Joe Biden plans to veto H.J. Res. 109, claiming that allowing financial firms to custody Bitcoin could jeopardize SEC oversight.

The Executive Office of US President Joe Biden has announced its opposition to proposed legislation, H.J. Res. 109, which aims to permit highly regulated financial firms to operate as custodians for Bitcoin.

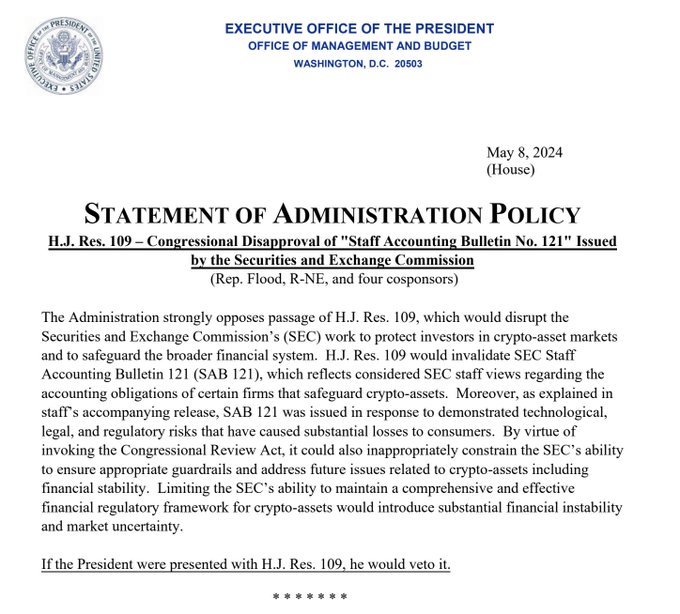

"The Administration strongly opposes passage of H.J. Res. 109, which would disrupt the Securities and Exchange Commission’s (SEC) work to protect investors in crypto-asset markets and to safeguard the broader financial system," the Executive Office stated. Furthermore, they indicated that the President would veto the resolution if it were presented to him.

The legislation in question, H.J.Res. 109, seeks to overturn the SEC’s Staff Accounting Bulletin (SAB) No. 121 under the Congressional Review Act (CRA). SAB 121 imposes certain restrictions on financial institutions regarding the custody of "digital assets." Proponents argue that if the bulletin were overturned, it would eliminate barriers that currently prevent regulated financial entities from serving as custodians for Bitcoin.

US Congressman Patrick McHenry, Chairman of the House Financial Services Committee, criticized the SEC's SAB 121, claiming it exemplifies regulatory overreach and makes it cost prohibitive for financial institutions to custody customers’ "digital assets." Congressman French Hill also supported the resolution, contending that the requirements of SAB 121 are not standard practice in financial services and should be nullified.

#WATCH: Chairman @PatrickMcHenry delivers remarks in support of H.J.Res. 109 to nullify SAB 121:

— Financial Services GOP (@FinancialCmte) May 8, 2024

"This bipartisan resolution is an essential effort to protect consumers and foster innovation in digital asset markets."

Read more 🔗https://t.co/jnIBJFHIPj

📺 Watch 👇 pic.twitter.com/fOxOh8DtWH

In an earlier bipartisan op-ed, Congressmen Mike Flood and Wiley Nickel highlighted concerns regarding current custodian options for spot Bitcoin ETFs and the associated risks of concentration due to the SEC’s guidance.

The House of Representatives was expected to vote on whether to oppose the SEC's Bitcoin accounting policy, SAB 121, but President Biden has defended the policy and expressed his intention to veto the resolution if it passes. The SEC and its chair, Gary Gensler, have defended SAB 121, which directs banks holding customer's "digital tokens" to carry them on their balance sheets, potentially incurring significant capital expenses. This guidance has been criticized for being handled poorly in a government review.