The bankruptcy of Arnold Reed regional trucking is not just a solitary event; it's a glaring symptom of a larger economic decline, shedding light on mistaken assumptions.

The bankruptcy of Arnold Reed regional trucking, one of the oldest and largest firms in the US, signals deep economic distress. This event is not an isolated incident but a symptom of a larger economic downturn that is increasingly evident in various economic indicators. The liquidation of Arnold Reed under chapter seven is a stark warning of the underlying weaknesses in the US economy, particularly in the job market.

The current economic cycle has been fraught with imbalances and mistaken assumptions. Interference from various quarters has obscured the real condition of the economy, which is now coming to light. The liquidation of Arnold Reed highlights the severity of the situation. Despite earlier signs of recovery during the pandemic when trucking demand appeared to surge, it was a superficial boom, driven by price inflation rather than genuine economic growth.

In February 2022, Arnold Reed was acquired by a Canadian trucking firm, which saw the move as an opportunity to capitalize on the seemingly thriving US market. The acquisition was expected to provide resources for growth and address supply chain demands. However, it was a misjudgment, as the increase in trucking costs did not translate to sustained demand. The acquisition was based on the illusion that high prices indicated a robust, expanding market, which proved to be a critical error.

The ensuing economic reality has been harsh. The acquiring company, Pride Group, now owes creditors over $637 million. The capacity glut and low rates have contributed to their financial woes. This situation reflects an economy where temporary price increases during the pandemic led to expansion based on false signals. The downturn is now revealing these miscalculations.

The plight of Arnold Reed is not unique. Online marketplace Etsy also experienced a boom during the pandemic, with its share price soaring. However, the subsequent decline reflects the broader economic inflection point. The recession that began in early 2022 has exposed the incorrect assumptions about the post-pandemic recovery.

Energy costs have surged, further aggravating economic conditions. The high oil prices contribute to the downturn, often leading to recessionary environments. Rather than inflation, these prices reflect the contraction of the business cycle.

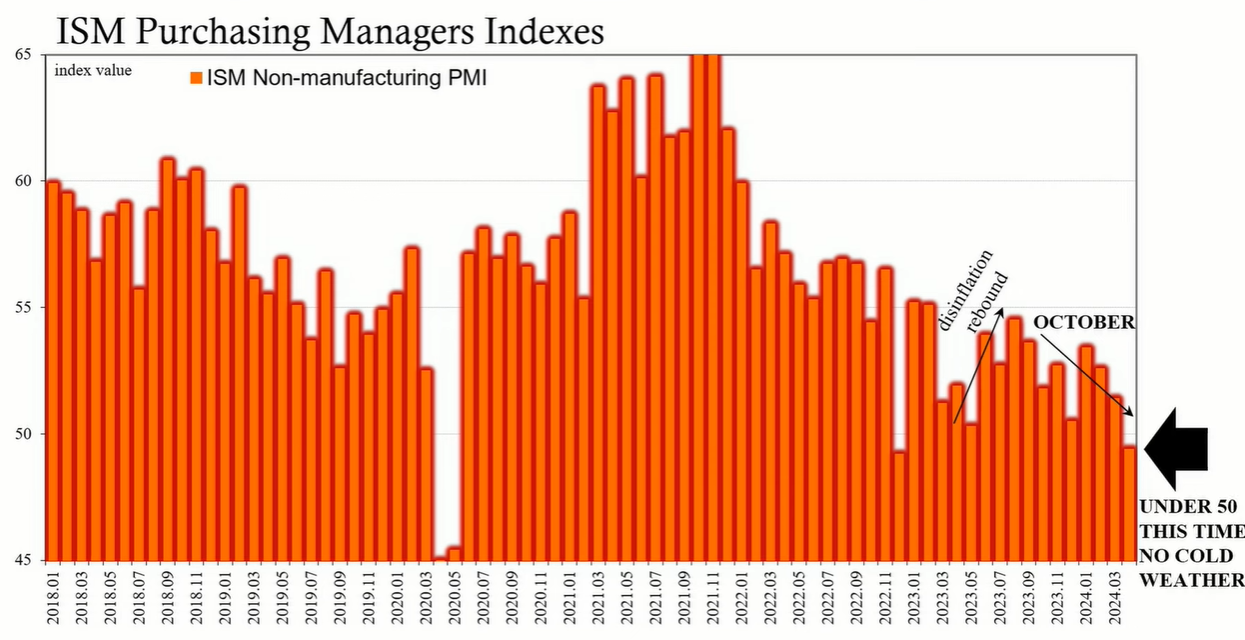

The Conference Board reported a significant drop in consumer confidence, with heightened concerns over jobs and incomes. These worries are validated by various data points, including the ISM non-manufacturing index, which fell into contraction in April 2024, indicating widespread economic weakening.

The ISM non-manufacturing employment index's fall to 45.9 in April 2024 is alarming. It suggests that service companies are facing revenue declines without a corresponding decrease in costs, leading to cuts in labor expenses. The hiring freeze and employment reductions signal the intensification of the economic downturn.

The collapse of Arnold Reed regional trucking and the broader data both point to a fundamental economic weakness. The downturn of the supply shock cycle persists, driven by past misjudgments and the conflating of price increases with economic recovery. Despite hopes for a soft landing, the indicators suggest an accelerating downturn, with the labor market being particularly hard hit. The economic outlook is one of contraction, with the cycle far from reaching a recovery phase.