Recent economic indicators reveal the U.S. is on the brink of a recession, with weak retail sales, declining employment, and rising consumer pessimism confirming a significant economic downturn.

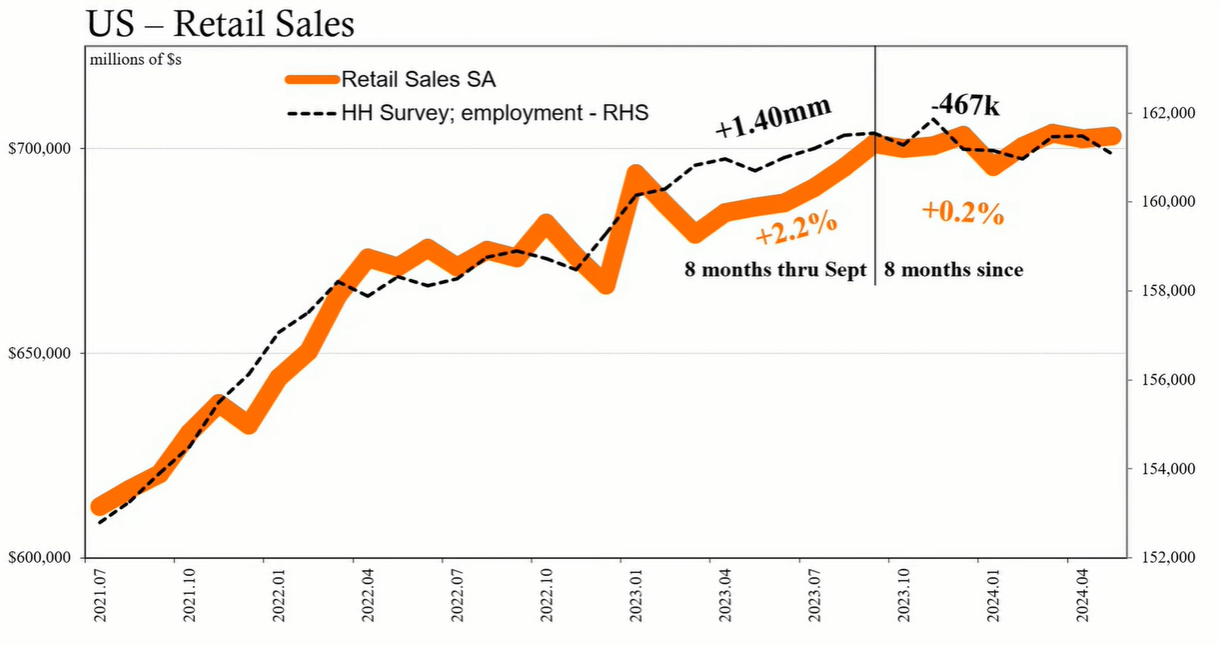

Recent economic indicators suggest that the United States may be on the verge of a recession. May's retail sales were particularly weak, compounded by downward revisions to previous months. Major retailers like Target, Kohl's, and McDonald's have signaled significant changes in consumer behavior. The shift in spending correlates closely with the household survey on employment, highlighting growing consumer pessimism.

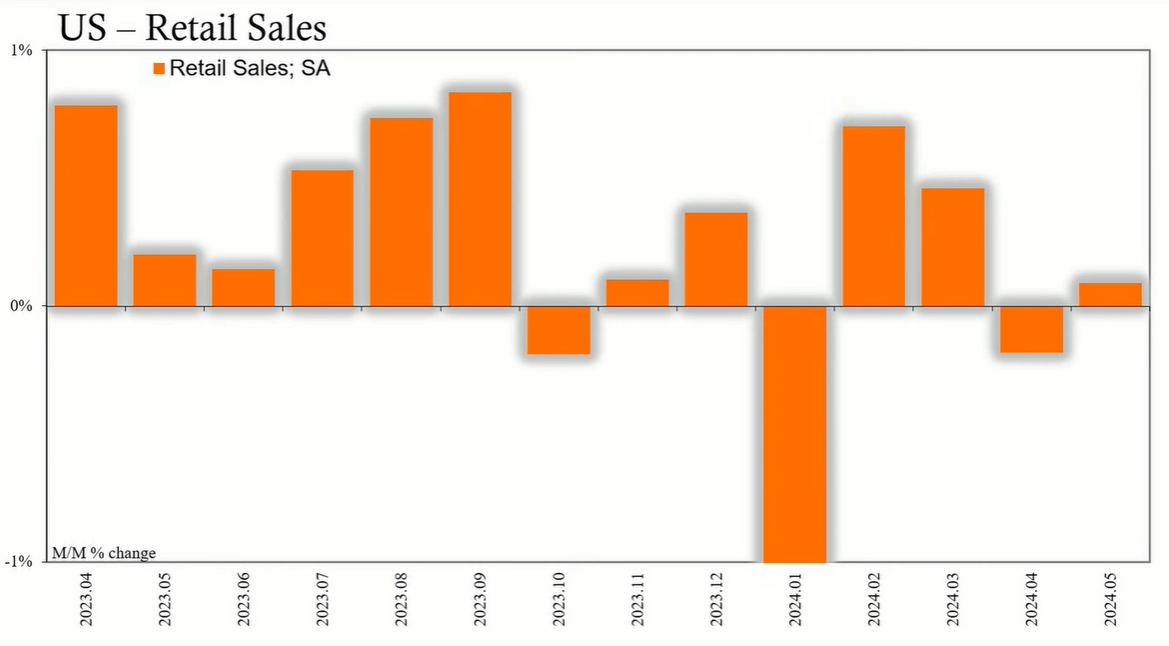

Data from the US Census Bureau revealed that May's retail sales showed a meager increase of 0.09%, falling short of the expected 0.3% growth. March and April's figures were also revised downwards. This trend mirrors the decline in consumer confidence reported by the University of Michigan, where confidence plummeted since March due to increasing price pressures and labor market concerns.

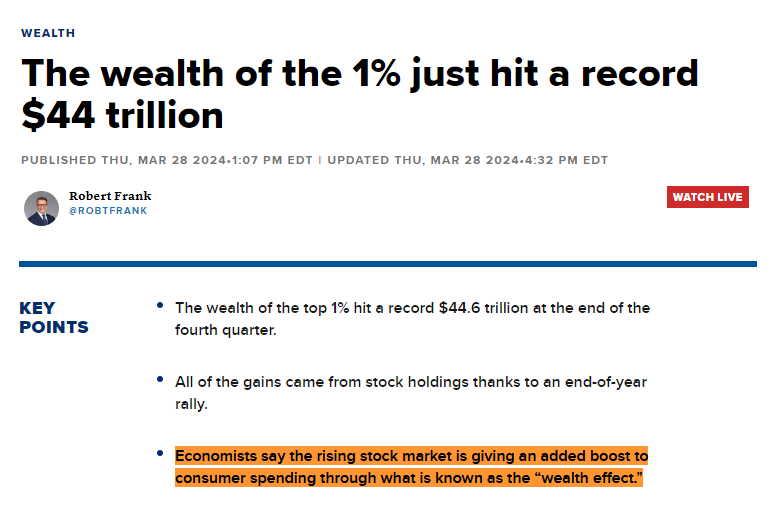

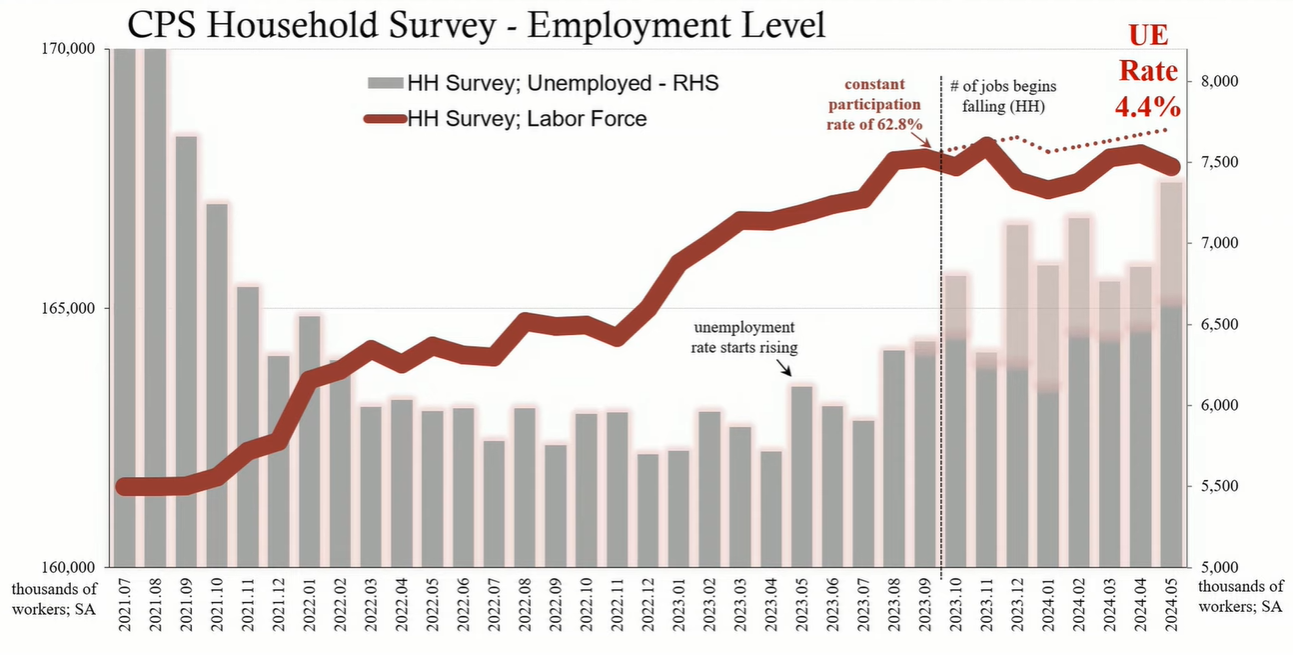

The employment landscape, as depicted by the household survey rather than payroll numbers, shows a modest decline in employment levels. This decline has had a tangible effect on consumer spending habits. Despite record highs in stock market indices, there appears to be no wealth effect influencing consumer spending, emphasizing the critical role of employment and income over market gains.

The adjusted unemployment rate, a more comprehensive measure of labor market health, has increased to 4.4%. Mainstream media outlets, including CNN, have begun acknowledging the economic slowdown and its impact on consumers across all income groups, suggesting widespread caution in spending on goods, travel, and vacations.

A McKinsey & Company report shows a fall in US consumer optimism, driven by inflation, savings depletion, and perceived labor market weakness. Consumers are cutting back on discretionary spending, particularly in travel and hospitality. Deloitte’s insights corroborate this, indicating a decline in planned leisure trips with paid lodging.

The observed consumer cutbacks could lead to decreased business revenues, prompting further reductions in labor hours and employment. This cycle risks spiraling into a full-fledged recession. The Federal Reserve's beige book has noted flat retail spending and a mixed outlook for the hospitality sector, reinforcing concerns about the economy's trajectory.

The convergence of weak consumer spending, cautious travel plans, softening employment, and heightened price sensitivity points to a significant economic slowdown. The adjusted unemployment rate and other labor market indicators suggest that the US economy may not be experiencing a soft landing but rather heading towards a recession. As consumers and businesses brace for potential impact, economic vigilance is paramount.