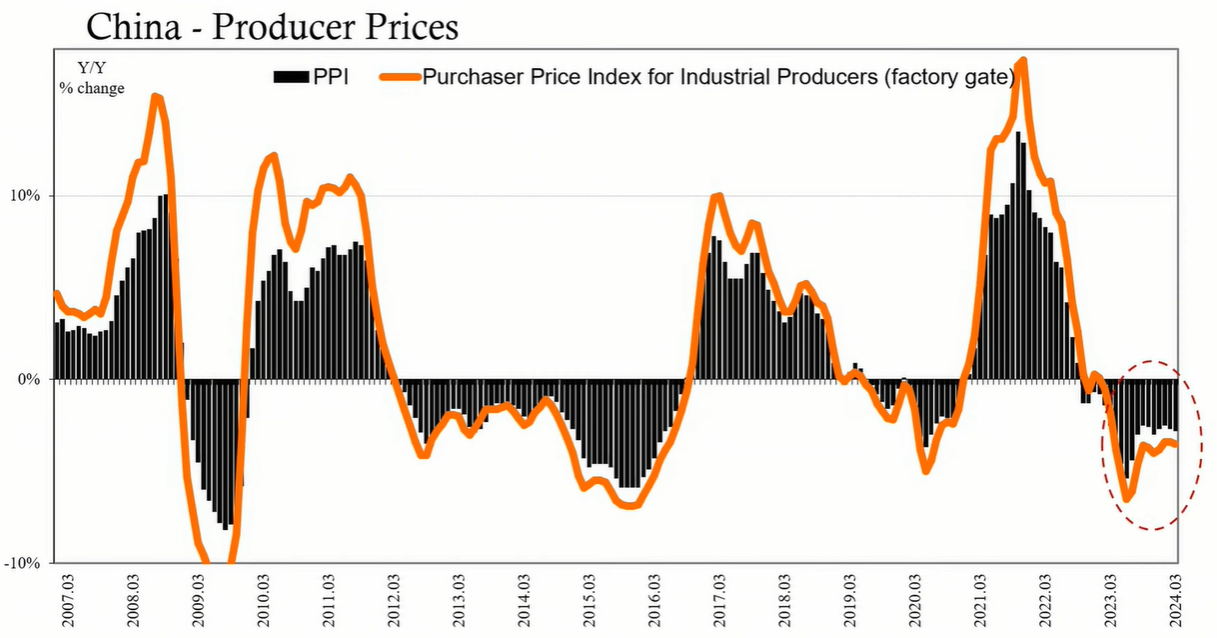

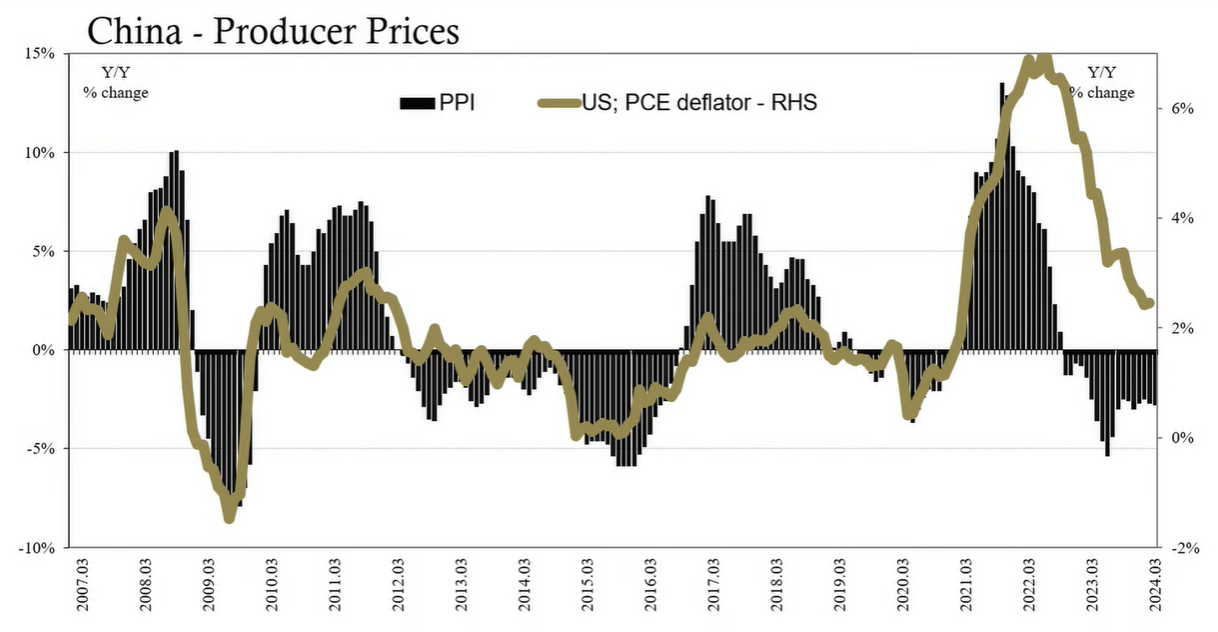

The PPI in China decreased by 0.1% in March, marking the fifth consecutive month of decline, despite surging global oil prices. The last increase in the PPI was noted in August and September of the previous year, correlating with an oil price spike. The factory gate price index, which reflects the cost of raw materials, also fell by 0.1% in March. This ongoing decline in producer prices, even in the face of increasing fuel and power costs, is concerning and indicates deflationary pressures within the Chinese economy.

The Chinese yuan continues to face downward pressure, with the People's Bank of China (PBoC) making slight adjustments to its value. After the release of the CPI and PPI data, the yuan's value dropped again, nearing the PBoC's 2% daily limit. This ongoing currency weakness reflects broader economic challenges and has significant implications for global trade and pricing.

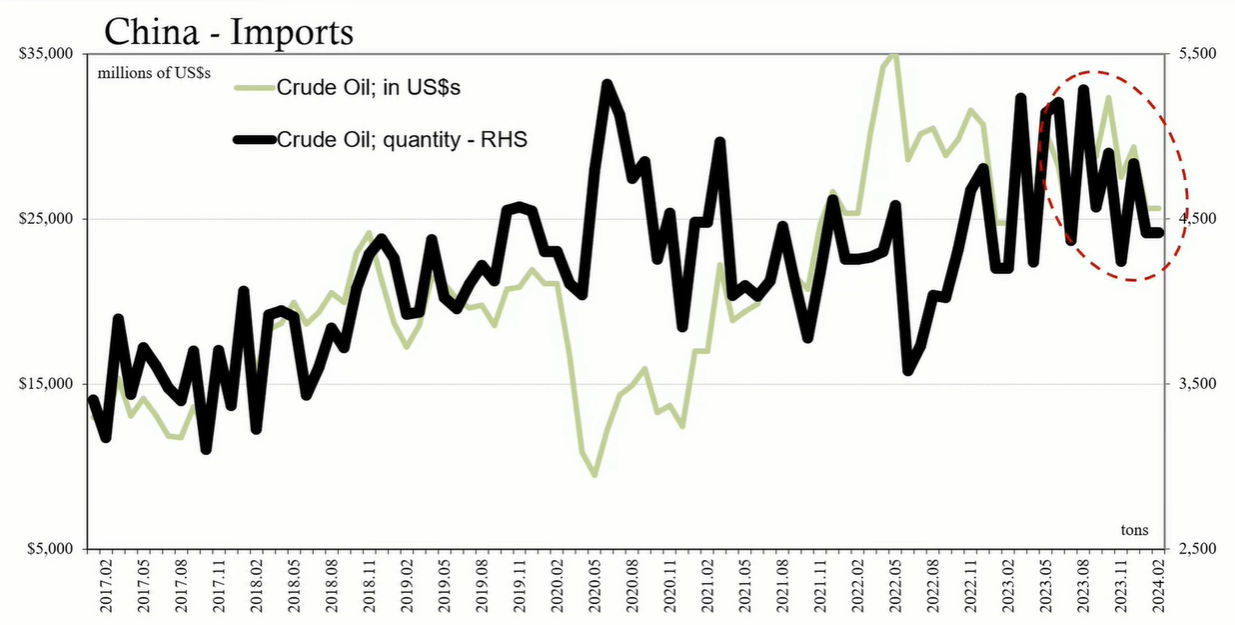

China's role as a major importer of crude oil means that any economic weakness reflected in its consumer and producer prices can directly influence global oil prices and, consequently, consumer price inflation elsewhere. For example, when Chinese imports of crude oil fell last year, oil prices and bond yields declined, signaling disinflationary trends globally. These global factors are not limited to direct commodity price impacts but also indicate broader economic conditions affecting multiple regions simultaneously.

Historically, China's producer prices have been early indicators of global economic trends. In 2018, despite inflationary concerns in the West, China’s PPI started declining in October 2017, foreshadowing global economic cooling. Similarly, during the 2014-2015 period, despite expectations of a post-QE recovery and inflation, weak Chinese producer prices and falling oil prices due to reduced Chinese demand pre-empted a global economic downturn.

The data emerging from China's CPI and PPI suggest that the global economic environment is facing significant headwinds. The persistent weakness in these indicators, coupled with yuan depreciation and the ineffectiveness of government stimulus, point to a more subdued inflationary outlook than some current debates suggest.